Introduction

This, perhaps, won't be the most original remark or statement, but sometimes a project can benefit from a fresh pair of eyes that use a whole new approach to unlock value. New Nadina Explorations Ltd. had a massive run about two years ago, when the share price shot up from just a few cents to over CA$4 before it cratered just a few months later, as the initial excitement waned. The company continued to trade between $0.05 and $0.20 and appeared to be going out of business.

This changed in August, when the Manex Resource Group agreed to take the reins at the company and overhauled the board of directors and the management team. The company was rebranded into Equity Metals Corp. (EQTY:TSX.V), with a main focus on the Silver Queen project in British Columbia.

From New Nadina to Equity Metals: the Same Project Seen through a Different Set of Eyes

A new management was installed, the board of directors was overhauled, as well with two directors resigning and moving into consulting roles, while Larry Page and Joe Kizis were taking their places.

Two weeks later, the new management announced New Nadina would change its name to Equity Metals, and a concurring CA$500,000 placement was announced. This placement was almost immediately upsized to CA$1 million to accommodate the investor interest, and the cash will be useful to boost the working capital position, which dropped to zero as of the end of August.

The placement was a hard-dollar raise, with units priced at CA$0.08. Each unit contains one common share as well as a full warrant with a strike price of CA$0.12, valid for a period of three years.

About the Silver Queen Flagship Project

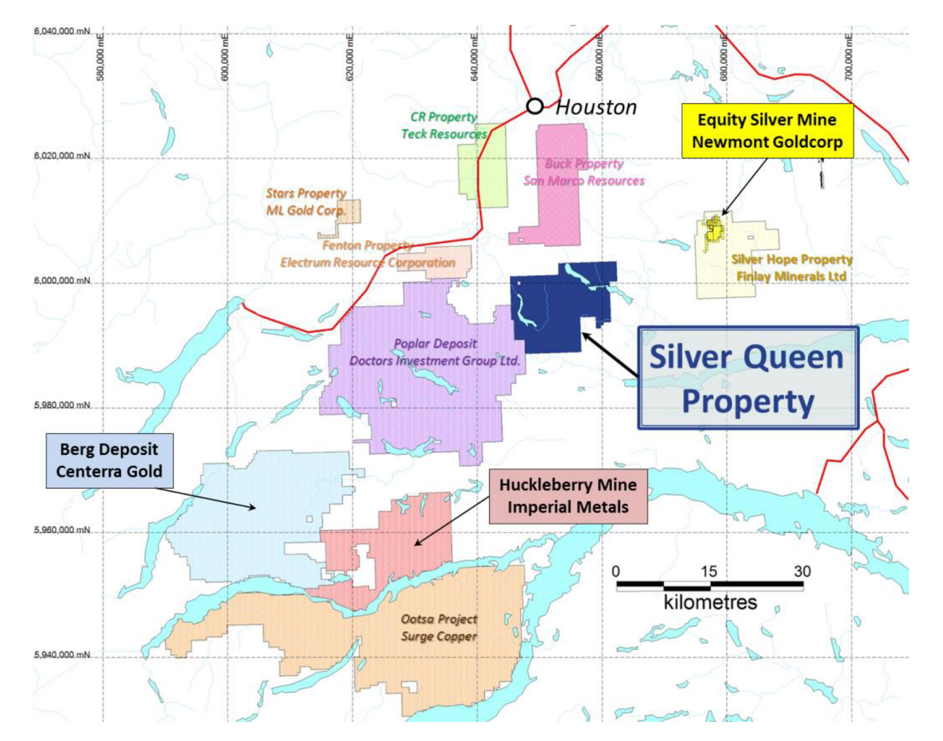

Silver Queen is located approximately 600 kilometers north of Vancouver and about 35 kilometers south of Houston (which has around 3,000 inhabitants), and consists of 45 claims for a total surface area of almost 19,000 hectares (190 square kilometers). All claims are 100% owned by Equity Metals, are royalty-free, and as previous operators have spent quite a bit of money on the claims, the claims will remain in good standing for an additional eight years, until November 2027.

The required minimum spend to keep the claims in good standing is now CA$20 per hectare per year, which means Equity Metals will have to spend around CA$375,000 on exploration per year to keep the claims in good standing for an additional year beyond the 2027 deadline. Once the company completes its planned 2020 exploration program (subject to the final plans and Equity's ability to raise money to execute on those plans), we estimate the company will have spent enough money on the claims to keep them in good standing until 2030. That's a clear positive as it means there's no urgent need for Equity Metals to be overly aggressive on the exploration front, and it can throttle back its exploration expenses if needed without running the risk of losing the claims.

