Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) announced in a news release that its newly updated preliminary economic assessment (PEA) on its KSM project in British Columbia shows improved economics and decreased economic impact.

"The new technical report gives investors a compelling view of the project's potential," Chairman and CEO Rudi Fronk said in the release.

The new PEA calculates total production at KSM over an estimated 44-year mine life to be 27.6 million ounces (27.6 Moz) of gold and 17 billion pounds of copper.

The new projected after-tax internal rate of return is 14%, a 40% increase over the 10% in the 2016 PEA. Similarly, the new post-tax net present value at a 5% discount is $6 billion, 80% higher than the $3.4 billion in the previous report. Also, the after-tax payback on $5.2 billion of initial capital is now 4 years, having dropped from 6.4.

As for costs, the total life-of-mine cost, accounting for all project capital and byproduct credits, is an estimated $4 per gold ounce produced, dramatically lower than the previous $358.

Regarding the forecasted environmental impacts of KSM, the updated PEA, compared to the previous version, decreases mine waste rock by 57% and greenhouse gas emissions by 33%.

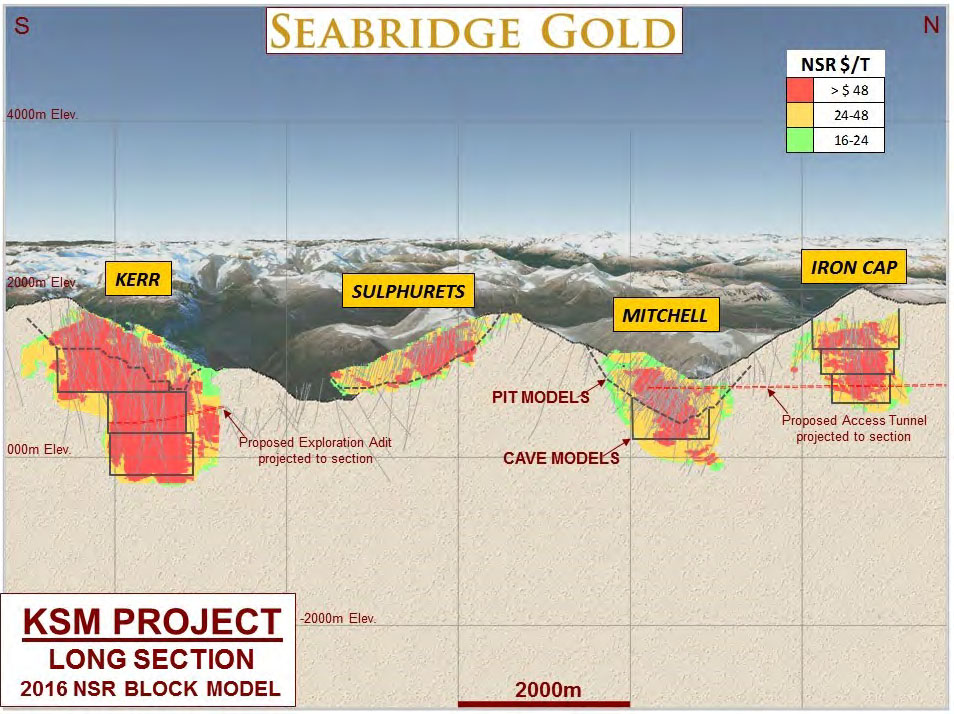

All of these changes result from including the recently expanded, higher grade Iron Cap deposit in the new mine plans and incorporating it at an early stage. This scenario does not affect the current preliminary feasibility study, "which remains in effect and will be included with the 2020 PEA in an updated NI 43-101 Technical Report to be filed on SEDAR within 45 days," the company stated.

Additionally, because the PEA is based on Iron Cap's Inferred resource estimate, the company indicated that it is highly likely the resource will be upgraded with further drilling, offering further project upside. The new PEA indicates that production at KSM based on the current Inferred resource is an estimated 20.8 Moz of gold and 13.8 Mlb of copper.

"These PEA economic projections, if achieved, would rank KSM among the best large scale producing mines in the world," added Fronk.

Read what other experts are saying about:

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Seabridge Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.