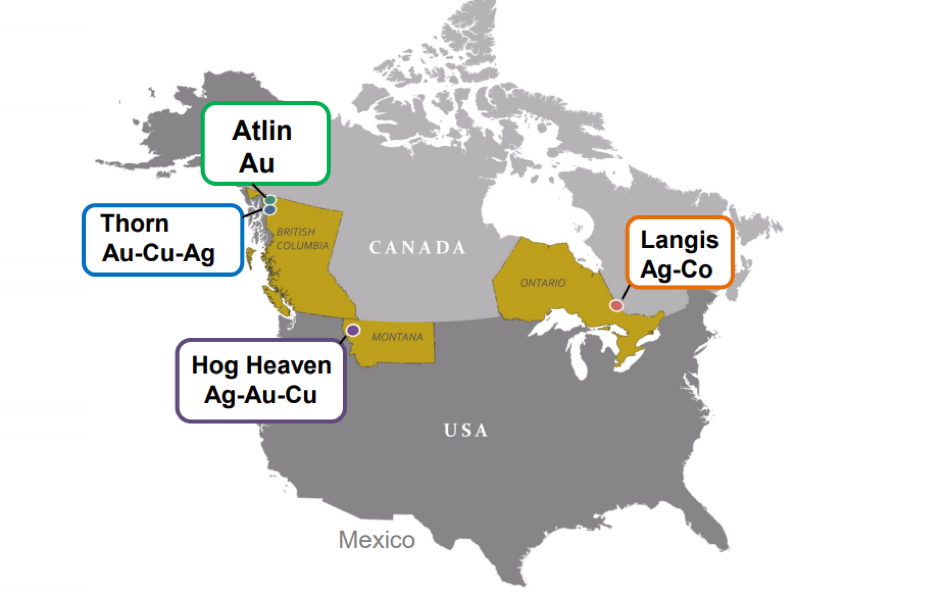

After focusing on the cobalt camp in 2018, Brixton Metals Corp. (BBB:TSX.V) is shifting gears and will spend of its time and effort on the Atlin Goldfields project in British Columbia. After successfully assembling a contiguous land package allowing Brixton to secure ownership of almost the entire Atlin gold camp, Brixton is gearing up for its first ever summer exploration campaign in the region.

But the company's exploration season will be kicked off by one deep drill hole at Thorn, where it plans to follow up on a thick layer of copper mineralization that had been identified during previous exploration campaigns.

This results in a two-pronged approach for Brixton Metals this year.

2019 Will Be the Year for the Atlin Gold Camp

Brixton Metals has been carefully putting its land position in the Atlin Goldfields together for the past few years and is now sitting on a total land package in excess of a thousand square kilometers. Brixton Metals is the first company that has been able to consolidate almost the entire gold camp under one umbrella (there still are some small claims owned by third parties in the district, but Brixton Metals clearly is the dominant player.

