VanGold Mining Corp.'s (VGLD:TSX.V) flagship project, El Pinguico, hosts a high-grade past producing silver (Ag) and gold (Ag) mine (400 tonnes/day). It's located 7 km south of the city of Guanajuato, in central Mexico. The mine operated from the late 1880s until 1913, mining the El Pinguico and El Carmen veins, thought to be splays of the Veta Madre, the Mother Vein. The Mother Vein (MV) outcrops for 25 km and is the most important source of precious metal mineralization in the region.

Management believes this major vein may cross onto its property underneath the high-grade El Pinguico and El Carmen veins, at a predicted depth of 400–600 meters. The MV has been mined to within 250 meters of the company's border. Minimal drilling has been done to date on the company's concessions, and none has sought to intercept the MV.

VanGold's main project is within 2–30 km of Endeavour Silver's El Cubo and Bolanitos mine and mill complexes, Fresnillo PLC's Las Torres mine and mill, and Great Panther's Guanajuato complex.

Bulk sample results are good, a substantial de-risking event

On June 2nd, the company announced the completion of its bulk sample and metallurgical testing programs. Earlier, management had delivered 1,039 tonnes, (of an estimated 175,000-tonne surface stockpile), for processing at Endeavour Silver's Bolanitos mill located ~28 km to the north. {excellent drone footage here}. Flotation metallurgical tests were performed, creating a very high-quality Au/Ag concentrate.

On June 9th, the company announced results of the bulk sample testing, in which management gained critical insights into metallurgy, recoveries, reagent usage and the mineralogy of the ore. This information, and associated cost components, will be studied to assess the potential to direct ship El Pinguico's surface stockpile, (combined with a similar-sized underground stockpile that's at least ~3 times the grade), to one of several mills in the area.

Average recoveries of gold were 75.2%, (high of 77.7%) and silver at 60.4%, (high of 67.2%). Importantly, a strong concentrate ratio of 232 to 1 was obtained. After removing a small amount of the milled metals for future analysis, the final product consisted of 4.265 tonnes averaging 132 g/t Au, plus 6,661 g/t Ag.

The overall head grade after processing was 1.23 g/t gold equivalent (Au Eq), using a 96 to 1 Au-Ag ratio. The successful bulk sample enabled management to gain a much better understanding of how higher recoveries might be achieved and how to replicate, or possibly improve upon, these results.

Few juniors see data like this ahead of large investments

Arguably more important than the metallurgical metrics is the substantial de-risking of the VanGold Mining story. How many juniors, pre-maiden resource, get to see this kind of data before committing years of time, managerial resources and equity capital? Mission critical info from June, 2020, not from decades ago. Info that helps management, in many respects, beyond just metallurgy.

Armed with these valuable findings, VanGold can negotiate with greater confidence and credibility with toll millers (Endeavour Silver, Great Panther and Fresnillo Plc), local community leaders, strategic investors and permitting bodies.

How many otherwise early-stage juniors could become meaningfully cash flow positive within the next year? Once cash flow starts, monetizing the two stockpiles is expected to take roughly 30 months. This is a company with a pro forma Enterprise Value {market cap +debt – cash} of ~C$7 million [share price C$0.12], (pro forma for ongoing exercises of C$0.10 warrants).

VanGold will not need to raise much additional cash if/when the 30-month cash flow period begins, (probably in Q1 2021). Management expects to have at least C$1.5 million in cash at the end of June.

As great as this bulk sample de-risking news is, VanGold is also a compelling exploration story. Hundreds of thousands in cash flow per month, if achieved, would pay for a lot of drilling at El Pinguico. And, there would be plenty left over for exploring the company's other targets and/or making acquisitions.

