Dwight Eisenhower was in the Oval Office and America was still on the gold standard when British Columbia prospector Dick Billingsley first staked mining claims. Then 14, Billingsley pounded in wood stakes north of Rossland in British Columbia's West Kootenays on behalf of an uncle who worked in the mining industry and speculated on claims on the side. That uncle worked for the Consolidated Mining and Smelting Company of Canada—otherwise known as Cominco, which merged with Teck Resources Ltd. (TCK:TSX; TCK:NYSE) in 2001.

Billingsley has been staking claims ever since. In the process, the 78-year-old Surrey resident has become one of the largest individual claims holders in B.C., with about 120,000 hectares of ground under his control.

Cycles have come and gone, and there have been some big wins. One of them was Tatogga, the property Billingsley and his wife and business partner Gaye Richards vended to GT Gold Corp. (GTT:TSX.V). GT discovered a gold-rich copper porphyry at Saddle North and a high-grade gold discovery at Saddle South, attracting a strategic investment from Newmont Corp. (NEM:NYSE) and hitting a $250-million valuation along the way.

The veteran prospector made the transition from midnight staker to keyboard claims when the province switched to digital claim staking in 2004. But he can still be found bouncing around B.C.'s backroads in his one-ton Ford 350 pickup truck, snowshoes and other supplies on hand in case of emergencies. Different times call for different strategies, however.

"When you want to stake claims you don't do it during the day, you do it between 2 and 4 a.m.—before 7 a.m. Eastern time," Billingsley says with a smile. "At 7 the guys back East are getting up, having their coffee and turning their computers on."

One of Billingsley's claims packages is the Alwin property, which he optioned to GSP Resource Corp. (GSPR:TSX.V) earlier this year for staged cash and share payments. That made Billingsley one of GSP's largest shareholders, and he has since added to his stake both in the public market and in financings, bringing him to just under 10% of outstanding shares.

Dick Billingsley

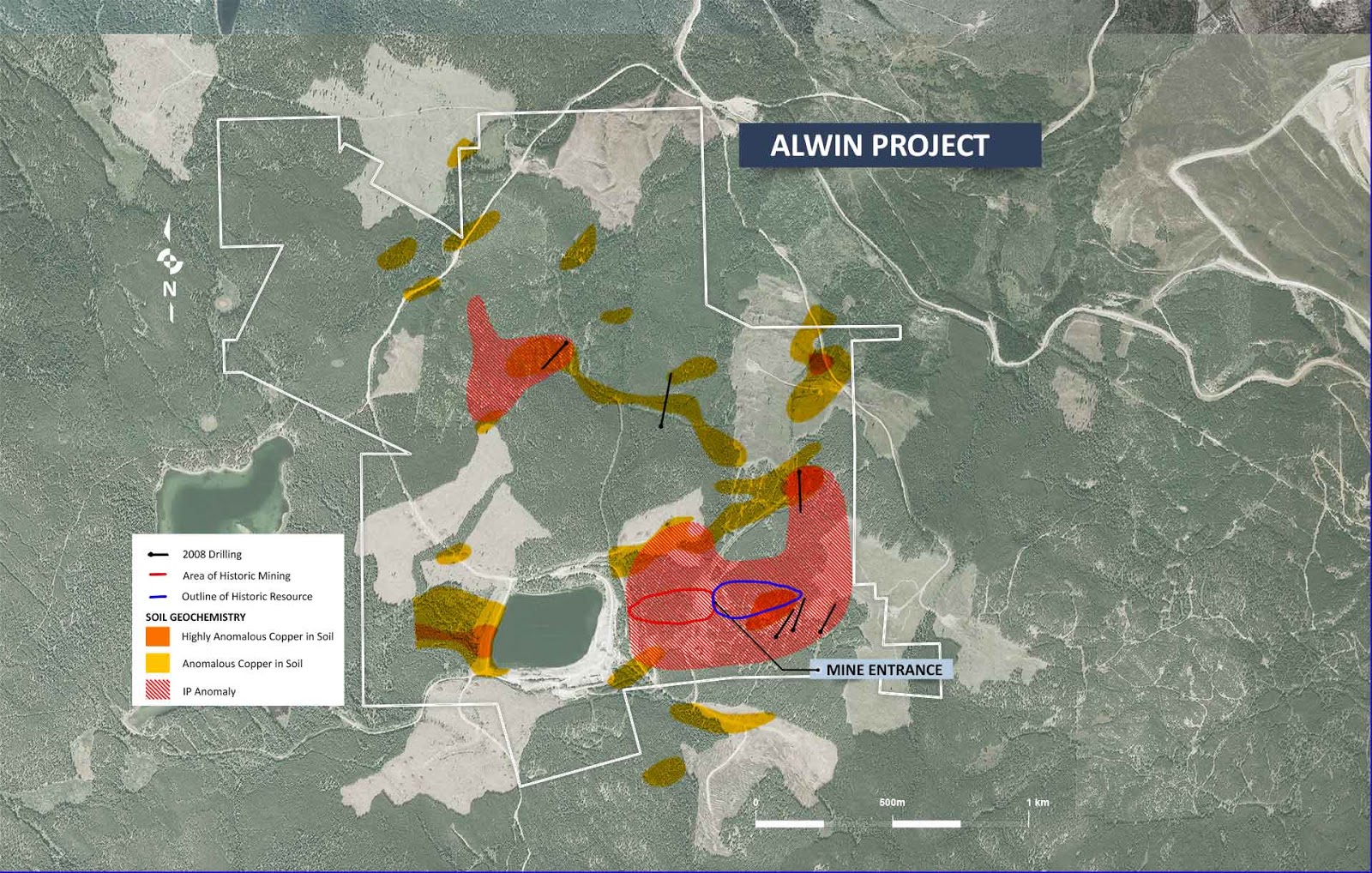

The Alwin property, which hosts a past-producing underground copper mine, is adjacent to Teck's Highland Valley Copper (HVC) open-pit mine, 17 kilometers west of Logan Lake. Billingsley, to the right at Alwin's "Copper Rainfall" showing, is excited about the potential of identifying more high-grade mineralization at Alwin. The mine was in operation at different times, producing a total of about 235,000 tonnes grading 1.54% copper.

