This article was conceived as a "souvenir article" to assist subscribers who did the trade—and I know from feedback that a significant number of you did—in gloating at its glorious success—but here's the thing, working on it turned up some valuable insights that we can turn to our advantage in the immediate future. You will soon see what I mean.

As Friday wore on I became more and more uncomfortable about sticking with the Puts, on account of the by then massively oversold condition of the market after five straight days of dropping like a rock, and, aware that after such a week, reversals often happen at or around the weekend, I figured that "a bird in the hand is worth two in the bush," and so waited for what I thought was a good point for us to offload our Puts for the best prices possible. On the 1-day intraday chart for the NASDAQ Composite index shown below we can see that we missed the best chance, which was at about 10 in the morning, but fortune was kind and threw up a second opportunity in the early to mid-afternoon, and so an alert was sent out at about 1.45 pm EST to sell all Puts, after which the sector continued to drop for about another 20 minutes, so if you moved quickly you would have been able to get out at excellent prices, and I know that some of you did. After zig-zagging around the market rallied into the close and finished near to the highs for the day on huge volume. So what happened? What does this action portend?

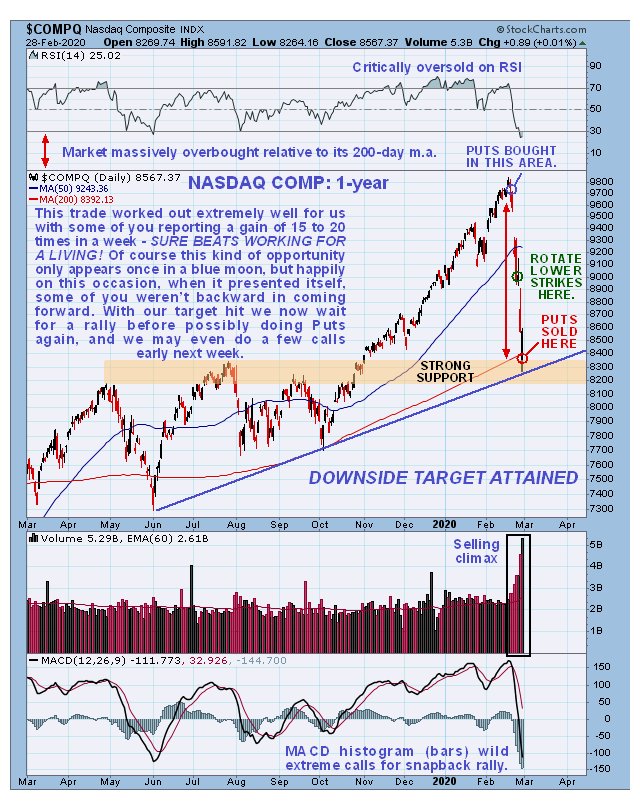

We can best see exactly what was going on using the 1-year chart for the NASDAQ Composite. On this chart we can see that the steep decline last week stopped exactly at a trendline target, which the market arrived at in a massively oversold state and on climactic volume, and it coincidentally arrived at a zone of strong support arising from trading at and below this zone from April through October. So this is clearly a good point for the rout to stop.

