Ely Gold Royalties Inc. (ELY:TSX.V; ELYGF:OTCQB) features a unique royalty generation model. The company holds a sizeable portfolio of resource properties in the Western United States—mostly Nevada—that it makes available to sell outright or through a four-year option contract. Once the buyer completes the payments, it owns outright 100% of the project, and Ely Gold retains a royalty on future production.

The buyer has no work commitments. If a buyer on a four-year option decides not to continue with the payments, the property is returned to Ely Gold.

Trey Wasser, Ely Gold's president and CEO, told Streetwise Reports, "Our model is much more scalable than the traditional joint venture model, as we have no property/exploration management responsibilities. This allows us to build a much larger portfolio that is constantly generating new royalties. It also allows us to keep our overhead very low and operate just like a royalty company. This keeps the company's cash flow positive. We, in turn, then can actively seek and purchase additional existing third-party royalties. This is how Ely Gold is transitioning into North America's newest gold royalty company."

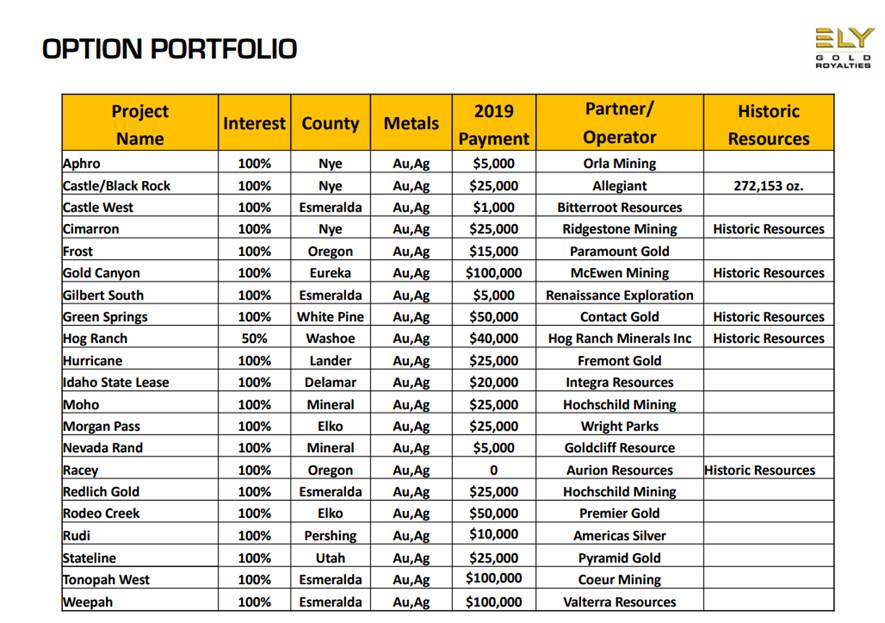

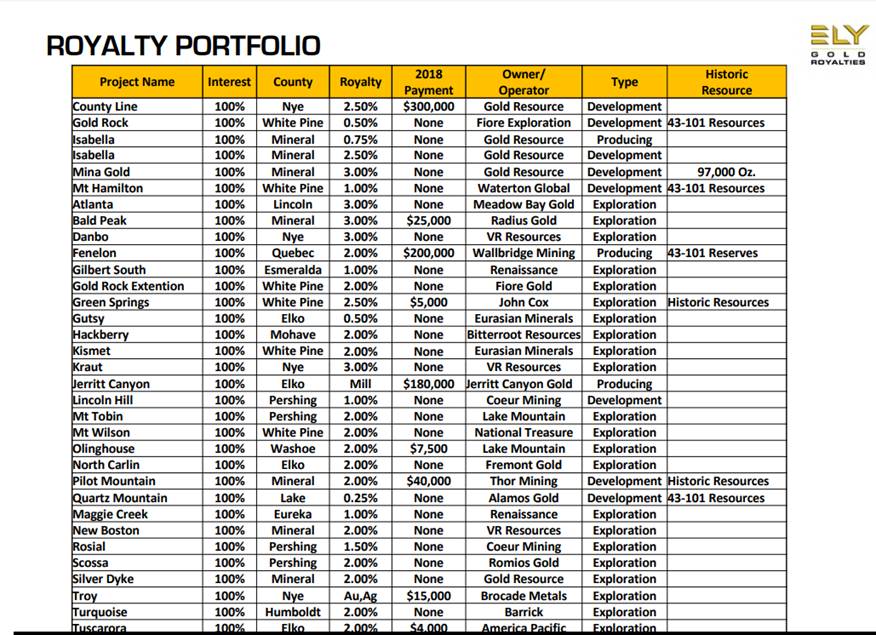

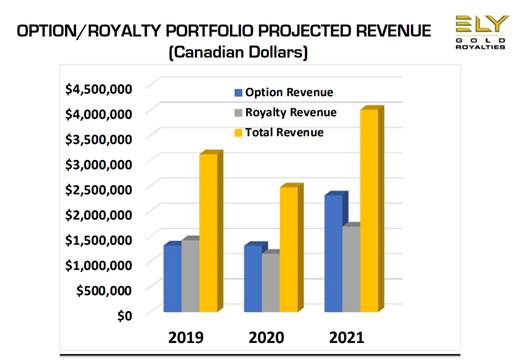

Ely Gold's portfolio currently includes 33 deeded royalties, 21 properties optioned to third parties, and more than 20 properties available for optioning.

The company is one the radar of some of the most well-known names in the resource industry. In July, a company controlled by Eric Sprott purchased a 1% royalty on the Fenelon Mine property, located in central-west Quebec, that is operated by Wallbridge Mining Company Ltd., for US$1.25 million. Ely Gold retains a 2% royalty on the property.

Sprott also participated in an Ely Gold private placement, purchasing approximately 5.6 million Ely Gold units at the price of CA$0.18 for gross proceeds of more than CA$1.01 million. Each unit consists of one common share and one half of a common share purchase warrant; the warrant carries an exercise price of CA$0.30 and is valid for three years. This placement has Sprott holding 5.7% of Ely Gold shares, 8.3% if the warrants are exercised.

In January, Exploration Capital Partners 2005 Limited Partnership, where noted resource investor Rick Rule serves as president, subscribed for 9.069 million units at CA$0.11 per unit in the first tranche of a private placement. Each unit consists of one common share and one common share price warrant to purchase an additional share at an exercise price of CA$0.22 for five years. Exploration Capital Partners holds 9.74% of the issued and outstanding shares of Ely Gold on a non-diluted basis, and 17.75% on a partially diluted basis.