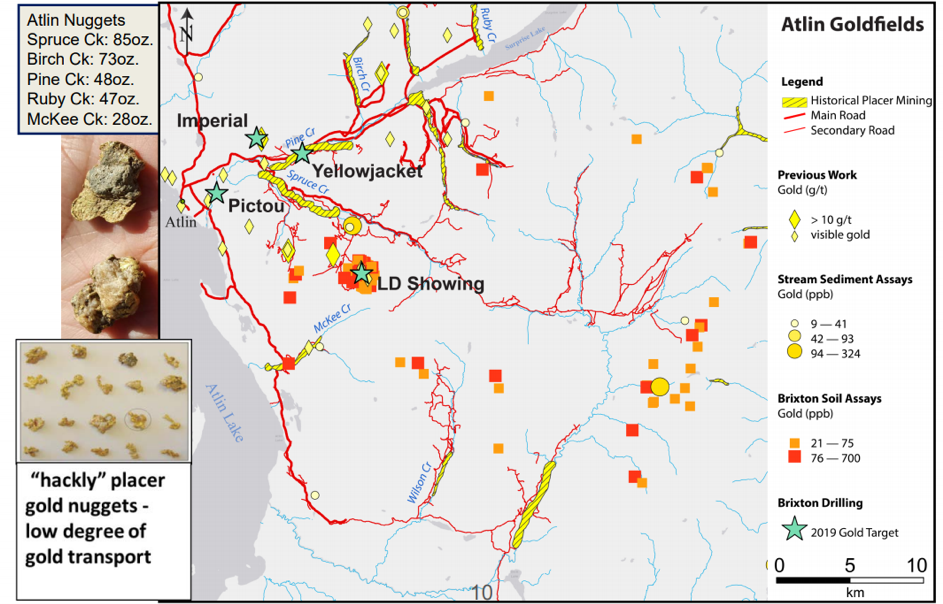

The Atlin project is particularly interesting because of its very rich history: Data indicate placer mining has been ongoing for in excess of a century, and some of Canada's largest gold nuggets were actually discovered in this camp. In fact, the largest nugget ever found on Canadian soil weighed 85 ounces and was found here, in the Atlin gold camp. This provides plenty of reason for an exploration company to have a closer look at Atlin as modern exploration techniques could help Brixton to target the feeder zones. After all, the gold nuggets and placer gold had to come from somewhere.

This doesn't mean Brixton can just go in, drill a few holes and find gold all over the place; that's not how it works. Let's first take a step back to have a look at the bigger picture, as Atlin Goldfields seems to host three different rock types.

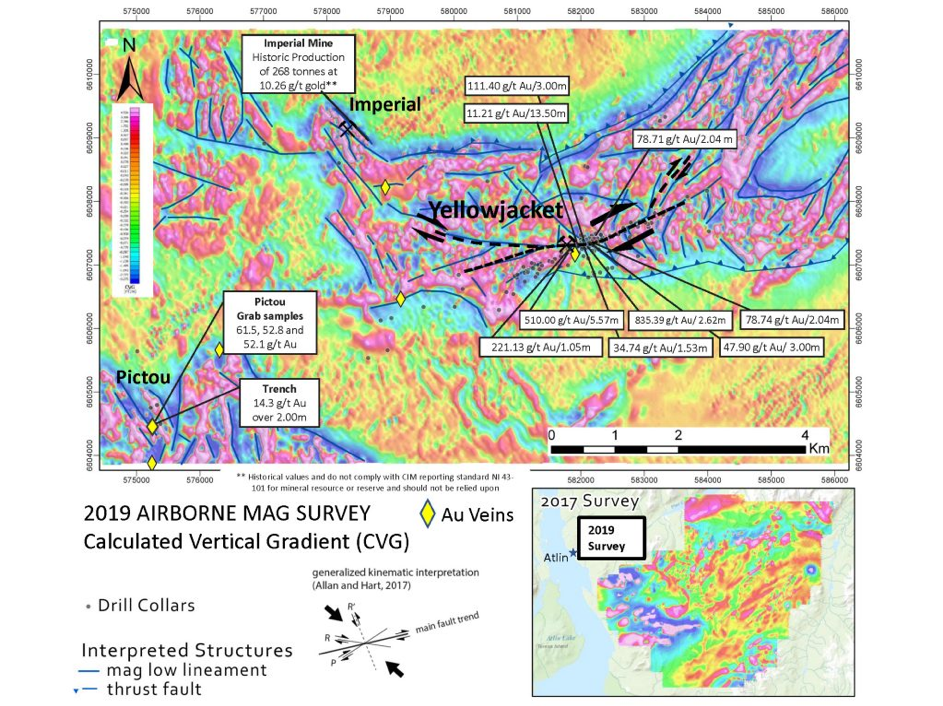

The Yellowjacket zone probably contains the low-hanging fruit, as this area has been mined before, a mining permit for up to 200 tonnes per day remains valid and it currently still hosts a historical resource estimate of almost half a million tonnes at an average grade of just over 10 grams per tonne (10 g/t) gold. That's a good start, but we also shouldn't discard the historical drill intervals at Yellowjacket where the previous operators encountered, for instance, 3 meters of almost 48 g/t gold, 5.6 meters of in excess of 500 g/t gold, and in excess of 2.5 meters at 853 g/t gold.

Of course, these intervals containing grades of in excess of 100 g/t gold will always remain the exception, but it does indicate the system is very prospective and prolific, and Brixton will very likely put these zones at the top of its list of priorities.

Another high-priority target would be the LD showing, which is located just 10 kilometers southeast of Yellowjacket, but Brixton will also focus on the Imperial and Pictou zones, while a newly discovered gold-in-soil anomaly should also be followed up on.

Brixton won't rush into Atlin, but will use and apply a methodological exploration program which will include additional sampling programs to further refine its drill targets on the 8 "areas of interest" before effectively drilling the ones that stand out.

