In 2019, digital ad spend in the United States will surpass traditional ad revenues, according to eMarketer. It estimates that total U.S. ad spend will reach $238 billion in 2019, of which digital ads should reach $129 billion or 54% of the market, while traditional media ads should total $109 billion. The firm also estimates that revenue from U.S. online media ads will hit $172 billion by 2021, a whopping 33% increase over just two years.

Into this rapidly expanding digital media market comes Adcore Inc. (ADCO:TSX.V), a Tel Aviv-based company with offices in Canada and Australia. Adcore, which recently went public and trades on the TSX Venture Exchange, has just announced landing a major client, Australia and New Zealand's number one site for travel experiences, Experience Oz, with an online advertising budget of up to CAD$5 million per year.

Adcore has developed machine learning technologies that use artificial intelligence algorithms to automate online search and shopping advertising.

"In addition to our deep integration with Google Ads and Shopping," Adcore CEO Omri Brill told Streetwise Reports, "Adcore also works closely with Facebook, Linkedin and others, empowering small and medium sized businesses to achieve enterprise level scale and ROI for the first time."

The company provides a three-pronged solution:

- semdoc2 is a powerful software, Brill explained, designed with digital agencies and campaign managers in mind. Semdoc2 allows account managers to discover critical errors, growth opportunities and generates a real-time account analysis.

"Semdoc2 is the most powerful account auditing technology on the market," Brill stated. "Adcore's system analyzes an existing advertising account and, using 52 account and campaign metrics, determines how efficiently clients are running their campaigns. The system gives a detailed report on exactly what advertisers are missing with their existing campaigns, and what they should do to improve their advertising."

- Adcore Views is the "ultimate automation tool for search marketing professionals," Brill noted. "From campaign creation to smart bidding. Adcore Views' machine-learning bidding algorithms allows clients to set target ROAS (return on ad spend) and CPA (cost per acquisition) goals to their campaigns with a click of a button." The company notes that Adcore's algorithms are trained to work with minimal amount of conversions and are effective for any campaign size. Adcore Views dynamically creates campaigns, ads and keywords in real time straight from a client's data feed.

- feed:itor is the "ultimate shopping solution. From feed management to campaign creation. Powerful enough to create, optimize and export data feeds to over 200 shopping channels and price comparison websites," Brill explained. Adcore's technology uses AI and deep learning to automatically optimize the product feed that clients submit to sites like Google Shopping, Amazon or eBay. Feed:itor can provide inventory and price management in real time with a customer's database or product base. For instance, a travel website will have lots of hotels in its database, with inventory constantly changing. The system will apply the appropriate price, based on market conditions, and stop advertising a specific hotel when there is no more inventory for that hotel.

Adcore is able to provide inventory management, linking to the customer's inventory database and automatically populate the relevant ad copy and keywords associated with each product.

"We're continually improving our platform to be more efficient and effective," Brill explained. "For example, our recently launched 'Click to Fix' button literally fixes all the errors you have in your account. The system does everything for you."

Adcore's contract to manage Experience Oz's digital media is across search, display and social; the budget is up to $5 million per year and is renewable annually.

"Adcore is the perfect partner to take our search and shopping to the next level," stated Den Manns, founder and director of Experience Oz. "Their ability to analyze and adapt our digital campaigns in real-time means every dollar we spend delivers far better results than we ever could achieve on our own."

"Winning yet another client of this size further evidences our ability to capitalize on the growing shift among small and medium sized businesses toward AI powered advertising technologies," said Rob Reynolds, Adcore's partnership director.

Adcore's Australian office has had other recent wins, including the Klika Group and Australian Geographic, and longer term clients that include The Fork, Get Price and Bookwell.

Opening a North American subsidiary is one of the company's top priorities. "We are in the process of opening a Toronto office," Brill explained. "We are going to staff it with senior sales and marketing teams from Tel Aviv and Canada. With North America being the biggest market for Adcore, we want to be closer to our client base to better serve and connect with them."

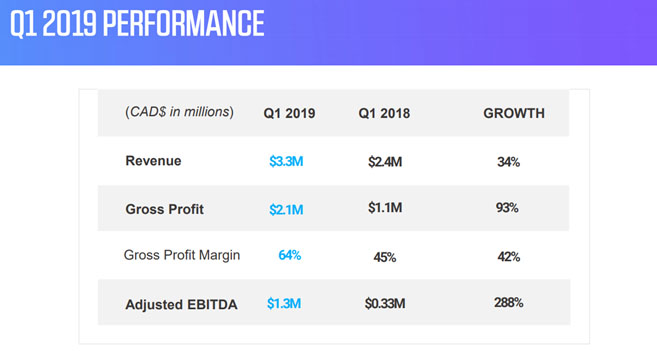

Adcore announced on June 4 its Q1 results, for the period ending March 31, 2019. First quarter highlights include:

- Total revenue was $3.3 million compared to $2.4 million for the same period in 2018, an increase of 34%

- Revenue less media costs (gross margin) was 64% compared to 45% for the same period in 2018, an increase of 42%

- Adjusted EBITDA was $1.3 million compared to Adjusted EBITDA of $0.33 million for the same period in 2018, an increase of 288%

- Adcore continued to invest in its global sales and marketing team and its industry-leading technology, including the launch of the brand new “Click-to-fix” feature of the semdoc2 platform

- Total working capital was $416,000 compared to ($166,000) for the previous period, an increase of $582,000

- As at March 31, 2019, the corporation's cash and cash equivalents was $1.66 million

"We couldn't have asked for a stronger start to 2019," said Brill. "The first quarter of 2019 was another record quarter for Adcore. We managed to exceed our projections and deliver strong growth in both top line and bottom line. The first quarter's results have affirmed the corporation's bullish outlook for 2019."

Adcore has set itself apart from others in the field. "The word on the street is that no one makes money in advertising technology," Brill stated. "But we have figured it out and are cash flow positive."

"The company has done well as a private company, but now that we are public, we have access to capital and better access to the North American market; it's a new era for the company. We expect a huge increase in growth over the course of the coming years," Brill explained. "Adcore has grown rapidly, is profitable and is tightly held."

Adcore has approximately 55 million shares outstanding, and roughly 65 million fully diluted. Brill, Adcore's founder and CEO, owns around 70%. County Capital One, a capital pool company, is a major investor and was the vehicle for taking Adcore public.

Adcore has caught the attention of technical analyst Clive Maund, who wrote on CliveMaund.com on May 28, "With the founder and CEO of the company holding the majority of the stock and the balance tightly held, the stock price looks like it will respond very positively to any influx of new demand.

"Due to the dynamic growth prospects for this sector, Adcore should be relatively immune from the vagaries of the broad stock market, which is a reason why it is of interest to us here. It looks like a good stock to add to a portfolio of New Tech stocks."

[NLINSERT]Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Adcore. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Adcore, a company mentioned in this article.

Additional Disclosures:

CliveMaund.com: Clive Maund does not own shares of Adcore and neither he nor his company has been paid by that company.