Additionally, McEwen Mining recently purchased an option agreement from Fremont Gold Corp. for Gold Canyon claims in Nevada for 300,000 McEwen shares. The claims are located in McEwen's Gold Bar Mining Complex, where the company achieved commercial production in May. McEwen takes over the obligation to pay the option payments to Ely Gold for the property, $112,500 per year for three years and a final payment of $300,000 on or before December 29, 2022.

Ely Gold has been actively selling options on properties, including:

- The past-producing Green Springs gold project in Nevada to Contact Gold Corp. for 2 million common shares of Contact Gold, US$25,000 and reimbursement of prepaid claims fees, $50,000 annually for three years, and a final payment of $100,000 in the fourth year. Ely Gold will retain a 1% net smelter royalty on 76 core claims and a 0.75% royalty on two leased claims.

- Castle West property in Nevada to Bitterroot Resources Ltd. for $241,000 in payments over four years. Ely Gold retains a 3% net smelter return royalty on precious metals production.

- Nevada Rand property in Nevada to Goldcliff Resource Corp. for $250,000 in payments over four years. Ely Gold retains a 2.75% net smelter return royalty on precious metals production.

- War Eagle property in Idaho to Integra Resources Corp. for $200,000 in payments over four years. Ely Gold retains a 1% net smelter royalty.

Ely Gold has also been acquiring royalties, including, since the first of the year:

- Jerritt Canyon Processing Facilities per ton royalty interest for the Nevada facility operated by Jerritt Canyon Gold LLC, a privately held company. Ely Gold paid US$650,000 and issued 500,000 warrants for the interest. The royalty varies from US$0.15 to US$0.40 per ton, leveraged to the price of gold.

- Lincoln Hill property in Nevada, a 1% NSR royalty on the project operated by Coeur Mining Inc. for $755,000 and 500,000 common share warrants at an exercise price of CA$0.18 for two years. This project is next door to Coeur's Rochester Mine.

- Isabella Peart Mine in Nevada, 0.75% gross receipts royalty on the producing mine operated by Gold Resource Corp. for US$300,000. Ely Gold holds additional royalties on other Gold Resource projects.