The company has received the final report of a 1,922-kilometer airborne magnetic survey over the Atlin Goldfields project, which used a cesium magnetometer to identify anomalies on the property. Brixton is still interpreting the data from this survey, but it identified an abundance of structures and cross structures that may play a dominant role in the structural controls of the gold mineralization.

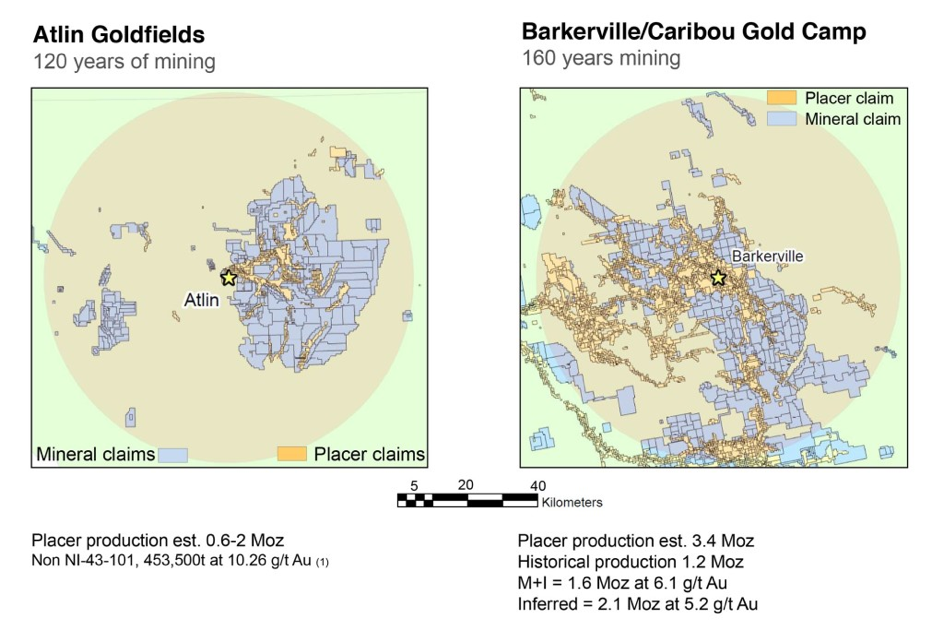

Atlin, a Second Barkerville/Caribou?

Brixton Metals compares its Atlin gold camp with the Barkerville/Caribou gold camp, also in British Columbia. Some companies use comparable projects/districts that could considered to be a stretch, but we feel Brixton's comparison does make sense. In both districts there has been a rich history of in excess of 100 years of placer mining with a cumulative gold production of millions of ounces of gold. The total production at Barkerville/Caribou (3.4 million ounces from placer activities and 1.2 million ounces from historical mining activities) is better documented than the total gold production at Atlin, but based on historical data and documents, Brixton estimates the Atlin gold camp was responsible for up to 2 million ounces recovered from placer operations.

The Barkerville system is more mature than the Atlin gold camp, as the feeder gold zone at Atlin hasn't been discovered yet, but that's exactly the challenge Brixton Metals is rising to.

