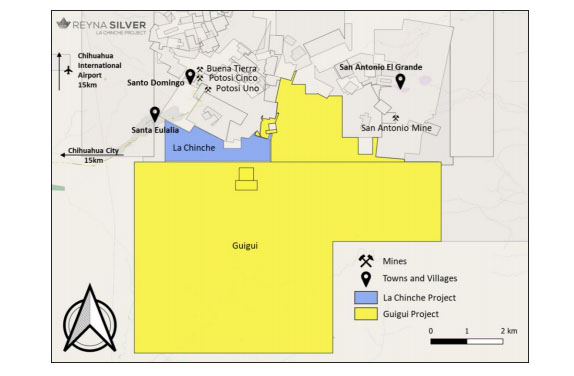

In a news release, Reyna Silver Corp. (RSLV:TSX.V; RSNVF:OTCMKTS) announced it agreed to acquire an 80% interest in the La Chinche mining concession that is contiguous to its Guigui property, thereby consolidating its land position in Mexico's Santa Eulalia historical mining district.

"We already know that alteration and geophysical anomalies seen in Guigui continue into La Chinche, so now we can pursue them without concern for artificial limits," Reyna Silver President and CEO Jorge Ramiro Monroy said in the release.

For the acquisition, Reyna Silver entered into agreements with two groups: the La Chinche concession owner and United Minerals.

Total consideration to the owner for an 80% interest in the 250 hectares of land includes a US$42,000 in cash on signing; spending US$900,000 in work on the property over two years, completion of a resource estimate and based on that resource, payment of additional amounts. Those include up to a minimum of US$1 million (for up to 1.5 million tons of resource based on a 12% zinc equivalent cutoff) plus another US$250,000 for every 500,000 tons of resource beyond the 1.5 million tons at a comparable grade.

With its agreement with United Minerals, Reyna Silver has the option of getting United Minerals to give up its existing earn-in agreement with the concession owner and allow Reyna to negotiate such an agreement with the owner. Should Reyna Silver decide to pursue this option, it will pay United Minerals a total of 11.5 million share purchase warrants distributed over two years and 500,000 common Reyna shares, half upfront, half at the end of two years. The warrants would be valid for a year at CA$0.74 each.

"We are pleased United Minerals has recognized the value in combining assets and has structured a deal that bets on exploration success by allowing Reyna to focus on putting funds in the ground," Monroy added.

Upon acquisition of the La Chinche concession, Reyna Silver will own the land between its Guigui project and the southernmost known mineralization in the West Camp. The West Camp region is where 70% of past production occurred, and that amounted to 500 million ounces of silver, 3 million tons of lead and 2.2 million tons of zinc. Whereas the mineralization source for that production has not been found, Reyna Silver believes it lies to the south, within its 4,554-hectare Guigui project.

"Field mapping and sampling over these anomalies is already well advanced and is adding geochemical support for drilling targets being defined in Guigui that may extend into La Chinche," the release noted.

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Reyna Silver. Please click here for more information. Within the last six months, an affiliate of Streetwise Reports has disseminated information about the private placement of the following companies mentioned in this article: Reyna Silver.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Reyna Silver, a company mentioned in this article.