- Fenelon Mine in Quebec, operated by Wallbridge Mining Company, a 2% NSR royalty, for CA$600,000.

"Ely Gold has royalties on three properties that are producing: Isabella, Fenelon and Jerritt Canyon," Wasser told Streetwise Reports. "In addition, eight or nine of our properties have been optioned to companies—some of the best operators in Nevada—that have mining operations right around the optioned properties. These are operations that are in production or near to achieving production. That means that as the operators explore our properties, all they have to do is find a minor deposit. If they find 200,000 to 500,000 ounces of gold, that might not be enough to build a new mine, but it would work as a satellite deposit. The timeline to production is much shorter, as is the threshold of discovery. They are just looking for more resources to feed their existing mines."

Wasser believes the company is in a sweet spot for picking up royalties. "Ely Gold is now in a position with a market cap of CA$33 million where we are able to look at $2 million to $5 million royalty deals. We have very little competition at that end of the market. For royalty companies with $200 million market caps and higher, that size of deals won't move the needle, but it does for us. These deals really do add up and result in more capital appreciation for shareholders."

Industry observers are following Ely Gold closely. On June 12 Resource Maven Gwen Preston noted that Eric Sprott paid CA$1.67 million for a 1% royalty on the Fenelon Mine property. "This royalty sale is a great example of how Ely balances building a strong royalty portfolio with ensuring it captures opportunities to make money today. Ely paid $700,000 for the 1% royalty just last fall, so it's clearing almost $1 million in a move that also brings a famous and followed mining investor into the shareholder registry."

On June 19, after Ely Gold optioned the Nevada Rand and Castle West properties, Preston commented, "These are just two more examples of the deal-making mode Ely has been in of late. It's monetizing its assets while continuing to build out its robust royalty portfolio. Given the leverage that Ely offers on bullish precious metals markets, this is definitely a company we'll want to hold onto as those markets begin to hit their stride."

After Ely Gold acquired the 1% NSR royalty on Coeur Mining's Lincoln Hill project, Thibaut Lepouttre of Caesars Report commented on May 1, "Considering the average grade at Lincoln Hill is higher than the grade of its adjacent Rochester mine, we would expect Coeur to be very interested in bringing Lincoln Hill into production as fast as possible in which case Ely's net smelter royalty could start to bring in cash."

Ely Gold's shares have appreciated rapidly in the last year, from a 52-week low of CA$0.09 last October, to a high of CA$0.41 in early August, before settling to around the current CA$0.31.

Ely Gold has around 99 million shares outstanding and 126 million fully diluted. It has a tight share structure with approximately 11% of the shares held by management and insiders; 25% by long-term shareholders; 10% by Exploration Capital Partners, a Sprott Resource company helmed by Rick Rule, and 5% by Eric Sprott.

"After spending three years on the road with my partner, geologist Jerry Baughman—president of the company's U.S. subsidiary, Nevada Select Royalty—building up the portfolio, we are now at the point where investors both large and small are recognizing the shareholder value that we are creating," Wasser stated.

Read what other experts are saying about:

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Ely Gold Royalties Inc. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Additional disclosures:

Disclosures from Resource Maven, June 12 and 19, 2019

Companies are selected based solely on merit; fees are not paid.

The publisher, owner, writer or their affiliates may own securities of or may have participated in the financings of some or all of the companies mentioned in this publication.

Caesars Report:

Disclosure: The author has a long position in Ely Gold.

Disclaimer: This report contains certain "forward-looking statements" within the meaning of Canadian securities legislation, including statements regarding the Company’s contemplated acquisition or sale of royalties and Properties, and any stated plans for further near-term exploration and development of the its Properties. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "aims," "potential," "goal," "objective," "prospective," and similar expressions, or that events or conditions "will," "would," "may," "can," "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the risk of accidents and other risks associated with mineral exploration, development and extraction operations, the risk that its partners will encounter unanticipated geological factors, or the possibility that they may not be able to secure permitting and other governmental clearances, necessary to carry out their stated plans for the Properties, the Company’s inability to secure the required TSXV acceptance required for any Transaction, and the risk of political uncertainties and regulatory or legal disputes or changes in the jurisdictions where the Company carries on its business that might interfere with the Company's business and prospects. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effect.