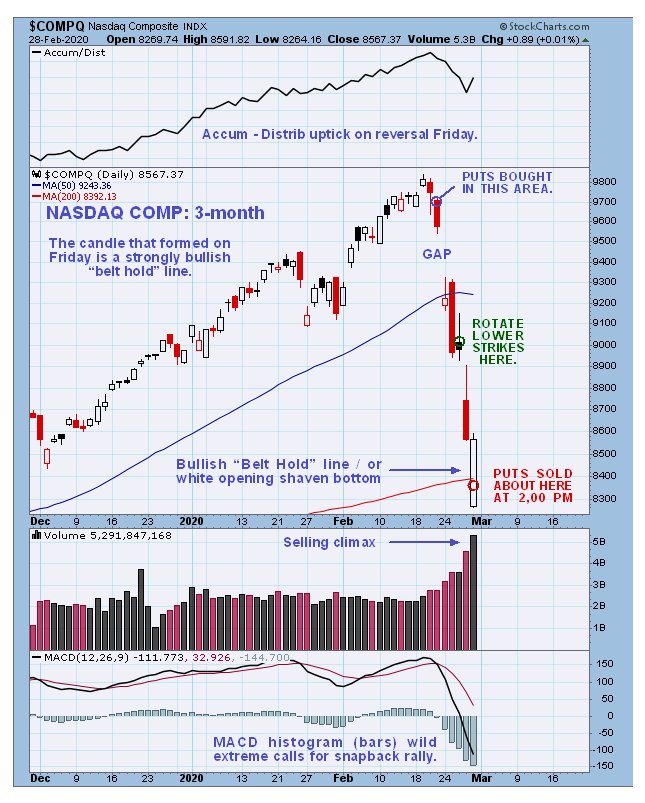

It is thus most interesting to observe on the 3-month chart for the NASDAQ Composite the sort of candle that formed on Friday it was a big white shaven bottomed candle of a type known as a "belt hold line" or a "white opening shaven bottom" and a large white candle like this appearing after a severe and precipitous decline is bullish and a sign of a reversal, at least for the short term, especially when it occurs on heavy volume as this did, and especially as it occurred at the rising 200-day moving average. What this means is that we shouldn't just have liquidated our Puts—we should have placed a modest portion of the proceeds immediately into Calls. That is easier to see now but in the heat of battle it was not so obvious.

If fortune is kind to us again, the market will zigzag around on Monday below Friday's close, perhaps dipping during the morning, enabling us to do some Calls at reasonable prices, for the scenario predicated by the action on Friday is a relief rally that should be big enough to make a good profit in Calls. Such a rally could be triggered by the market starting to smell an emergency 1% rate drop in the offing, for example, since Trump will do anything to resuscitate the market.

The idea to short the Tech sector crystallized when we reviewed a compelling body of evidence that pointed to an imminent market crash.

Now we will proceed to gloat at, er, I mean look at, the 3-month charts for Apple and Microsoft, in which we made massive profits in Puts in a very short space of time.

