Assays are pending for holes drilled this season at Iron Mountain and Camp Zone, two of Group Ten Metals Inc.'s (PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE) most advanced targets at the Stillwater West platinum group element (PGE)-copper-nickel project in south-central Montana. I initiated coverage on Group Ten in the Oct. 9, 2017, newsletter and recently went on a site visit to the company's 54-square-kilometer Stillwater West property. The visit reinforced the enormous mineral potential and gave me a glimpse of some of the hurdles that will need to be cleared in order to create shareholder value.

I flew into Billings, Montana's largest city with a population of about 110,000, and it was a one-hour drive to Red Lodge, where I stayed. Red Lodge is the Gateway to Yellowstone Park and nestled against the majestic Beartooth Mountains. With coal mining roots and a tourist flavor, Red Lodge has multiple bars alongside real estate offices, art galleries (with some mining-themed art) and stores selling MAGA gear.

It's another hour's drive to Nye (population 300), where Group Ten's core facility and helicopter landing zone are located. Nye is also on the doorstep of the Stillwater mine complex, which has three producing mines that form the highest-grade major platinum group metals (PGM) deposit in the world. Group Ten inherited a vast amount of historical data on Stillwater West, including some 28,000 meters of drill core. Company geologists have reevaluated about 12,000 meters of that core, and some of that has been submitted for assay, in cases where it was not assayed or assayed for only certain metals.

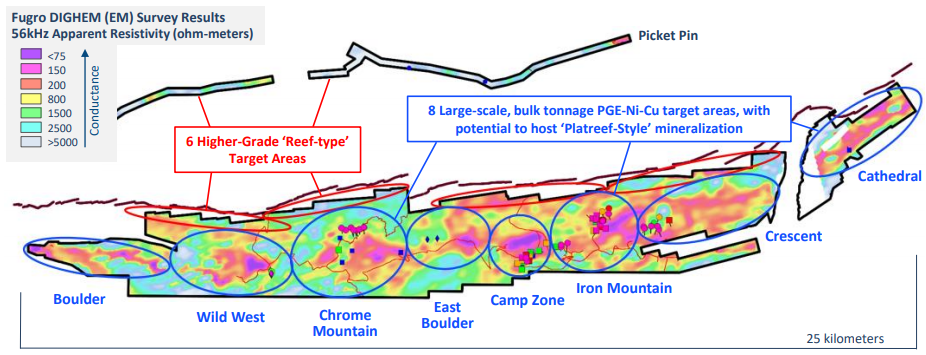

Group Ten is that rare junior mining company that is on the radar of majors but still under the radar for most retail investors. Majors are interested because Stillwater West truly has the potential to host multiple economic deposits (overuse has rendered "district scale" an almost-meaningless cliché, but it applies here). I believe Stillwater West hosts several bulk-tonnage deposits containing nickel and copper as well as platinum group metals, gold, rhodium and cobalt.

And the company is closer to delineating deposits at Stillwater West than many people expect, because of the historical data and core (Group Ten's qualified person (QP), Mike Ostensen, was also QP for much of the prior drilling). According to its Oct. 31 news release, the company plans to publish mineral resource estimates at the three most advanced targets on the property: Iron Mountain, Camp Zone and Chrome Mountain.

Impression #1: It was quickly apparent that mining is part of this area's DNA and it's not just the Stillwater mine complex, a major employer. You can buy miner's boots (among other more peculiar and charming items) at the general store in Fishtail, which has been open since 1900. Red Lodge was founded on coal; Nye used to be a copper mining camp. A short hike from one of Group Ten's drill sites was a prospector's cabin, near an old collapsed adit where the hermit used to hand-mine copper.

Prospector's cabin: The roof had caved in, but the foundation wasn't going anywhere.

Group Ten first caught my attention in June 2017, when they acquired the Stillwater West PGE-nickel-copper project adjacent to the Stillwater mine in south-central Montana. A month before, South African miner Sibanye Gold Ltd. (SBGL:NYSE) had spent US$2.2 billion to buy Stillwater, rebranding as Sibanye Stillwater in a major diversification move out of South Africa. Much of the world's palladium and platinum is mined in South Africa, but Stillwater is the world's highest-grade PGM mining complex. The deposits host more than 105 million ounces of palladium and platinum (in all categories) at average grades of more than 12 g/t palladium and 3.5 g/t platinum.