But for Now, All Eyes Are on Thorn

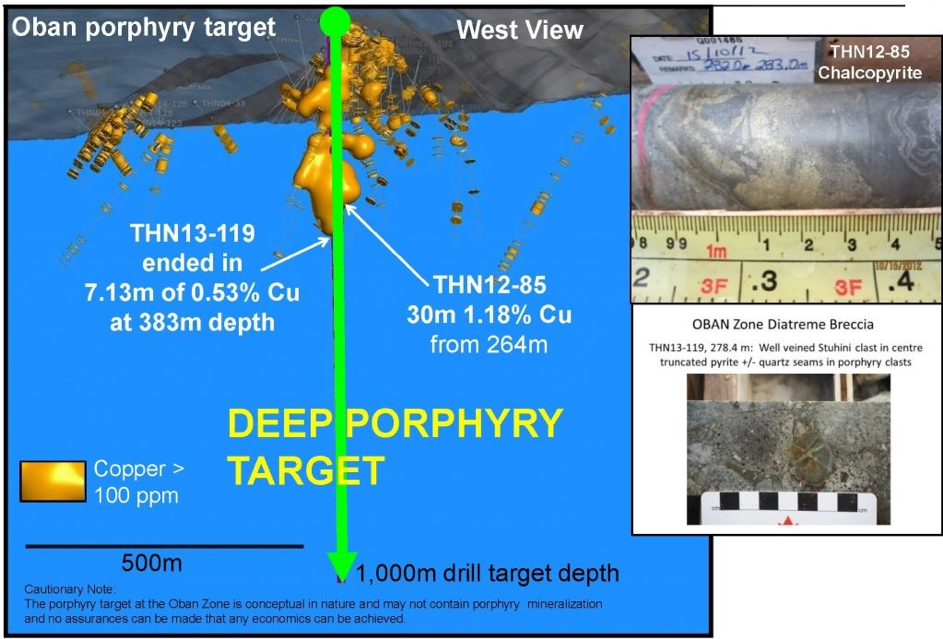

Although the main focus of this year's exploration budget will be on the Atlin gold camp, Brixton Metals has decided it wants to drill one deep hole at Thorn, where the company hopes to hit widespread porphyry-type mineralization. This deep hole is meant to follow up on a previous exploration hole that was drilled in 2013, which ended in copper mineralization at depth, and another hole drilled in 2012, which returned 30 meters containing 1.18% copper. This, combined with the discovery of the Outlaw zone and the porphyry zones at the Chivas and Camp Creek targets, provides a whole new perspective on the Thorn project. Originally thought to be a high-grade silver project, the widespread copper mineralization may provide a whole new perspective on Thorn.

These are excellent copper values, and although the 0.53% copper encountered in hole 13-119 appears to be low, that grade is sufficient to make a block-cave operation work, as Newcrest Mining Ltd. (NCM:ASX) is currently mining a grade of 0.36 g/t gold and 0.26% copper at its Cadia mine in Australia. As the previously drilled hole ended in mineralization, Brixton would like to figure out how deep the mineralization runs, and while a 1,000-meter hole won’t be cheap, it's the best way to gain a lot more insight in the copper mineralization at depth.

The drill program at Thorn started about a month ago, and we expect the hole to be completed relatively soon. It will still take a few weeks before we see the assay results (Brixton may decide to release the drill results in batches, or wait until it has assayed the complete 1,000 meter of drill core).

A CA$2.4M Working Capital Position

As of the end of September (when Brixton's financial year ended), the company still had a working capital position of approximately CA$1.35 million (CA$1.35M), but it preferred to "play it safe" and pulled the trigger on a financing in November, which was closed in December.

Brixton raised CA$2.78M, of which approximately CA$750,000 was raised in hard dollars by issuing 4.9 million units priced at CA$0.15, and an additional CA$2.04M was raised in a flow-through financing at CA$0.17. The units contain a full warrant allowing the warrant holders to acquire an additional share in Brixton at CA$0.25 for a period of two years (until December 2020). The warrants do contain an acceleration clause, which calls for an expedited expiration date should Brixton's shares trade above CA$0.50 for 20 consecutive trading days.

As of the end of March (which are the most recently filed financial statements), Brixton had a remaining working capital position of approximately CA$2.4M. It's important to emphasize the majority of the funds are going in the ground. Of the CA$1.9M in cash expenses during the first half of Brixton's financial year, CA$1.1M was spent on exploration and evaluation expenses. That's quite a lot considering the exploration programs are usually scaled back a bit during the winter periods. During the preceding financial year, almost two-thirds of all expenses were spent on the projects, which is an excellent ratio.

Conclusion

The past few years haven't been easy for Brixton Metals, but the company was able to keep its portfolio together and now has four quality assets, and two of them (Atlin and Thorn) will be focused on this year.

Hog Heaven remains an interesting project, while Brixton will very likely also follow up on its kimberlite discovery at Langis, but it's awaiting more detailed information on its discovery to design a more accurate "plan of action," which makes the decision to focus on Atlin and Thorn a bit easier.

The deep hole at Thorn should be completed soon, and then we'll just have to wait for the lab to provide the company with the assay results.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

[NLINSERT]Disclosure:

1) Thibaut Lepouttre: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: a long position in Brixton Metals. My company has a financial relationship with the following companies referred to in this article: Brixton Metals. I determined which companies would be included in this article based on my research and understanding of the sector. All images were sourced from Brixton Metal's publicly available documents. Additional disclosures are available here.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.