The infrastructure around Silver Queen is quite good. The project is connected to Highway 16 by 44 kilometers of an all-weather road that can deal with heavy traffic, as the same road was used to supply the Huckleberry copper mine, 80 kilometers farther south from Silver Queen. The Huckleberry mine (which is owned by Imperial Metals Corp. [III:TSX]) is currently on care and maintenance and Imperial Metals has been working on some plans to re-open the mine but we don't expect any progress on this front until the copper price moves back up to over $3 per pound again.

Thanks to the Huckleberry mine, there's plenty of other infrastructure in place, as Houston is also serviced by the Canadian National Railway on the railroad to Kitimat and Prince Rupert to the west, and Prince George to the east. Additionally, Equity Metals has been granted access to the powerline that currently runs from Houston all the way to the Huckleberry mine.

So, from an infrastructure point of view, Silver Queen is in a sweet spot with easy access to a highway, railway and power. Meanwhile, the property is far enough from Houston and other settlements to not bother anyone should any mining activities be developed.

The Silver Queen gold-silver system isn't a new discovery. First mineralization was encountered in 1912 and the operators back in the day immediately drifted three adits into the slope of the mountain, from which pods of a few dozen tonnes with high-grade lead-silver mineralization were shipped to a smelter. There has been some historical production since, but nothing to get too excited about in terms of volume. The grades that were encountered were spectacular though. An old resource estimate compiled in the 1980s estimated the Number 3 Vein contained almost 600,000 tonnes of rock at a grade of 3.4 g/t gold, in excess of 230 g/t silver, in excess of 8% zinc/lead and almost half a percent of copper. Of course, this estimate was compiled more than 30 years ago and is, per definition, not up to today's standards. But it does give us an idea how rich the mineralized system was.

There's one issue, though, that Equity Metals will have to deal with later on, and that's the value of the arsenic in the copper-lead concentrate. But as most of the test work is a few decades old as well, applying more modern techniques in the flow sheet will be necessary to get the concentrate as clean as possible in order to avoid being penalized by the smelters.

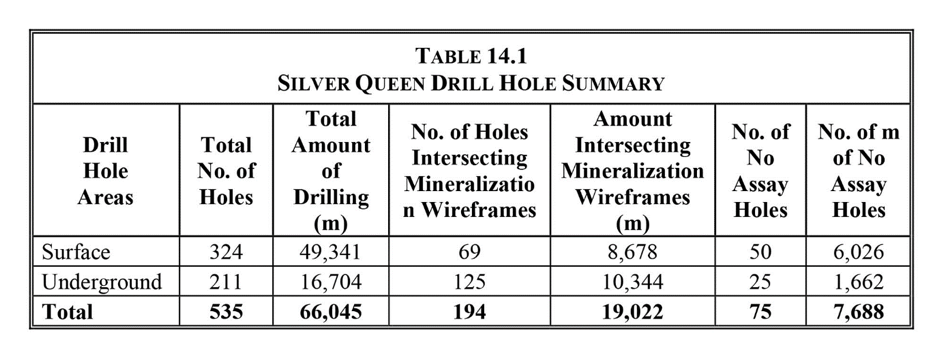

But Silver Queen isn't a virgin project. There is a recent resource estimate completed in 2019 (NI-43-101 compliant, actually) based on in excess of 66,000 meters of drilling in 535 holes. About 75% of the drilled meters are from surface drill holes, while the remaining 25% (211 holes) are from underground drilling.

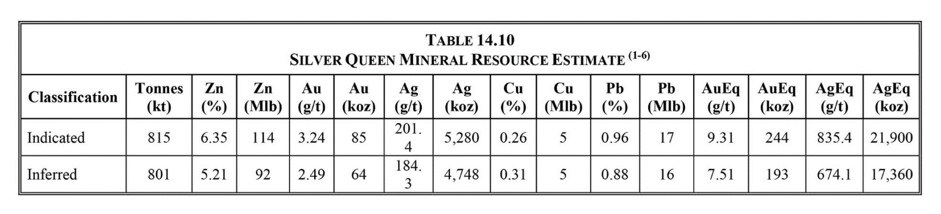

This resulted in a total resource of 1.6 million tonnes (50/50 between the Indicated and Inferred resource categories), containing a total of 440,000 ounces gold-equivalent.

Defining 1.6 million tonnes with a handful of gold (149,000 ounces) and silver (10 million ounces), with a little bit of lead and zinc on top of that, is definitely not impressive for a project that has seen almost 70,000 meters of drilling. In fact, we would even describe that result as pretty disappointing, which is why the project needed a fresh set of eyes to figure out how future exploration programs could be made more efficient and successful in discovering and delineating economic mineralization.

