WOW. What a three months it's been. Things appear to be relatively better now, but I was very worried. At its worst, four major U.S. stock market indexes were down an average of 37.5% from all-time highs set in February. I feared stocks would keep falling and that copper might trade under US$1.50/lb for a long, long time. Luckily, that scenario did not play out.

I don't know if we're out of the woods yet, but copper is up nearly 20% from its March low. Perhaps analysts realizing that long-term demand for EVs has remained intact breathed some life back into Dr. Copper? Look no further than Tesla's sky-high valuation (US$190 billion) for proof of concept!

Silver, although trailing behind gold, is up, so no worries there. I never claim to have any keen insights on commodity prices, but this time may be different. So much new debt and money printing, with no end in sight…. So much uncertainty from COVID-19…. Precious metals are in a bull market that could be epic and long-lasting. Silver frequently outperforms gold in bull markets, that means there's a lot of catching up to do.

With this in mind, I revisited my favorite Russian copper-silver play Azarga Metals Corp. (AZR:TSX.V) by interviewing its President and CEO Michael Hopley. We had a wide-ranging conversation in which a key takeaway is that A LOT IS HAPPENING at the company!

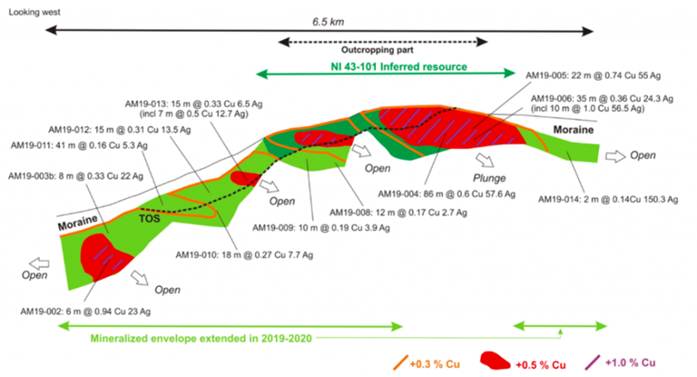

Impressive drill results and favorable metallurgical testing data was released, and a new resource will be out in a few weeks. If the resource estimate is strong, management might commission an optimized PEA. Mr. Hopley could not tell me much regarding the parameters, but in a prior press release management stated that its mineralized strike length had increased from 3.4 to 6.5 km (+91%), and that the overall grade has not changed much.

The current resource is 62 million tonnes. Given a 91% strike extension, I would not be surprised to see 90 million or 100 million tonnes, which could result in an Indicated and Inferred resource approaching two billion copper equivalent pounds. Several near-term catalysts could be impactful and the company is well funded. Please continue reading to learn more about Azarga Metals and its investment thesis.

Peter Epstein: Michael, please tell us how you landed as CEO of Azarga Metals.

Michael Hopley: For almost 20 years I've been part of management or on the Board of predecessor companies to Azarga Metals. The company acquired its flagship Unkur property in 2016 and successfully explored it later that year and in 2017–18. However, due to perceived geopolitical risks, and a difficult funding environment, the project has not advanced as rapidly as we would have liked.

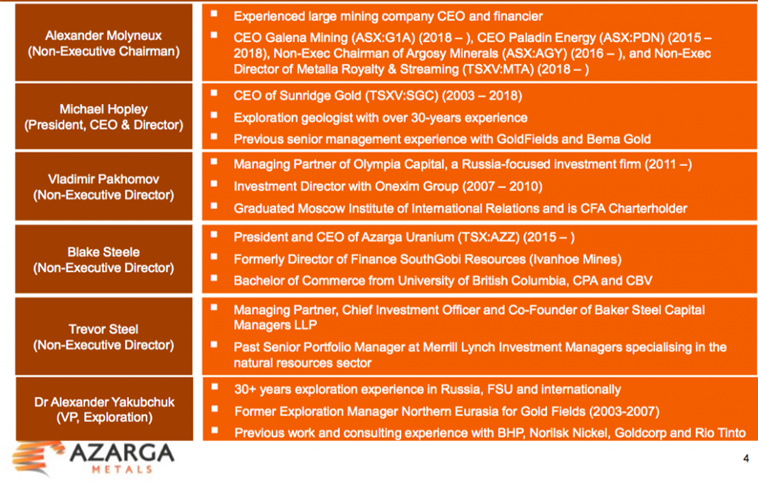

Since 2018, management has turned over; our new team {see team bios above} is very well suited for the specific tasks at hand. When we received a significant financing package from Baker Steel early last year, I was invited to come out of retirement to be president and CEO. As a director it was obvious to me that Unkur had serious potential to be a world-class copper-silver project, so I accepted.

