Although our buying towards the end of May didn't succeed in triggering a breakout by Black Tusk Resources Inc. (TUSK:CSE; BTKRF:OTCMKTS; 0NB:FSE), it rose a bit and its technical condition has continued to improve, as we can see on its 8-month chart below. There is no point in writing much here because the arguments in favor of buying the stock were set out in the May 29th article on it. Given the ongoing strong upside volume and continuing strong volume indicators, I am frankly surprised that it hasn't broken out already. Maybe it's waiting for the moving averages to kiss, which as we can see they are about to.

There is an important point that I want to mention that was not covered in the original article, which is that when we look at the base pattern from the early October low on a 1-year chart, we can see that it has taken the form of a Cup & Handle, with the Handle of the pattern now looking complete as the moving averages come together. Again on this chart we can observe the super bullish volume pattern and volume indicators. One explanation for the lack of progress so far may be that there is a big seller in this area, but if that is the case the volume pattern and volume indicators suggest that he is on the wrong side of the equation, and that once this selling is absorbed, the price will take off higher.

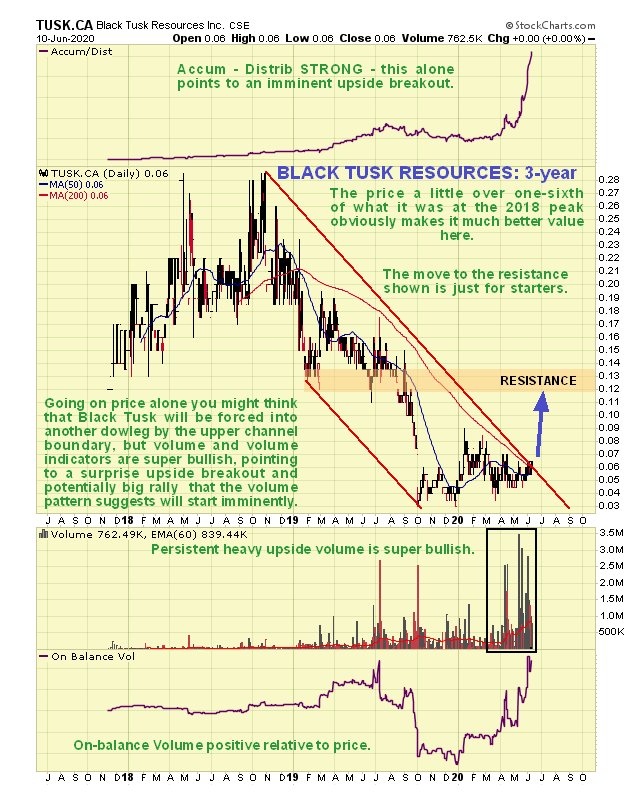

Finally, on the 3-year chart we can see that with the sideways to up movement of the past couple of weeks the price is pushing a breakout from the long-term downtrend shown in force from late 2018.

The one "fly in the ointment" that could delay the breakout or cause a minor short-term retreat is that a potential Head-and-Shoulders top is forming in the sector indices and GDX that could become operative if the stock market continues to drop hard, as we can see on the latest 6-month GDX chart shown below. Any retreat caused by this should only be minor because the Black Tusk chart is so technically strong.

Trading volume on the US OTC market used to be very light, but has built up nicely in recent weeks. There are a reasonable 68 million shares in issue.

Black Tusk Resources website.

Black Tusk Resources, TUSK.CSE, BTKRF on OTC, closed at C$0.06, $0.044 on 11th June 20.

Originally posted at 7.35 am EDT on CliveMaund.com on 12th June 2020.

Postscript added 13th June: Puzzled by the refusal of Black Tusk stock to advance, I have done a little digging around to see if I could unearth a fundamental reason for it—and I have. The company is waiting on soil sampling results from the McKenzie East Gold Project that are due within a week or so and possibly within days. Our charts provide compelling evidence that these results are going to be positive and lead to a breakout and sharp advance. The strong upside volume for weeks means one of two things—either insiders know the results are going to be good and they and their associates are piling in, or those who realize the potential of the district are making an educated gamble on them being good. Could the results disappoint? Anything is possible, but our charts strongly suggest that they will be very positive. In view of all of this it considered worth going overweight on this stock, and it might also make sense to regroup any losing positions into it.

Finally, in the event that this stock duly breaks out and goes screeching higher I would like to emphasize that I have no "inside information" on this company and have not been in touch with them. The deductions made are based solely on its stock charts and on information made public by the company.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

[NLINSERT]Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Black Tusk, a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.