The First Steps to Grow Silver Queen to 1.5 Moz Gold-Equivalent

And that's where the experience of the people who have been designing the Cerro Las Minitas (CLM) drill program in Mexico will be very useful. Rob MacDonald, Equity's new VP Exploration, was crucial in defining hundreds of millions of silver-equivalent ounces at CLM in Mexico at a discovery cost of US$0.07 per ounce silver-equivalent, as he was running a very tight exploration ship. And the team obviously would like to replicate the Mexican exploration efficiency in British Columbia to make sure it has more to show than an unimpressive 1.6 million tonnes after 66,000 meters of drilling. Although we shouldn't take this at face value (a large part of the historical drilling was meant to define a mineable reserve in the 1980s and wasn't aimed at exploration drilling), we expect Equity Metals to be more efficient, as resource expansion will be the company's main goal.

In fact, the new Equity Metals team has a two-pronged approach for Silver Queen. First of all, they want to follow up on and expand the current 1.6 million tonne, 440,000-ounce gold-equivalent resource estimate in the silver-gold epithermal vein system. The current exploration target of 1.5 million ounces gold-equivalent in the Inferred category may sound ambitious, but considering the current resource already contains almost half a million ounces in less than 2 million tonnes, the high grade at Silver Queen actually means the company doesn't really have to find a large tonnage to meet this threshold.

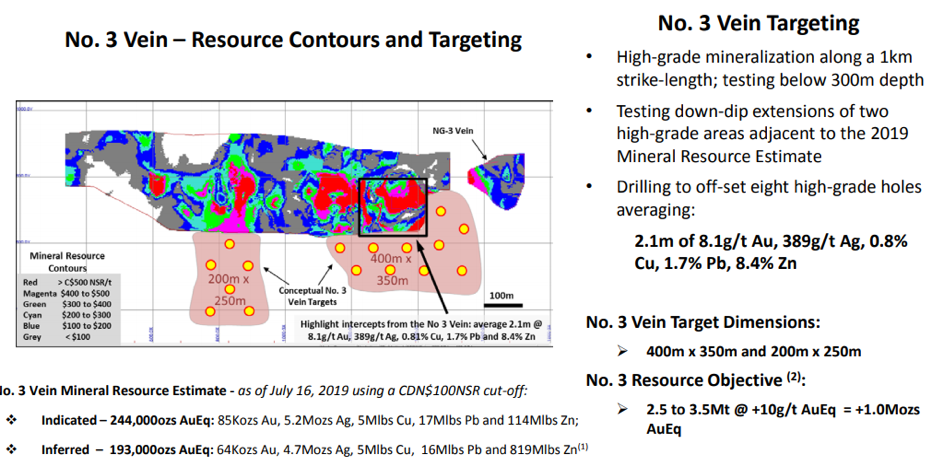

The No. 3 vein (which was discovered a few decades ago) remains open along strike, and the potential to discover additional high-grade ore shoots still exists. Those potential ore shoots will be the main focus for Equity Metals as it realizes this is where the potential lies to rapidly expand the resource estimate towards reaching a certain critical mass.

Just like at Southern Silver, the Equity Metals team isn't too shy to put its official exploration targets in writing. It expects the NG-3 vein to hold 1–3 million tonnes at an average grade of 10 g/t gold-equivalent, while the Camp Vein is estimated to hold in excess of half a million tonnes at an average grade of 1000 g/t silver-equivalent. That's not unreasonable considering the historical resource already contains just over 200,000 tonnes at a grade of 829 g/t silver, 4% zinc and 1 g/t gold. Considering this structure remains open at depth (previous drill activities were quite shallow) and along strike, it shouldn't be too hard to add a few additional hundred thousand tonnes.

But there's a second exploration idea behind the Silver Queen target. As mentioned before, the mine closest to Silver Queen is Imperial Metals' Huckleberry mine, a large, open-pit copper mine where Imperial had been mining a huge low-grade porphyry-type ore body before low copper prices made the operation unviable.

During the first 14 years of the Huckleberry mine life, a total of 870 million pounds of copper, 3.4 million ounces of silver, 105,000 ounces of gold and about 8 million pounds of molybdenum were produced. Back in 2011, the mine was expected to contain just over 250 million tonnes of rock in the Measured and Indicated categories, so needless to say this was/is a huge porphyry system. But with an average grade of 0.305% copper, the economics just don't work.

So why is the Huckleberry mine (and the nearby Berg project, owned by Centerra Gold Inc. [CG:TSX; CADGF:OTCPK], which has similar characteristics, with 400 million tonnes at an average grade of 0.31% copper, 3 g/t silver and 0.034% molybdenum) an important piece of the puzzle here?