Peter Epstein: Can you describe in greater detail Azarga's 100%-owned Unkur Copper-Silver project?

Michael Hopley: Yes, Unkur is located in eastern Russia (Siberia), ~400 km north of the Chinese border. China is by far the largest consumer of copper and silver. My team believes that Unkur hosts a discovery of global significance, with district-scale potential. It's ~35 km from the giant Udokan copper project that reportedly contains >55 billion pounds of copper. The geological setting and possible scale of our project is similar to Udokan. Russian company Baikal Mining is building it and it's scheduled to start production in 2022.

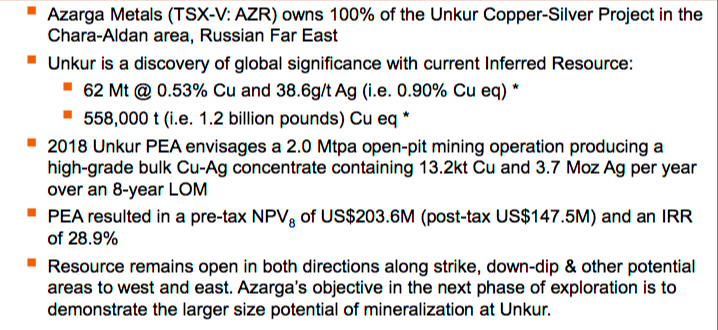

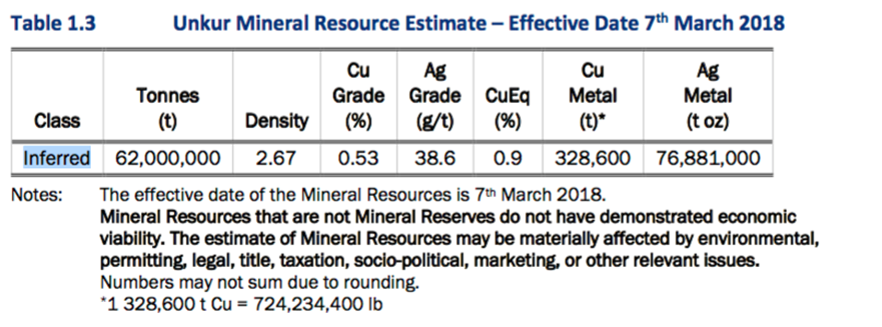

After completion of the first modern exploration in 2016–2018, we reported an NI 43-101 compliant Inferred resource of 62 million tonnes @ 0.53% Cu + 38.6g/t Ag, equivalent to 558,000 tonnes (1.2 billion pounds) copper equivalent (Cu Eq.) at an attractive grade of 0.90%. That's ~US$52/t (~C$71/t) in-situ rock… that's mineralized rock in the ground. The resource remains open in both directions along strike and at depth.

Peter Epstein: On April 9th, Azarga Metals announced drill results. Two assays stood out. The best had a 22-meter interval of 0.74% Cu and 55 g/t Ag. What do these results mean for the Unkur story?

Michael Hopley: This exciting result was from drill hole AM19-005, an in-fill hole drilled to test a higher-grade area north of our current resource. The intercept extended our high-grade envelope further north and deeper compared to the model we used to estimate our existing resource. Select recent drill results over a 6.5 km strike length {shown below}, are encouraging, especially as the project remains open in both directions along strike, and at depth.

As a frame of reference, the 22-meter interval you mentioned equates to ~US$74/t (C$100/t) in-situ value. And, that intercept included a shorter interval of 9m of 1.34% Cu + 99.4 g/t Ag, an in-situ value of C$181/t. To be clear, those two values are not indicative of the overall deposit. Still, if our metallurgy holds up, C$71/t rock (before recoveries) could be economic under the conditions, the right mine plan.

