Haldane exploration camp

After Alianza Minerals Ltd. (ANZ:TSX-V) increased the earlier announced CA$750,000 financing to CA$1 million, after it received plenty of interest, this CA$0.05 round eventually closed at CA$1.1 million, which is nothing but successful for a tiny CA$5 million market cap at the time of closing.

According to management, a number of existing shareholders were keen to average down at these low prices, but also a few new groups came in following the hard work of Executive Chairman Mark T. Brown and CEO Jason Weber. The financing consisted of CA$691,000 in $0.05 non-flow-through units with a full warrant (three-year, $0.10), and CA$414,000 in $0.06 flow-through shares. Finders' fees of 7.5% in cash and 7.5% in finders' warrants were paid to eligible parties.All in all, this meant 20.7 million additional shares and 13.8 million warrants, which when all exercised would mean considerable dilution but nothing out of the ordinary. The share structure still is very decent at 81 million outstanding, and it really is time to spend serious money on drilling. With this extra money Alianza will be able to expand the upcoming drill program at their flagship Haldane silver project, which is good news, of course.

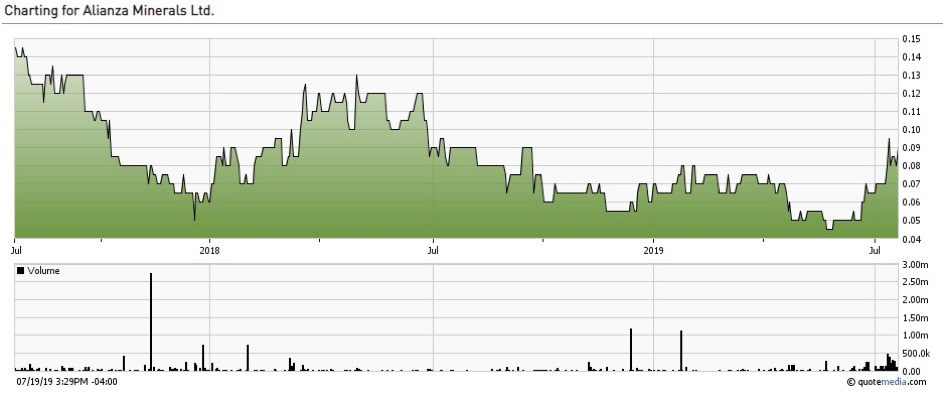

Investors seemed to realize they missed their chances at the financing as the gold price and a modestly following silver price went up, and sentiment started changing for junior explorers. Pretty intense buying in the open markets in the last few weeks saw the share price of Alianza almost fully recover to levels seen the last time in Q2 2018. It now stands at $0.09/share again.

Share price; two-year time frame

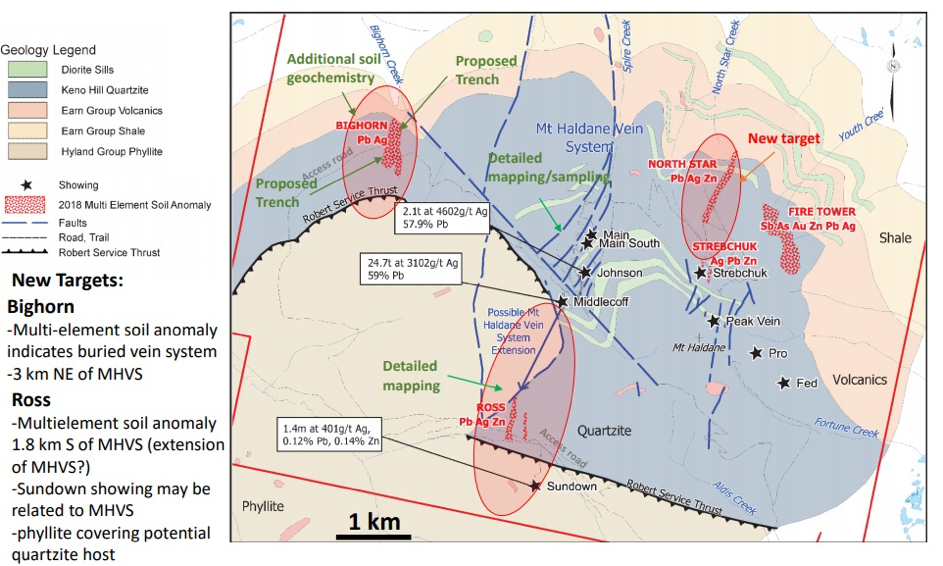

In the meantime, Alianza completed its phase 1 work program at Haldane, consisting of soil geochemical sampling, mapping and trenching. This program was intended to further define drill targets, for which a phase 2 program is slated to start in August. The main focus for management are the new targets like the Bighorn anomaly, and the extensions of known target areas like the Ross and Mount Haldane Veins System targets. According to the news release, a decent amount of work has been completed for phase 1:

