On Aug. 29, Cypress Development Corp. (CYP:TSX.V; CYDVF:OTCQB; C1Z1:FSE) announced the successful completion of the slurry rheology and filtration studies that are an integral part of the prefeasibility study (PFS) for its Clayton Valley clay-hosted lithium project, located immediately adjacent to Albemarle Corp.'s (ALB:NYSE) Silver Peak brine processing facilities in Nevada.

Management believes its U.S. location will become an increasingly valuable attribute. While many junior lithium companies like to name drop "Albemarle" and "Silver Peak," Cypress owns 100% of one of just a few projects in Nevada that Albemarle might actually be interested in.

More Promising Results from Cypress' Expert Technical Team

Back to the latest news: The outcome was the result of months of testing by laboratories and a detailed review with consultants and equipment vendors. This news represents a major milestone in the project because the results simplify the process flow sheet.

Cypress CEO Dr. Bill Willoughby commented in the press release, "A critical step for us at Clayton Valley is the separation of solids and liquids. A viable process is dependent upon the ability to separate the process leach solution (PLS) from the leached residue whether by thickeners, filters, or other means. Significant test work has allowed Cypress to identify a commercially viable process, based on filtration, to take the solid-liquid separation from the laboratory benchtop to the operational scale."

Readers may recall that Cypress released positive results from the first and second phases of its PFS metallurgical program in February and July. Since then, work has continued on other aspects of the PFS, including recovery and concentration of lithium from solution through mechanical evaporation, membrane filtration and ion-exchange processes.

CEO Willoughby continued, "The Cypress technical team discovered the Clayton Valley clays behave differently at varying leach conditions. By looking at the electro-kinetic potential of the clays we can select the optimal reagents and equipment. We also know under what conditions the rheology of the slurries becomes a limitation, and can design the flow sheet accordingly. With this new knowledge, we are confident we can simplify a significant portion of the leaching flow sheet."

Cypress is looking at additional steps to simplify plant design, with the goal to further streamline the production process and lower costs. With metallurgical and materials handling studies completed, Cypress expects to publish a PFS during the fourth quarter.

