In a Dec. 18 research note, Echelon Wealth Partners analyst Ryan Walker reported that Lion One Metals Ltd.'s (LIO:TSX.V; LOMLF:OTCQX) first deep hole at its Tuvatu project in Fiji delivered multiple high-grade intervals.

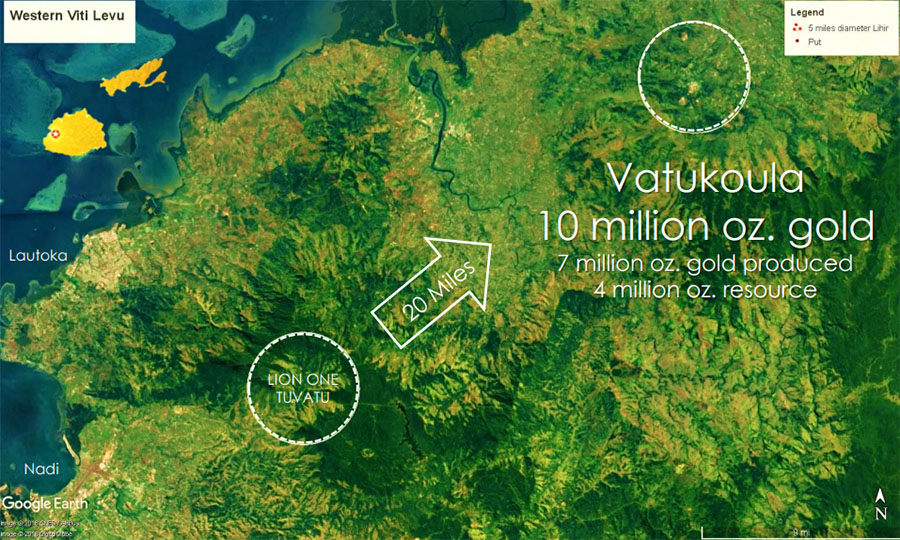

That maiden hole, TUDDH493, "cut hydrothermal breccia 70 meters (70m) below existing resources," Walker indicated. The mineralization encountered in the hole does not resemble any previously seen at Tuvatu but is similar to that seen previously in the Vatukoula gold mine in the region.

Walker noted gold assay highlights from hole TUDDH493, which include:

- 0.35m (0.3m estimated true width, from 177.25 downhole) at 105 grams per ton (105 g/t)

- 3.83m (2.3m true width, 322.17m) at 10.21 g/t, including 0.12m at 56.7 g/t

- 4.29m (2.5m true width, 422.53m) at 33.22 g/t, including 0.31m (423.41m) at 322 g/t and 0.37m (424.63m) at 22.5 g/t (UR2 lode)

- 0.38m (507.82m) of 0.97 g/t.

"We note that the broader intervals maintain good grades," commented Walker. In comparison, the gold grade of the existing Tuvatu resource in the Indicated category is 8.46 g/t, and the gold grade of the existing Inferred ounces is 9.7 g/t. Also, importantly, about 80% of the existing resource is within just 200m of surface," the analyst added.

Walker also relayed that the second deep hole of the four-hole program, TUDDH494, has been drilled halfway to its 1,000m target and should be completed in January. The hole "was designed to undercut the above-noted, high-grade UR2 lode (4.29m at 33.22 g/t)," noted Walker. Already, it hit a roughly 2m long "notable mineralized interval" at 188.8m downhole, according to Lion One.

Echelon does not have a rating or target price on the gold exploration company. Lion One's share is trading at around CA$1.31.

Read what other experts are saying about:

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Lion One Metals. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures from Echelon Wealth Partners, Lion One, December 18, 2019

Echelon Wealth Partners compensates its Research Analysts from a variety of sources. The Research Department is a cost centre and is funded by the business activities of Echelon Wealth Partners including, Institutional Equity Sales and Trading, Retail Sales and Corporate and Investment Banking.

I, Ryan Walker, hereby certify that the views expressed in this report accurately reflect my personal views about the subject securities or issuers. I also certify that I have not, am not, and will not receive, directly or indirectly, compensation in exchange for expressing the specific recommendations or views in this report.

Important Disclosures:

Is this an issuer related or industry related publication? Issuer.

Does the Analyst or any member of the Analyst’s household have a financial interest in the securities of the subject issuer? No

The name of any partner, director, officer, employee or agent of the Dealer Member who is an officer, director or employee of the issuer, or who serves in any advisory capacity to the issuer. No

Does Echelon Wealth Partners Inc. or the Analyst have any actual material conflicts of interest with the issuer? No

Does Echelon Wealth Partners Inc. and/or one or more entities affiliated with Echelon Wealth Partners Inc. beneficially own common shares (or any other class of common equity securities) of this issuer which constitutes more than 1% of the presently issued and outstanding shares of the issuer? No

During the last 12 months, has Echelon Wealth Partners Inc. provided financial advice to and/or, either on its own or as a syndicate member, participated in a public offering, or private placement of securities of this issuer? Yes

During the last 12 months, has Echelon Wealth Partners Inc. received compensation for having provided investment banking or related services to this Issuer? Yes

Has the Analyst had an onsite visit with the Issuer within the last 12 months? No

Has the Analyst or any Partner, Director or Officer been compensated for travel expenses incurred as a result of an onsite visit with the Issuer within the last 12 months? No

Has the Analyst received any compensation from the subject company in the past 12 months? No

Is Echelon Wealth Partners Inc. a market maker in the issuer’s securities at the date of this report? No