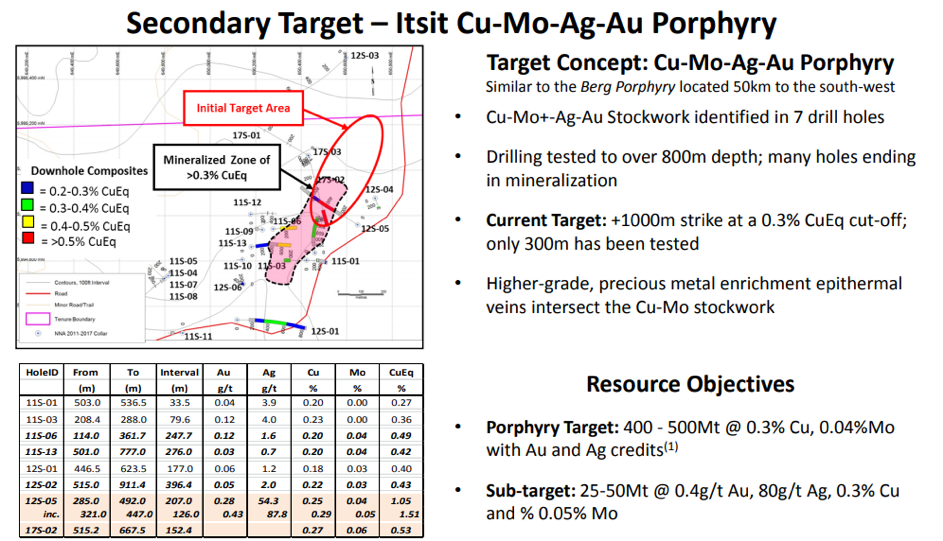

On one part of the Silver Queen project, Equity Metals has a similar porphyry footprint indicated by historical drilling in seven holes that intersected similar copper-gold-silver-molybdenum mineralization. With some of the holes containing thick layers of mineralization (for instance, 248 meters at 0.49% copper equivalent (Cu eq), 396 meters at 0.43% Cu eq and 207 meters at 1.05% Cu eq), there are definitely sniffs of what could be a very large copper porphyry system at Silver Queen.

Of course, it's still very early days and there's no guarantee the size or the average grade of the project will be sufficient to warrant future development. But if the copper price would indeed go up, (which is what most market commentators appear to be expecting), a lot of these "marginal" projects would suddenly come into play again.

Equity Metals' initial exploration target for the porphyry zone is 400-500 million tonnes at an average grade of 0.3% copper, 0.04% molybdenum and some gold and silver. The size and grades were very likely just "borrowed" from Huckleberry and Berg, as they do represent the typical porphyry deposits within the Skeena Arch of British Columbia. That being said, at Southern Silver Exploration Corp. (SSV:TSX.V; SSVFF:OTCQB; SEG1:FSE), the exploration targets have always been comfortably met, which may indicate VP Exploration Rob MacDonald is quite conservative with his projections.

Although copper seemed to have gained momentum again and is now trading at around $2.80 per pound, a low-grade porphyry deposit isn't what we are looking for and we hope/expect Equity to predominantly focus on the high-grade epithermal veins to reach its 1-1.5 million ounce gold-equivalent exploration target as the company has announced in its press releases.

The Capital Structure

Equity Metals has now also closed its second and final tranche of the CA$0.08 equity raise (with a full warrant with a CA$0.12 strike price), raising a total of CA$1.05M. There are only 1.14 million historical warrants with two tranches having exercise prices as high as CA$3.80 and CA$4.25; however, the $0.12 warrants that have just been issued could easily act as a "secondary financing." There still are 1.06 million historical warrants that are also exercisable at CA$0.12 by Sept. 25, 2022, (which is one month before the first 8.92 million warrants of the recent raise expire).

The total amount of warrants with an exercise price of CA$0.12, and expiring in Q3/Q4 2022, is now 14.2 million, and if they would all be exercised, Equity Metals would receive CA$1.7 million in cash proceeds. But before counting on that money, Equity Metals needs to focus on exploration success.

Conclusion

Although Equity Metals has a few other projects in its portfolio, it's clear the focus will be on the Silver Queen project, where Equity can build upon an existing resource estimate. Equity's team is now reinterpreting the historical data, but is planning an initial drill program in the first half of 2020 to drill-test three targets on the Silver Queen vein system.

Now that Equity Metals is recapitalized and a fresh set of eyes of a new team will look at the project, the current market capitalization of just over CA$2.1 million appears to offer a very intriguing risk/reward ratio.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

[NLINSERT]Disclosure:

1) Thibaut Lepouttre: The author has a long position in Equity Metals. The author's company has a financial relationship with Equity Metals. The author determined which companies would be included in this article based on his research and understanding of the sector. Additional disclosures are available here.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.