Identifying further high-grade copper mineralization is also the mission of Simon Dyakowski, GSP Resource Corp.'s young CEO. Dyakowski is a CFA charterholder and former broker who grew up in the business—his geologist father, Chris Dyakowski, is GSP's chairman and a director.

And family ties figure in the story of how Simon secured the Alwin property for GSP. His father Chris ran San Marco Resources Inc. (SMN:TSX.V) while San Marco explored Alwin between 2005 and 2008. San Marco drilled five shallow holes into the main mineralized trend near the eastern part of the mine workings, and three more holes that tested IP (induced polarization) anomalies north and northwest of the mine.

Results were mixed, and all the data is on the GSP website. The first three holes returned sniffs of shallow higher-grade mineralization, including 3.3 meters (3.3m) of 2.37% copper (Cu) and 0.5m of 8.45% Cu. Hole 4 hit 13.5m of 1.86% Cu from 117m downhole, including 0.9m of 4.1% Cu and 3m of 6.2% Cu. Removing those high-grade sub-intercepts still leaves a residual grade of 9.6 meters of 0.29% copper, slightly higher than the head grade at Teck's HVC. Hole 4 ended prematurely in an old unmapped drift.

San Marco moved onto other projects and the Alwin claims were picked up by Billingsley. CEO Dyakowski believes GSP is well positioned to tag shallow high-grade mineralization, the target of the initial drill program (permitting is well underway). One of the tools at GSP's disposal is a new 3D digital model of the Alwin mine compiled by Renaissance Geoscience Services and released last week. The 3D model—assembled using historical drilling, mining and geological data from prior operators—will help GSP target shallow unmined material in two zones north of the historical Alwin mine.

GSP's objectives are twofold: 1) explore the prospects of an open-pit mining scenario by targeting higher-grade mineralization around the #4 zone; and 2) target lower-grade porphyry-style mineralization to the north. For phase 1, GSP plans to drill two deeper (200-meter) holes into the #4 zone as well as a 600- to 800-meter hole farther north into the porphyry target.

HVC is the largest open-pit copper-molybdenum mine in western Canada. In 2019, the operation produced 121,000 tonnes of copper at grades of about 0.27%, generating $196 million in gross profit for Teck. The Vancouver-based producer is mining increasingly lower grades at HVC and the mine was originally scheduled to close in 2028. However, Teck recently applied to extend the mine life to 2040.

On its website, GSP has a great satellite image of the Alwin/Highland Valley neighborhood in 2004 and 2015, with a sliding bar to make comparisons more easily. Two differences are immediately noticeable: 1) the amount of logging that has occurred on the Alwin property since 2004; and 2) the extent to which Teck is moving westward toward the Alwin property. If GSP can prove up a near-surface high-grade copper deposit and/or the existence of a copper porphyry system at Alwin, it becomes a pretty compelling target for Teck. However, there are other possible outcomes for Alwin that don't rely on a Teck takeout—two nearby mills, Craigmont and Afton, have spare capacity.

Alwin has a 270-meter below-surface development decline and about 2,700 meters of underground tunneling, as well as 649 diamond drill holes totaling 34,500 meters. One of the prior operators calculated a historical (non-NI-43-101-compliant) resource around the mine workings of 390,000 tonnes grading an average 2.5% copper, assuming 25% dilution. But the mine shut down due to low copper prices before they could tap into that zone.

GSP CEO Simon Dyakowski

GSP's low all-in drilling costs of $175/meter mean the company is poised to expand the drilling if they are successful during the first phase. CEO Dyakowski, pictured, owns more than 12% of shares, accumulating in each financing round and the open market. Insiders hold a total of about 35% of shares. GSP is well structured, with only 14.7 million shares outstanding and a free trading float of about 6 million shares when you take out insider holdings and escrowed stock.

As for Billingsley, he thinks Alwin ore could make a great high-grade feedstock to mix with the lower-grade ore that Teck is mining at HVC. That would increase the operation's profitability ahead of a mine life extension at one of Teck's core assets.

"Alwin could be my next big score," Billingsley says.

GSP Resource Corp. (GSPR:TSX.V)

Price: 0.35/share

Shares out: 14.7 million (18.7 million f-d)

Market cap: $5.15 million

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Kwantes has two decades of journalism experience and was the mining reporter at Vancouver Sun, the city's paper of record.

[NLINSERT]Disclosure: James Kwantes owns GSP Resource Corp. shares and warrants and GSP is one of three Resource Opportunities sponsor companies. This article is presented for information purposes and does not constitute investment advice. All investors need to do their own due diligence and/or consult a financial advisor.

Streetwise Disclosure:

1) James Kwantes' disclosures are listed above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Resource Opportunities Disclaimer: Readers are advised that this article is solely for information purposes. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice. The information is based on sources which the publisher believes to be reliable, but is not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available data.