The U.S. monetary and fiscal authorities are shoveling trillions of dollars into the U.S. economy to prevent a collapse of the economy and the financial system. Will this money be repaid or otherwise withdrawn from the system? If not, what consequences can we anticipate?

We know under TARP the loans and preference share funding provided to various companies in 2008/9 was largely repaid. We expect most large companies will repay the loans they receive this time also, but the terms will be very easy and they will be made easier if needed. Money for state governments, hospitals and other emergency health-related expenditures is not coming back. Most of the money to smaller companies will likely be in the form of grants if they keep employees on salary. Money directly to individuals will not be repaid.

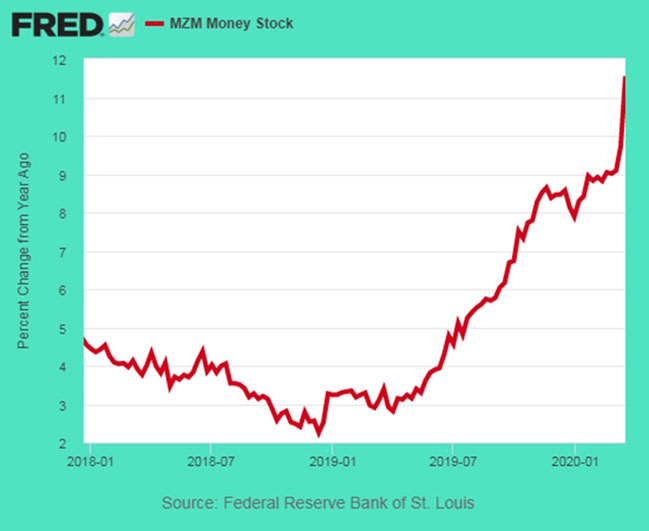

When loans are repaid, the newly created cash is terminated but most of the trillions from the Fed and Treasury will remain in the system. We therefore expect to see an abrupt increase in money supply and that's already evident (see below). Whatever happens, nothing will be allowed to reduce dollar liquidity or bank reserves. Attempts to reduce the Fed balance sheet in 2018 went very badly and will not be repeated. Also, in the U.S. there is no trust that the programs will not be abused and we expect they will be abused, angering ordinary citizens who are likely to feel that the least worthy have benefited most.

In the Weimar Republic, the strains put on the financial system were too extreme...especially the war reparations on top of all the expenditures required to recover from the First World War. Their currency, once the strongest in Europe, became worthless. And now we have talk of fighting the coronavirus as if it is a war. The effects may be thought of as similar...too much demanded from the central authorities and met in the same way, by extreme money printing.

Will U.S. fiscal and monetary policies destroy confidence in the dollar? We think this is likely. Eventually, too many demands are met with too many dollars, investors begin to avoid holding the currency and we begin to see backwardation in the dollar and gold futures. That will be a very negative sign for the conventional monetary system and a spectacular boost to gold. Meanwhile, the Fed has certainly figured out how to jam money supply higher. Is this sort of growth possible on an ongoing basis without loss of confidence in the currency and a large increase in inflation? We don't think so.

This article is the collaboration of Rudi Fronk and Jim Anthony, cofounders of Seabridge Gold, and reflects the thinking that has helped make them successful gold investors. Rudi is the current Chairman and CEO of Seabridge and Jim is one of its largest shareholders.

Disclaimer: The authors are not registered or accredited as investment advisors. Information contained herein has been obtained from sources believed reliable but is not necessarily complete and accuracy is not guaranteed. Any securities mentioned on this site are not to be construed as investment or trading recommendations specifically for you. You must consult your own advisor for investment or trading advice. This article is for informational purposes only.

[NLINSERT]Disclosures:

1) Statements and opinions expressed are the opinions of Rudi Fronk and Jim Anthony and not of Streetwise Reports or its officers. The authors are wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation. The authors were not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the authors to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

2) Rudi Fronk and Jim Anthony: we, or members of our immediate household or family, own shares of the following companies mentioned in this article: Seabridge Gold. We personally are, or members of our immediate household or family are, paid by the following companies mentioned in this article: Seabridge Gold.

3) Seabridge Gold is a billboard sponsor of Streetwise Reports. Click here for important disclosures about sponsor fees.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.