Gold Terra Resource Corp. (YGT:TSX.V; TRXXF:OTC; TXO:FSE) (160,493,235 shares @ US$0.18 = US$28.9 million market cap)

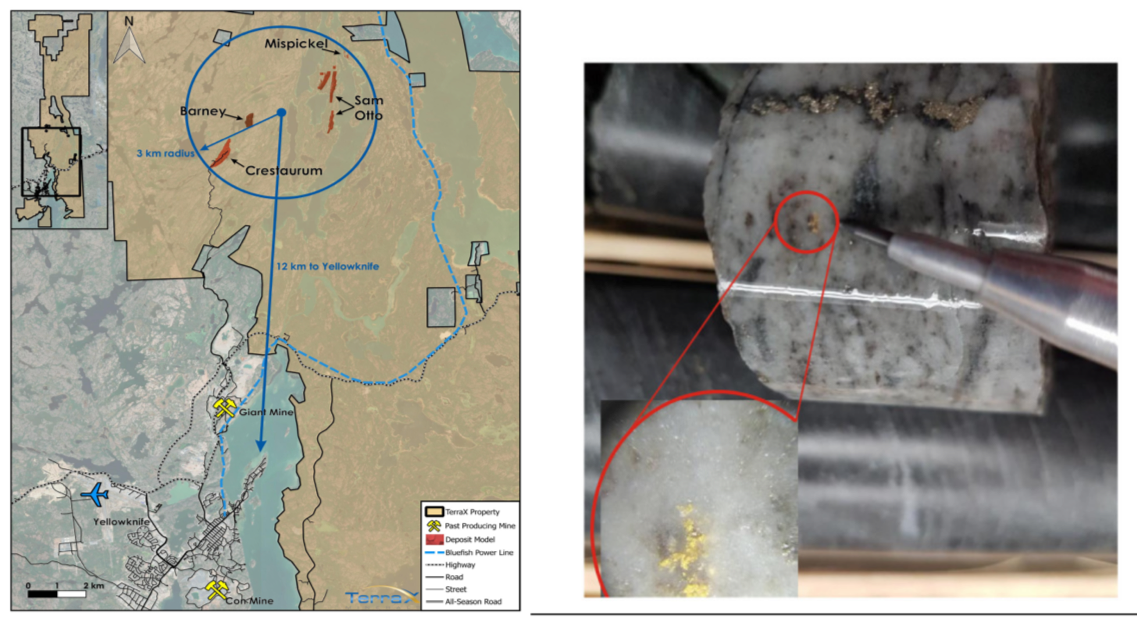

I have picked up a few shares of Gold Terra because I think things may be about to get exciting for this company. I say that on the basis of the company's Feb. 6 report, in which it reported that the first 1,916 meters (1,916 m) of the current 10,000-meter winter drill program on its Sam Otto target has been completed and sent for assays. Drilling is being done on the Sam Otto during the winter because it's easier to access the drill sites while the ground is frozen, and the objective is to expand the existing resource. Currently on this target, an open-pit constrained resource of 426,000 ounces has been outlined from material grading 1.23 g/t. In addition, another 22,000 underground ounces have been outlined, grading 3.65 g/t gold, at Sam Otto.

So, what I find interesting now that makes owning some shares a higher priority than in the past, are these details from the Feb. 6 news release. The company reported intersecting wide shear zones at Sam Otto South, with three holes containing quartz veins showing visible gold and having the potential to repeat the success of hole TSO-035. Management believes these preliminary results could aid significantly in achieving the goal of expanding the resource at Sam Otto.