Next Major Milestone Is a PFS in the Fourth Quarter

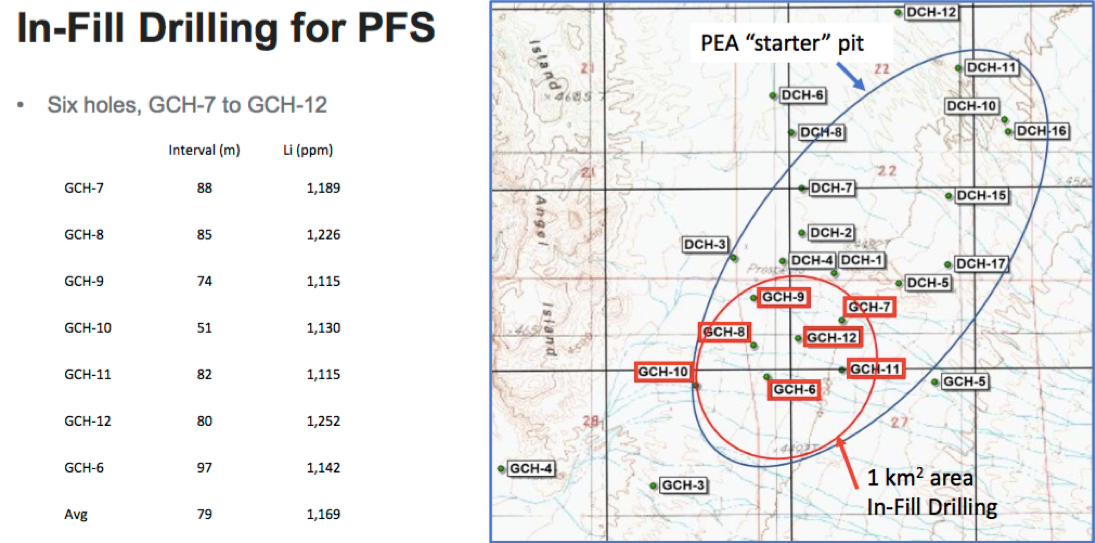

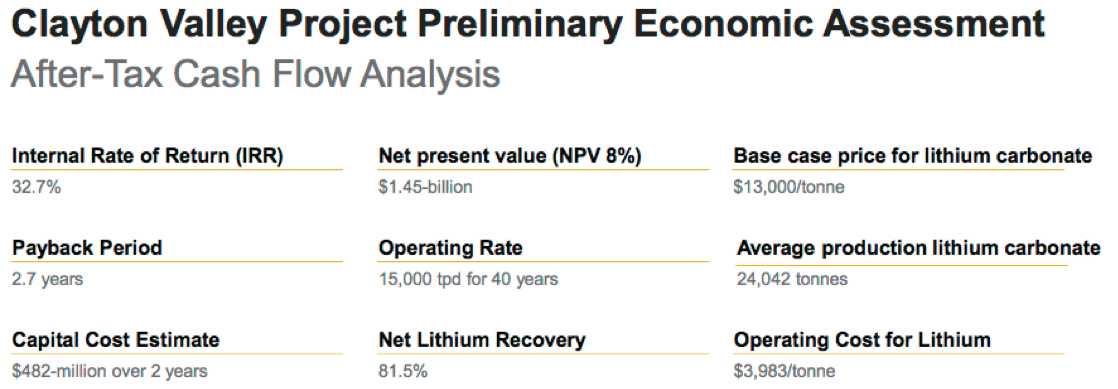

It appears the PFS has been pushed back a few months. After a recent capital raise the company is comfortably funded through delivery of a PFS later this year. Come to think of it, what's the rush? Investor sentiment remains very weak for lithium, cobalt, vanadium and graphite juniors. As long as Cypress is funded, let them keep carrying out studies to improve the PFS! Below are some highlights from the PEA.

It's important, at this point, to reiterate the considerable strength of management, the board, technical advisers and retained consultants. All of these impressive people and groups are being effectively led by CEO Willoughby, who has a doctorate in Mining Engineering and Metallurgy from the University of Idaho.

Who on earth could possibly be better to run this show than a PhD in engineering and metallurgy!?! Willoughby knows what he's doing, and he's a driving force behind the very good results and progress his technical team is delivering.

I asked Dr. Willoughby about last week's news, and he said, "It's a major technical problem to separate ultrafine clays particles less than 5 microns from a leach solution. Our solution could put us in the forefront of clay-hosted lithium projects globally."