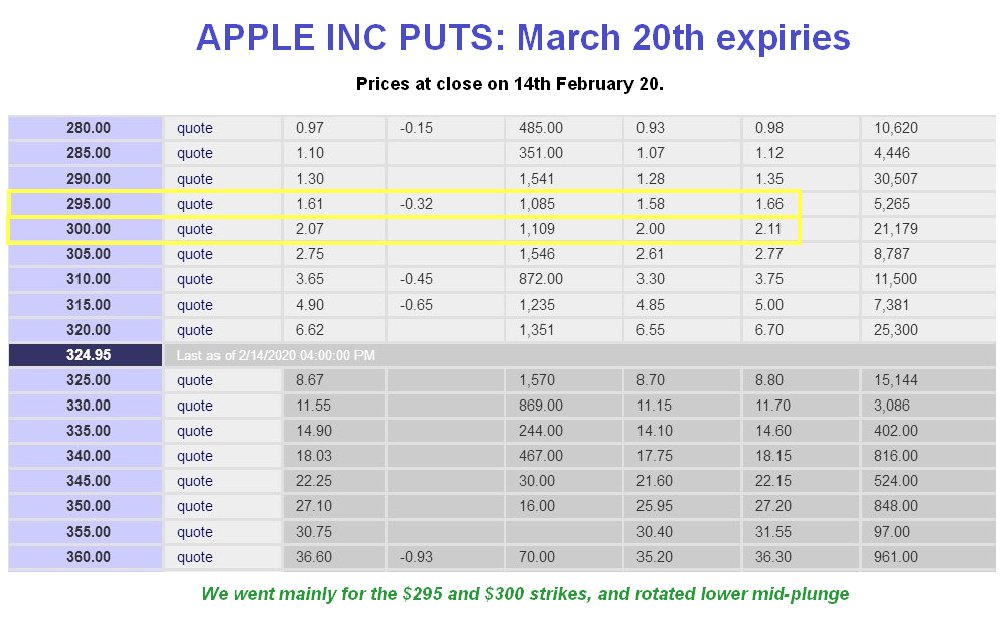

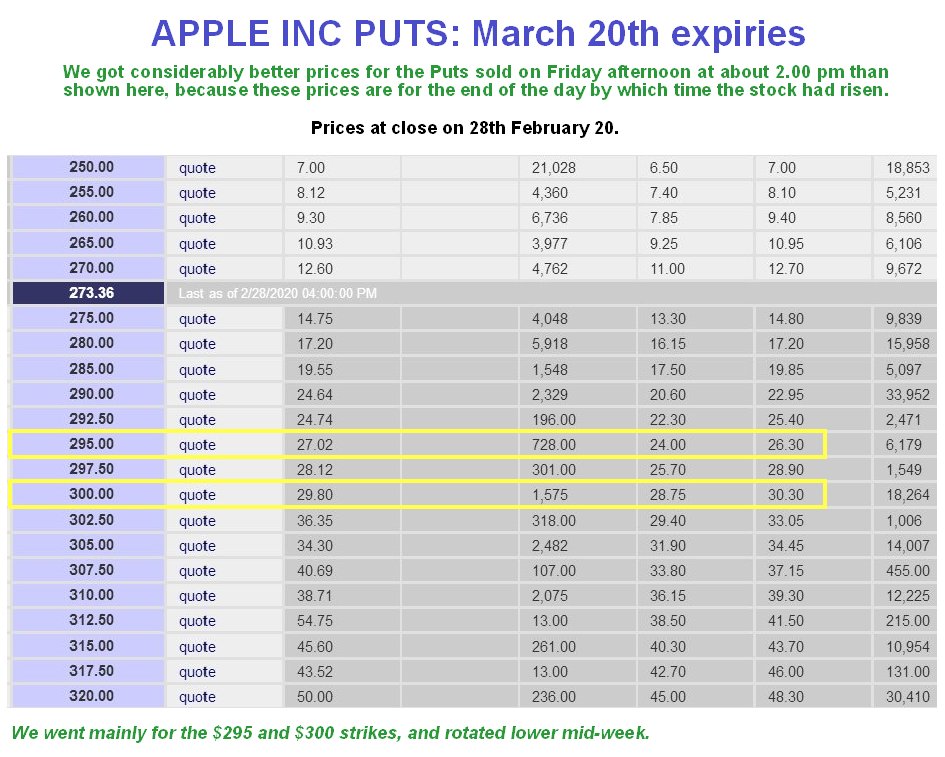

Starting with Apple, we see that we bought the Puts at the optimal time, right before the crash started. It was suggested to rotate to lower strikes at about hallway down at the point shown, the reason being to safeguard most of our gains in the event of it snapping back higher. That didn't happen so it was a shame we did that as we lost the gains that accrued between the old and new strikes. Nevertheless, we still came out of it with massive profits, and I know that some of you toughed it out without rotating into lower strikes, an approach that paid off.

Now here's where the fun gets even greater as we look first at where we bought the Puts, which were the March 20th expiring $300 strike, and we also did the $295 strike a little later. . .

Now see where they finished on Friday. The $300 has risen nearly 15-fold, and in fact we got more than that as we sold at about 2.00 pm when prices were considerably better. Apple finished Friday with a large bullish "belt hold line" white candle on massive volume, which is viewed as a sign of at least a temporary bottom.

A 12 to 15-fold gain in a week is certainly something to be pleased about.

Now to look at Microsoft, which was a similar story, except that overall Microsoft looks somewhat more resilient than Apple, which is also evidenced by it putting in a bullish "piercing pattern" on Thursday and Friday, where Friday's close is well into the "real body" of Thursday's candle.