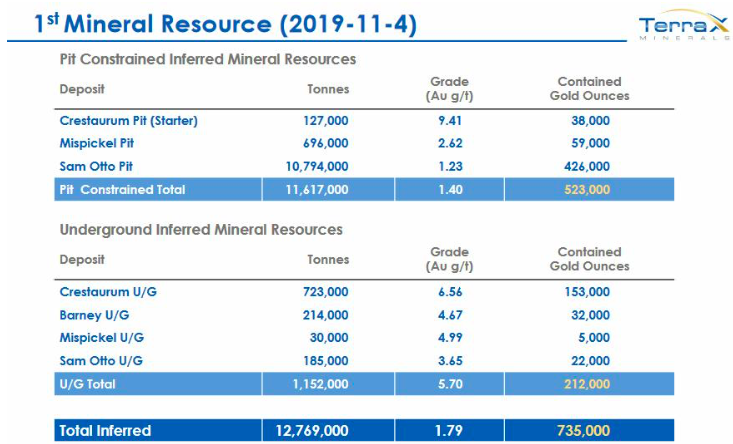

Management reported that "five holes totaling 1,497 meters have been drilled on strike and below hole TSO18-035 (line 3100N), which intersected 2.16 grams per tonne Au over 27.12 meters (March 9, 2018). The five holes have been drilled on a 50 m spacing laterally, and 100 m vertically near the previous hole TSO18-035. Typically the Sam Otto zone consists of a wide shear zone (30 to 100 m wide) and one to two g/t gold mineralization associated with disseminated sulphides such as pyrite, pyrrhotite and trace of arsenopyrite (Py-Po-Asp). The previous hole TSO18-035 contained significant quartz veins with some visible gold that brought the average zone to above 2.0 g/t gold. All five holes from winter 2020 have intersected wide zones of shearing, alteration and sulphide mineralization, ranging up to 160 meters wide with same mineralization style. The first three holes (53, 54 and 58) have all intersected visible gold in quartz veins similar tothe discovery hole TSO18-35." (Management provided a picture of Hole 54 in their press release, as published above.)

"In addition to the drilling on Sam Otto South, two holes have been completed in the Sam Otto Connector zone on line 4250N, which is one kilometer north. This area is between the Sam Otto Main zone and the Sam Otto South zone. Previous mapping and surface sampling have indicated a continuation of these zones to connect as one. Both holes have intersected alteration, shearing and sulphide mineralization (Py-Po-Asp) over plus or minus 80-meter widths."

As you can see, the lion's share of the current resource is from Sam Otto. Other targets that have contributed to the overall resource will be explored later this year. But the reports of visible gold and gold mineralization over significant intersection lengths I think are very promising.

Also, I think the fact that delays in reporting assays when visible gold is prevalent may suggest the need to double-check some very high-grade assays. I'm not sure just how soon assays will be forthcoming, but I'm guessing they could come at some time before the end of this month. They could be of a sufficiently high nature to attract some attention in a stock that, as you can see from the company's stock chart, is near its bottom.

What people are also not paying a sufficient amount of attention to is the recent addition of Gerald Panneton, of Detour Gold fame. Panneton is executive chairman. His addition as well as that of David Suda, president and CEO, really adds executive strength to go along with Joseph Campbell, COO, who was the head executive when this company was first added to this letter in August 2014.

It's been a long time coming, but I believe the time to celebrate may be very near for long-suffering shareholders. That's why I added some of these shares to my portfolio. I'm expecting considerable progress toward a larger resource in 2020, to the point where Gold Terra should start to make it onto many more computer screens by year-end.

As he followed the demolition of the U.S. gold standard and the rapid rise in the national debt, Jay Taylor's interest in U.S. monetary and fiscal policy grew, particularly as it related to gold. He began publishing North American Gold Mining Stocks in 1981. In 1997, he decided to pursue his avocation as a new full-time career—including publication of his weekly J. Taylor's Gold, Energy & Tech Stocks newsletter. He also has a radio program, "Turning Hard Times Into Good Times."

[NLINSERT]Disclosure:

1) Jay Taylor's disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Gold Terra Resource Corp., a company mentioned in this article.

Charts and graphics provided by the author.

Disclosures: J Taylor's Gold, Energy & Tech Stocks (JTGETS), is published monthly as a copyright publication of Taylor Hard Money Advisors, Inc. (THMA), Tel.: (718) 457-1426. Website: www.miningstocks.com. THMA provides investment ideas solely on a paid subscription basis. Companies are selected for presentation in JTGETS strictly on their merits as perceived by THMA. No fee is charged to the company for inclusion. The currency used in this publication is the U.S. dollar unless otherwise noted. The material contained herein is solely for information purposes. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice. The information contained herein is based on sources, which the publisher believes to be reliable, but is not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available information. Any opinions expressed are subject to change without notice. The editor, his family and associates and THMA are not responsible for errors or omissions. They may from time to time have a position in the securities of the companies mentioned herein. No statement or expression of any opinions contained in this report constitutes an offer to buy or sell the shares of the company mentioned above. Under copyright law, and upon their request companies mentioned in JTGETS, from time to time pay THMA a fee of $250 to $500 per page for the right to reprint articles that are otherwise restricted solely for the benefit of paid subscribers to JTGETS. To subscribe to J Taylor's Gold, Energy & Tech Stocks Visit: www.miningstocks.com.

Note: Article originally published on Feb. 14.