Demand Keeps Increasing, Supply Increasingly Uncertain

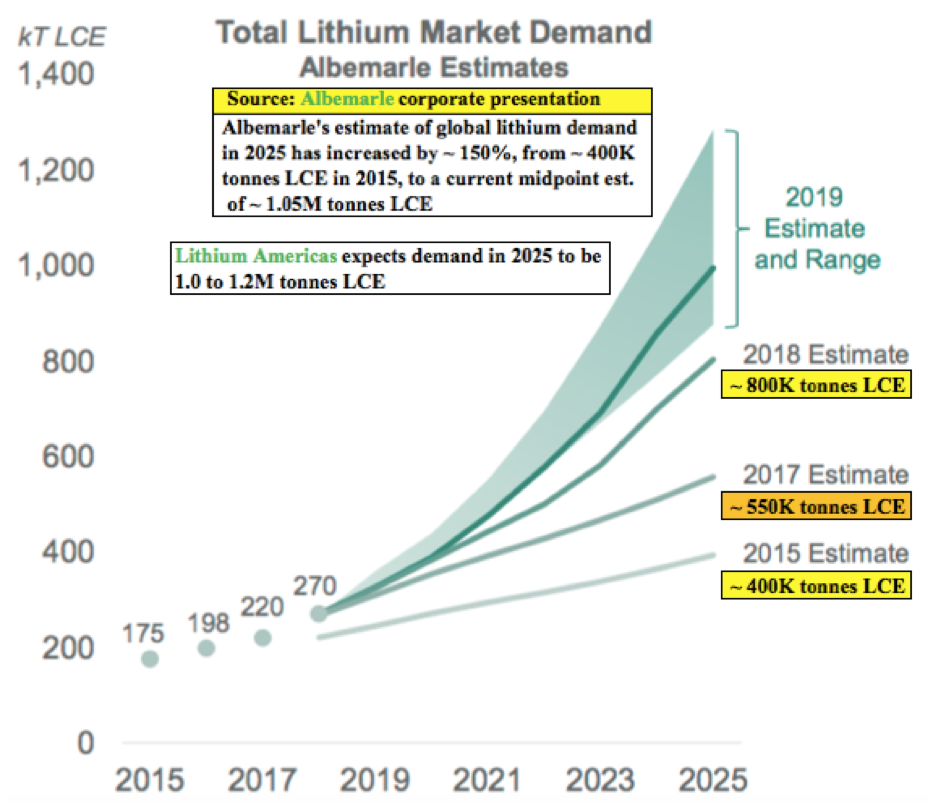

There's a massive disconnect in the lithium world. For years, demand forecasts have been going up. The demand side of the equation—driven by both energy storage and the electrification of passenger and commercial vehicles—is likely to increase at a compound annual growth rate (CAGR) of at least 15%, perhaps 20% or more. For example, at a 20% CAGR from Albemarle's 270,000 (270K) tonne figure in 2018, demand would reach 967K tonnes in 2025.

Albemarle has a particularly good graphic depicting this unmistakable trend. Four years ago they expected ~400K tonnes LCE (lithium carbonate equivalent) demand in 2025. Now, Albemarle is forecasting demand of about 1 million tonnes in 2025. Likewise, Lithium Americas Corp. (LAC:TSX; LAC:NYSE) is forecasting between 1.0 to 1.2 million tonnes LCE demand in 2025, a range it says comes from industry producers and publicly reported forecasts.

Finally, Fastmarkets expects LCE demand to grow from ~300K tonnes in 2019 to "at least" 1.1 million tonnes in 2025. So, a lot of forecasts come in and around the one million tonne mark, but even if it turns out to be less, I think it will be a major challenge for supply to approach that level in the next six years.

The longer the project delays in Argentina and Chile brine projects, and the more project mishaps occur, like at Nemaska Lithium Inc. (NMX:TSX; NMKEF:OTCQX), the more room for unconventional projects such as Cypress Development's Clayton Valley. The market will take every battery-grade tonne of lithium chemicals produced by any company that can supply them. Lithium juniors who can make it across the production finish line will be richly rewarded.

Despite significant fiscal and political challenges in Argentina that could further delay brine projects there, and continued slow movement in project development and production expansions in Chile, unconventional projects are still meaningfully undervalued compared to brine projects.