The mineralization at Stillwater West is complex: The rocks are up to 2.7 billion years old, with multiple mineralization styles. Metal-rich magma was laid down layer after layer and cooled slowly, creating various deposit types. The closest analog globally is Platreef in South Africa, the rich PGM-copper-nickel deposit that David Broughton played a key role in discovering (Broughton is a Group Ten advisor). And its mineral endowment makes Platreef one of the most valuable pieces of real estate on Earth.

Flying over the Sibanye-Stillwater's flagship mine (below) in a helicopter provided a good overview of the large operation. There were plenty of vehicles in the parking lot at the mill, which processes ore from three separate underground mines: Stillwater, East Boulder and Blitz. Local considerations are front and center: a separate vast tailings pond located away from the mill site was built behind a bluff, making it all but invisible from the road.

Impression #2: Group Ten's local knowledge at Stillwater West is a big edge. In addition to consolidating the previously splintered land package, Group Ten employs geologists with combined decades of experience working the project for prior operators. Chief geologist Craig Bow has 40 years of global experience as an economic geologist, including years of work at Stillwater from exploration to a production decision. Both project geologist Mike Ostenson and project geophysicist Justin Modroo (a professional extreme skier) are Montana natives; both men worked in the Stillwater complex for previous operators Premium Exploration Inc. (PEM:TSX.V; PMMEF:OTCQX) and Beartooth Platinum Corp. (BTP:TSX.V). A small example of sensitivity to locals: The helicopter landing zone is a short ATV ride from the core shack, in a rural area where the flight path to the drills will cause the least disruption for residents.

With a helicopter-assisted drill program, Group Ten's exploration costs are relatively high. (There are trails running to most of the drill locations but they are winding, time-consuming mountain ATV trails.) That makes dilution a major risk factor for Group Ten, but the company does have a few aces up its sleeve—namely, in-the-money warrants that should help boost the treasury, as well as non-core assets in Yukon (Kluane PGE-Ni-Cu) and Ontario (Black Lake-Drayton Au) that CEO Mike Rowley is working to monetize.

There has been merger and acquisition (M&A) action in the PGM sector, especially South African producers expanding outside of that (troubled) country. The latest was Impala Platinum Holdings Ltd.'s (IMP:JSE) $1-billion purchase of North American Palladium and its Lac des Iles PGM mine in Quebec. Majors also continue to be on the lookout for nickel and copper, which Group Ten has in abundance at Stillwater West. I was also intrigued to see Group Ten reference rhodium in its Oct. 31 NR headline and wonder if that's a sign of good things to come. Rhodium is currently trading at about US$5,000 an ounce and palladium trades at US$1,833 an ounce, up almost 45% this year.

The path to shareholder profits for Group Ten probably involves doing a joint venture (JV) deal with a major mining company prepared to spend the money to turn Stillwater West into a drill-hole pincushion and advance the deposits. That would leave Group Ten with a smaller slice of a very valuable project, which could still be worth many multiples of the current market capitalization. Execution will be key, but Group Ten could be sitting on, if not a gold mine, multiple deposits containing PGMs, nickel, copper and cobalt. Upcoming catalysts include drill results and mineral resource estimates from three of the most advanced Stillwater West mineralized zones.

Price: 0.17

Shares out: 81.1 million (122M f-d)

Market cap: $13.8 million

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Kwantes has two decades of journalism experience and was the mining reporter at Vancouver Sun, the city's paper of record.

[NLINSERT]James Kwantes Disclosure: This report was published and sent to paid Resource Opportunities subscribers on Nov. 3, 2019. James Kwantes is a Group Ten Metals shareholder and the company covered costs associated with the site visit and for distribution. This report is for informational purposes only and all investors need to do their own research and due diligence.

Streetwise Disclosure:

1) James Kwantes' disclosures are listed above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Group Ten Metals. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Group Ten Metals. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Group Ten Metals, a company mentioned in this article.

Resource Opportunities Disclaimer: Readers are advised that this article is solely for information purposes. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice. The information is based on sources which the publisher believes to be reliable, but is not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available data.

Photos provided by the author.