Peter Epstein: Speaking of metallurgy, please explain your latest results on that front.

Michael Hopley: Good question, this is important news. Previous metallurgical tests used only oxidized material from a surface outcrop. These new tests were on both oxidized & sulphide material taken from deeper parts of the Unkur deposit. Recoveries were up to 92% Cu and up to 88% Ag in our sulphide material, using conventional flotation.

The oxide results were as high as 96.4% Cu in an acid leach and up to 96.7% silver in a cyanide leach. Importantly, we think that a standard 30% Cu concentrate will be achievable, making it easy to sell to refiners. We believe this was a good outcome, especially for preliminary-stage testing. We think there's a reasonable chance that we could use heap leaching to treat our oxide material.

Peter Epstein: Early last year, Azarga received a US$3M investment commitment from Baker Steel Resources Trust. How did that investment unfold?

Michael Hopley: Over the past several years it has been difficult for junior exploration companies to raise cash. Baker Steel took the view that among hundreds of risky companies destined for failure, there will always be some with projects of considerable merit. Azarga's Unkur project stood out to them, a true vote of confidence.

Peter Epstein: Unkur's resource estimate is 62 million tonnes @ 0.53% Cu, plus 38.6 g/t Ag. That's a 0.90% Cu Eq. grade (~1.2 billion pounds Cu Eq.). How deep is the mineralization?

Michael Hopley: Mineralization at Unkur has been drilled to ~350 meters' depth, but remains open at depth and in both directions along strike. A new resource estimate by SRK is coming out in two or three weeks. While I can't say what that new resource might look like, I can reiterate what we said in a May 11th press release, namely that recent drilling had extended the mineralized strike length by 90% from 3.4 to 6.5 km.

Peter Epstein: Your 2018 PEA delivered promising financial metrics. Might Azarga be able to extend the 8-yr. mine life?

Michael Hopley: Yes, the existing PEA contemplates mining ~25% of our existing resource, or meaningfully less than 25% of our new resource estimate. We're looking to announce a significant increase in the resource size in the next two or three weeks. If the resource expansion is strong, then we would look to extend the mine life.

Instead of an 8-year mine life with throughput of 2.0 millin tonnes/year, perhaps we could increase it to 3.0 million or 3.5 million tonnes/year and extend mine life by a few years. I'm not saying we can get there from our upcoming resource update alone; we have to study the new numbers. But, if we can increase annual production, and possibly extend mine life, without a major increase in cap-ex, the impact on NPV, IRR and payback period could be quite favorable.

Peter Epstein: What are the biggest risk factors of the Azarga story?

Michael Hopley: Aside from metals' pricing, there are two primary concerns. Increased political tensions between Russia and the West, and the speed at which the world's use/investment in copper and silver returns to normal after the impact of COVID-19.

I find it encouraging that the Cu price fell to ~US$2.10/lb in mid-March, but has since recovered to ~US2.56/lb. Global automakers seem to have maintained fairly aggressive electric vehicle rollout plans, a promising sign for copper demand. Due to its industrial and investment / safe-haven attraction, silver futures touched US$11.80/oz, but have since rebounded to US$17.70/oz (+50%).

Peter Epstein: Why should readers consider buying Azarga Metals?

Michael Hopley: Azarga is one of the few juniors that's well funded. We're able to move the Unkur project forward with drill results, metallurgical testing, a new resource calculation in coming weeks and hopefully a new PEA in 6-9 months.

Our chairman, Alex Molyneux, is based in Asia and is well connected. He's also highly experienced in investment finance/M&A. Russian investors, as well as global sovereign wealth funds, are looking to diversify away from oil, gas and coal. Silver, and especially copper, are critical, green energy, high-tech metals of the future.

Peter Epstein: Thank you, Michael, for this timely update. I can honestly report that few other metals and mining juniors are doing as much during this pandemic. I look forward to seeing your updated resource estimate in coming weeks.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Azarga Metals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Azarga Metals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Azarga Metals was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.