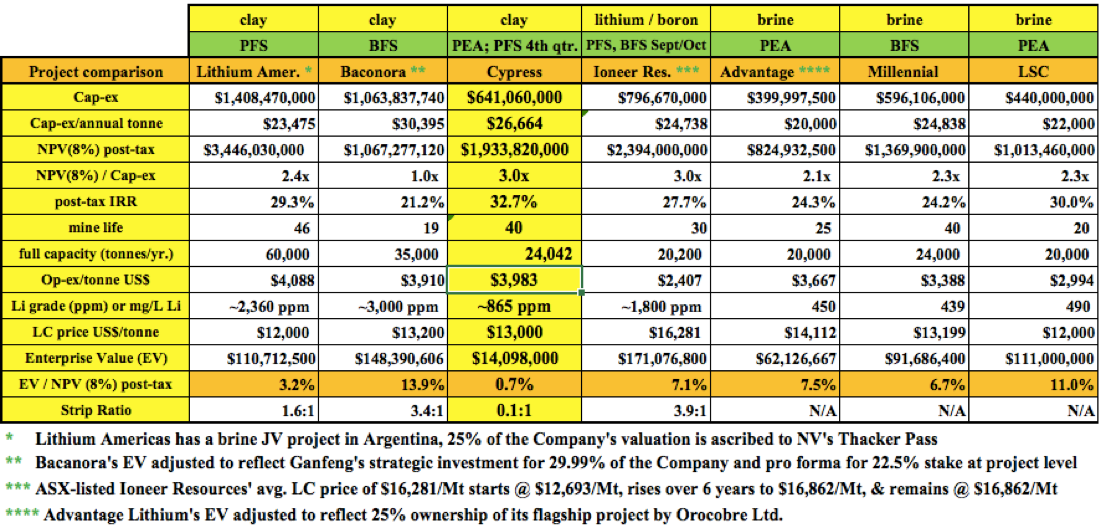

For example, Cypress Development Corp.'s enterprise value (EV) is less than 1% of the after-tax net present value (NPV) found in its PEA. Compare that to the average 8.2% EV/NPV on the chart below. Cypress' EV/capex ratio of 3.0 times (3.0x) is 40% better than the 2.1x average of the other unconventional projects.

Cypress has the highest after-tax internal rate of return (IRR) on the chart at 32.7%, compared to an average of 26.1% among the others. And the company's capex, at CA$641 million, is 21% lower than the peer average.

Finally, readers should note that the Clayton Valley project has a strip ratio of 0.1 to 1. The other three projects with strip ratios average 3.0 to 1. Cypress has 1/30th the strip ratio of its unconventional peers!

That's a big reason why the company has attractive opex and capex, despite having lowe-grade lithium (Li) to work with. Another reason is the mineralogy; the Clayton Valley project's lithium abundance is hosted in a friendlier clay than that at some of the other projects. Friendlier meaning easier and less costly to liberate the lithium into solution.

The extreme weakness in the vast majority of lithium juniors is actually great news. Great news for any lithium company hopeful that can produce lithium next decade. Great news for investors who may want to average down in their favorite battery metals names.

Brine Projects Have Gone from "Can't Go Wrong," to "Can't Fund"

A funny thing happened over the past two years. Brine projects went from no-brainers (lowest cost, best understood, most reliable) to the exact opposite. Solar evaporation ponds are getting less and less popular by the week, day, hour! And, unusually rainy weather in the Puna region of Argentina has negatively impacted pond yields. Speaking of Argentina. . .well just read the headlines, it's not pretty.

Chile imposed an onerous sliding-scale royalty on realized lithium prices from production in the Atacama salar. Albemarle's & SQM's (SQM:NYSE) best, lowest cost lithium brine operations. . .the world's best, may no longer the world's lowest cost.

Brine projects were sure things and clay-hosted lithium projects were, "maybe in 10 years." Now? Most brine projects are dead in the water, some of them never coming back to life. Even the top-quartile, most advanced projects are not getting funded. By contrast, the prospects for clay-hosted lithium projects are better than they were two years ago, albeit also difficult to fund.

Investors would be crazy not to consider unconventional assets. Brine projects, with evaporation ponds attached, will themselves be unconventional at some point in the future. The only question is when.

In early August, Glencore International Plc (GLEN:LSE) announced it was shutting a major cobalt/copper mine in Africa at the end of the year. Three weeks later, cobalt prices are up 30-35%. It might not take that much to get lithium prices back on an upswing. If prices were to improve, juniors like Cypress Development Corp., trading at under 1% of third-party derived after-tax NPVs, could do quite well.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Read what other experts are saying about:

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Cypress Development Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker / dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Cypress Development Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this interview was posted, Peter Epstein owned shares of Cypress Development Corp., and the Company was an advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any future events & news, or write about any particular company, sector or topic. [ER] is not an expert in any company, sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Cypress Development Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.