Total cash flow could be 2x-4x VanGold's C$7 million enterprise value

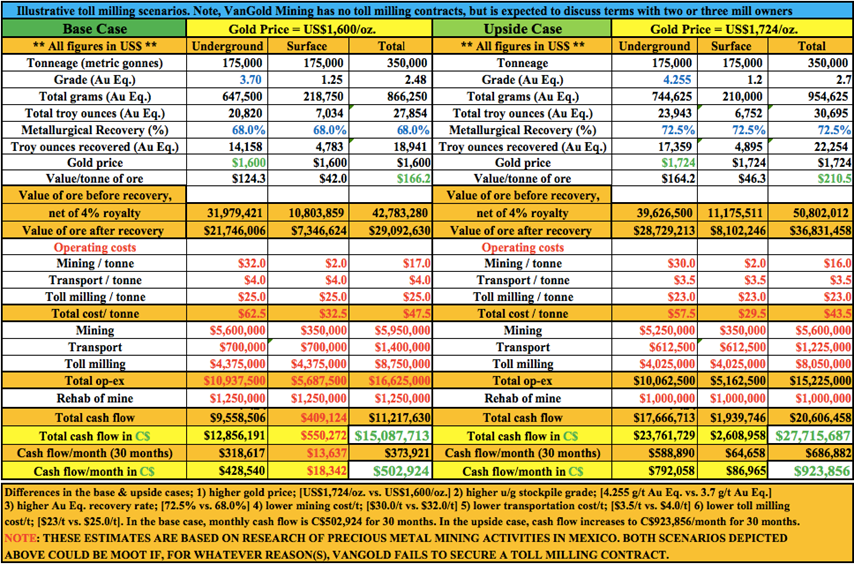

Until this week's news, it was hard to estimate how much cash flow might be generated from toll milling the stockpiles. While it remains difficult to know, I put together base and upside cases for toll milling the underground and/or surface stockpiles.

The key metrics in each case are, Au Eq. price; US$1,600/oz vs. US$1,724/oz, recovery rate; 68.0% vs. 72.5%, and lower operating costs in the upside scenario as shown below.

The upside scenario enjoys a modestly higher underground stockpile grade of 4.225 g/t Au Eq vs. 3.7 g/t Au Eq. There's a chance that the 3.7 g/t assumption is too low. In 1959, the Mexican Geological Survey estimated the grade to be 5.6 g/t Au Eq. Plugging in 4.225 g/t Au Eq (+15%) reflects this possible upside.

In the two scenarios depicted below, monthly cash flow of between C$502k & C$923k could commence early next year and last up to 30 months. Total cash flow from monetizing the stockpiles, assuming that a toll milling contract can be negotiated & signed, is C$15 to C$27 million.

Compare that to VanGold's pro forma enterprise value of about C$7 million. Notice that the upside case's Au Eq. price assumption is today's spot price, so hardly a stretch.

Next step, regain access to mine…

Clearing debris from the El Pinguico shaft is expected to begin in coming weeks. Once the shaft is safe & clear, VanGold will sample along the bottom of the underground stockpile that contains ~175,000 tonnes grading ~183 g/t Ag & ~1.75 g/t Au (~3.7 g/t Au Eq near current spot prices). The management team is trying to determine how consistent the grade is throughout the stockpile.

Clearing the shaft will allow for the inspection of the mine's #7 Adit (aka the "Sangria" adit), which may provide an inexpensive haulage route to transport underground stockpile material to surface. This is the company's preferred method of accessing the material, but fully refurbishing the shaft is another option under consideration.

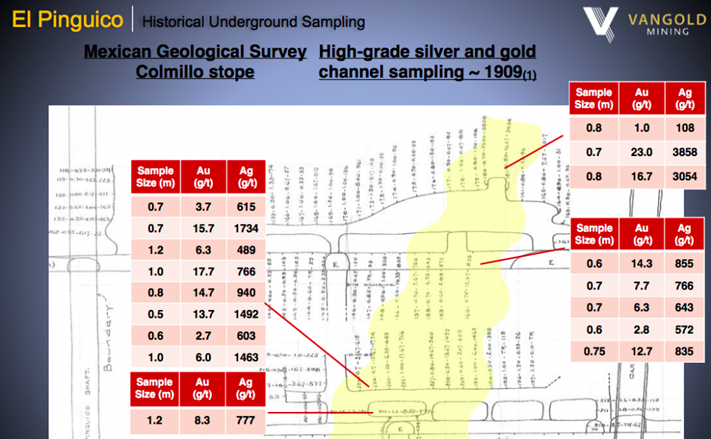

Once back into the El Pinguico shaft, crews should be able to access the Colmillo Stope, a high-grade portion of the mine prior to its closure in 1913. Examples of historical channel sampling from this area in 1909 can be found on page 5 of VanGold's corporate presentation. Notice the eight samples of >10 g/t Au, and five grading 1,000+ g/t Ag among a few hundred samples taken.

Conclusion

Every mining junior on the planet dreams of being in a position to self-fund exploration and development, to avoid massive equity dilution. Very few management teams have the opportunity to make that dream a reality like VanGold does. To be clear, significant risks remain, but the blue-sky potential for this sub C$10 million company is compelling.

As management continues to de-risk the VanGold Mining (TSX-V: VGLD) story, and if gold and silver prices remain elevated or go higher, there's ample room for the stock price to run. Blessed with a strong technical team & Board, a great project and a tremendous jurisdiction, the best is yet to come.

While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Vangold Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Vangold Mining are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock and warrants in Vangold Mining, and the Company was an advertiser on [ER].

While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.