"Trenching was completed at the Bighorn and MHVS areas, with three trenches totaling 153 metres excavated at the Bighorn Anomaly and one new trench (West Fault Road trench) completed at the MHVS. Eighty-seven grab and chip samples and 8 soil samples were collected from trenches. Additional soil geochemical sampling was also completed west of the Bighorn Anomaly and several lines of in-fill soil samples were collected at the MHVS where prior sampling widely-spaced or incomplete. A total of 409 soils were collected.”

The locations of phase 1 work are in green:

Too bad they didn't provide any results in the announcement yet, but analytical results are expected any day now. Historical results were pretty impressive, so I expect some high-grade sampling results here. The main goal was to define controlling structures, and refine the location of the offset fault on the Robert Service Thrust Fault (see low right on the map), which, in turn, results in drill targets, of course. The results for the assays are expected in October/November 2019.

Besides Haldane, Alianza also has the Hochschild Mining Plc (HOC:LSE) joint venture (JV) operational. Hochschild has optioned three Nevada sediment-hosted gold properties from Alianza. The BP and Bellview properties are located in the southern extension of the Carlin Trend, while the Horsethief property represents an off-trend gold target located 26 kilometers east of Pioche, Nevada. The Horsethief property is considered the most prospective by Alianza, and already was the focus of attention. As a reminder, here are the JV terms for the Horsethief and BP properties again:

"1. Horsethief Property

Hochschild can earn a 60% interest in the Horsethief Property by conducting US$5 million in exploration on the property over a 5.5-year period, with a committed minimum expenditure of US$500,000 in the first 18 months and a minimum US$500,000 in each subsequent year. Within 60 days of acceptance of the first option, Hochschild may elect to undertake a second option to earn an additional 10% (total 70%) in the property by funding a further US$5 million in exploration over 3 years (minimum US$500,000 in exploration per year).

3. BP Property

Hochschild can earn a 60% interest in the BP Property by conducting US$2.5 million in exploration on the property over a 4.5-year period, with a committed minimum expenditure of US$100,000 in the first 18 months and a minimum US$500,000 in each subsequent year. Within 60 days of acceptance of the first option, Hochschild may elect to undertake a second option to earn an additional 10% (total 70%) in the property by funding a further US$2.5 million in exploration over 3 years (minimum US$500,000 in exploration per year). Alianza is the operator. Hochschild will reimburse Alianza for 2018 property taxes and permit costs, totalling approximately US$41,600."

According to this news release published at the end of June, the first phase of exploration work at Horsethief was completed, but I found it to be a bit confusing that no results were published on Horsethief, as they will be at Haldane, for example. According to CEO Weber, this was done because of the nature of the work, which was almost entirely mapping and structural analysis. Some samples were taken, but not very many, and those results will be published when they are recieved.

Drilling for Horsethief will likely be starting up in October/November, and December will most likely see the drilling results subject to approval of the earn in partner Hochschild.

In the same news release it was mentioned that the phase 1 field program on the BP Project had commenced. BP will not see any drilling this year, as the 2019 program is expected to occur in two phases.The first, consisting of mapping and geochemical sampling, will occur in June and July, with a second phase of detailed mapping and sampling, and possibly geophysics, to be completed in September. Results should come in around December as well.

Conclusion

After signing two deals with Hochschild and Coeur Mining Inc. (CDE:NYSE), two household silver names in the space, defining targets and raising another CA$1.1 million, Alianza Minerals is good to go for drilling at their flagship silver Haldane project. This will happen in August, and with precious metals sentiment improving (although silver at a lower pace than gold, but catching up lately), finally there seems to be some kind of sentiment reversal for the good toward silver, which has been very negative since the last bull market, which ended in 2012.

Experts point at very low physical holdings, but as banks have bought large amounts, I only see a manipulated market with no real fundamentals—sentiment drivers at most, as I like to call them. I have no clue where gold and silver will go in the near future, but as long as gold stays above $1,400/ounce and silver above $16/ounce, things are looking slightly brighter nowadays. And, of course, this matters for Alianza, as improved metals sentiment could be a formidable catalyst on good drill results at Haldane. I am watching with interest.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website http://www.criticalinvestor.eu to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Alianza Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.alianzaminerals.comand read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Coeur Mining, a company mentioned in this article.

Charts and graphics provided by the author.