In Common Sense 2.0 , author Thomas Paine reboots a 21st century version of what was once the most widely read book in American history. Essentially, it's a renewed call to freedom.

The original Common Sense in 1776 inspired people from America's thirteen colonies to declare their independence from Britain. In version 2.0, the goal is to educate readers about ever-growing government machinations, boondoggles, graft, pork barrel spending, deceit, influence peddling and outright war mongering. All of these culminate in the most ominous threat: the slavery of debt.

"Common Sense 2.0 is a rallying cry to all, not just Americans."

Through a series of pertinent and sometimes shocking examples, Paine explains why today's America is at a crucial crossroads. Pulling no punches, he states: "On the one hand we have a military machine determined to spend the treasury dry competing with the banking and financial industry intent on stealing all the money from the treasury first…The American people have been put into the chains of slavery…"

The military-industrial complex, with its $1.5 trillion annual budget, has gone completely out of control. Paine explains how Lockheed Martin's F-35 jet, despite being a terrible fighter aircraft, will never get cancelled; its builder "…has at least one contractor in the districts of over 370 Congressmen. Consider it a gift that keeps on giving, AKA, a bribe."

"Paine doesn't just point out everything that's gone wrong in America. Instead, he is steadfastly optimistic of a brighter future and provides workable solutions."

In Chapter 4, the author explains how the seeds of the 2007–09 global financial crisis were planted much earlier by previous administrations. Over time laws were passed or repealed, which pushed bankers to make increasingly risky mortgage loans, while that risk was gradually transferred from banks to government entities like Fannie Mae and Freddie Mac, and ultimately the taxpayer. In Chapter 5, Paine details the mountains of toxic assets and casino-like derivatives held by American institutions, explaining how the Federal Reserve would ultimately bailout the enriched perpetrators, with AIG alone getting $85 billion, "else it would have taken down the counterparty, Goldman Sachs." Since then, the nation's largest banks like JPMorgan, Goldman Sachs, Citibank and Bank of America paid tens of billions in fines and penalties, while not a single executive was ever charged with a crime.

These bailouts were dwarfed in 2020 when the Covid-19 pandemic struck the world. To fight the swift and massive economic downturn, which saw the highest unemployment levels since the 1930s, the U.S. is spending over $6 trillion (so far) that it simply doesn't have. As the nation's official debt reaches well into the tens of trillions, just paying the interest will consume an ever-larger slice of the annual budget. And that's at the lowest interest rates in 5,000 years of history.

These bailouts were dwarfed in 2020 when the Covid-19 pandemic struck the world. To fight the swift and massive economic downturn, which saw the highest unemployment levels since the 1930s, the U.S. is spending over $6 trillion (so far) that it simply doesn't have. As the nation's official debt reaches well into the tens of trillions, just paying the interest will consume an ever-larger slice of the annual budget. And that's at the lowest interest rates in 5,000 years of history.

Common Sense 2.0 also highlights the war on drugs, forever conflicts in foreign countries, spiraling student debts, and average wages that simply can't keep up with the rising cost of living. The book does an outstanding job citing, with references, specific examples of all these major challenges.

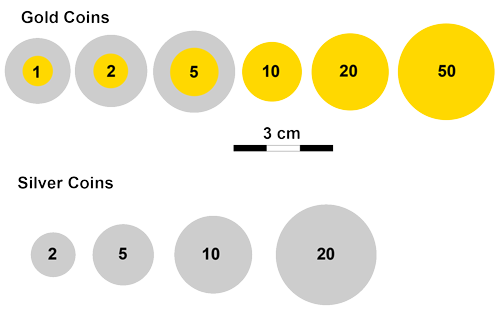

To deal with the nation's real unfunded liabilities, by some estimates now at $122 trillion, Paine suggests a solution used in times as far back as the Old Testament that would allow for a major financial reset. But that radical solution implies serious consequences, so he describes the differences between money and wealth, and how readers can prepare and protect themselves now. His simple yet eloquent proposal is an updated twist on a method that has already worked for thousands of years.

To deal with the nation's real unfunded liabilities, by some estimates now at $122 trillion, Paine suggests a solution used in times as far back as the Old Testament that would allow for a major financial reset. But that radical solution implies serious consequences, so he describes the differences between money and wealth, and how readers can prepare and protect themselves now. His simple yet eloquent proposal is an updated twist on a method that has already worked for thousands of years.

When reading Common Sense 2.0, two famous quotes come to mind.

The first was by Alexis de Tocqueville. Best known for writing about early American democracy in the 1800s, he stated, "The American Republic will endure until the day Congress discovers that it can bribe the public with the public's money."

And the second was by famed Austrian economist, Ludwig von Mises, commenting on the 1920s market crash and following 1930s depression. He warned, "There is no means of avoiding the final collapse of a boom brought on by credit and fiat monetary expansion. The only question is whether the crisis should come sooner in the form of a recession or later as a final and total catastrophe of depression as the currency systems crumble."

In the end, Paine remains hopeful: "If we can stop the military-industrial cartel in its tracks and end the forever wars…if we can restore some legal sanity to our banking system by going back to a form of honest money…then Americans can be put back to work doing productive things and spending the money they earn on what they need, not handing it to the banks, the military, and the government to be wasted."

Common Sense 2.0 is a rallying cry to all, not just Americans. And Paine doesn't just point out everything that's gone wrong in America. Instead, he is steadfastly optimistic of a brighter future and provides workable solutions.

Common Sense 2.0 is a rallying cry to all, not just Americans. And Paine doesn't just point out everything that's gone wrong in America. Instead, he is steadfastly optimistic of a brighter future and provides workable solutions.

No review can truly do it justice. We all need to read this book ...while there's still time to prepare for what lies ahead.

From midnight Sunday night until midnight Friday, the EBook is free on Amazon.

Ed Ward is a freelance writer, researching and writing on topics relating to the finance and investment industry. He takes a global-macro approach to investing and investment commentary, with a penchant for hard assets, and precious metals in particular.

[NLINSERT]Disclosure:

1) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article. Please click here for more information.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.