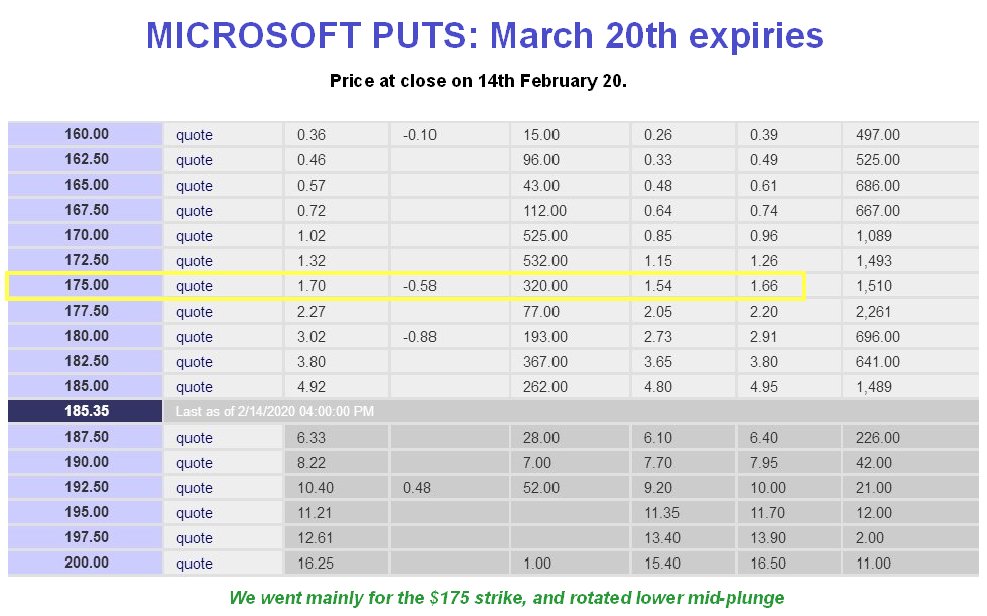

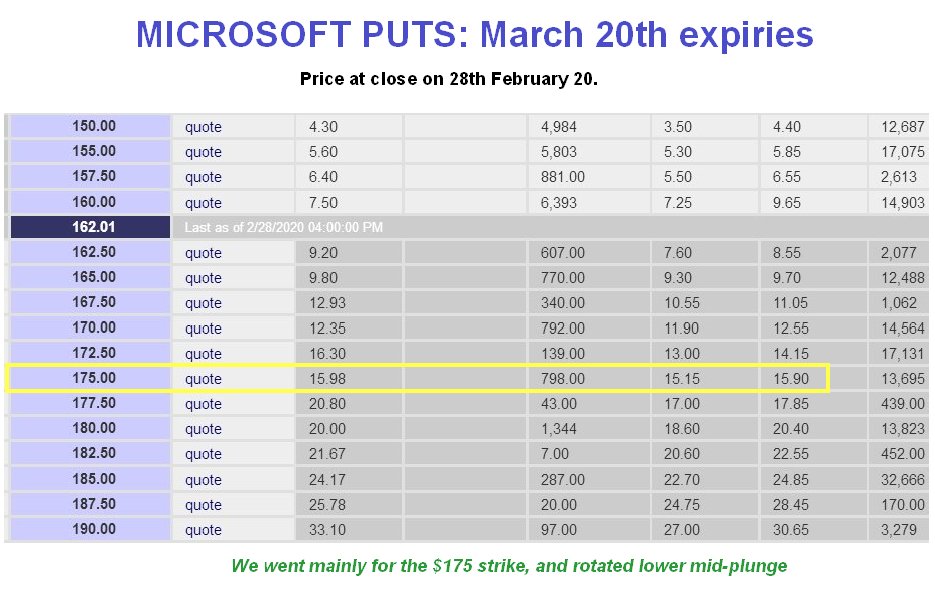

The Puts favored in Microsoft were again March 20th expiries, with a strike at $175, which had a more modest gain in comparison with Apple of about 10-fold, and again, because we sold mid-afternoon, we got better prices than those available at the close.

So we have every reason to feel pleased with ourselves over the outcome of these trades, and I would like to take this opportunity to congratulate those of you who had the courage to do these trades. As the British SAS say, "Who dares, wins."

As mentioned at the outset, this article is not mere gloating, for in the course of examining these charts we have discovered something useful—that the market has probably put in at least a short-term tradable bottom and should stage some sort of rally from here.

All Put tables courtesy of www.bigcharts.com

Originally posted on CliveMaund.com at 6.10 pm EST on 29th February 2020.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

[NLINSERT]Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.