Shares of a company with cutting-edge advertising technology are expected to begin trading on the TSX Venture Exchange on May 29. Country Capital One Ltd. announced that it has acquired all the issued and outstanding shares of Podium Advertising Technologies Inc., which has been doing business as ADCORE. Shares have been consolidated on a 4.5738 to one basis, and the company will trade under the name Adcore Inc. with the symbol ADCO.

Investment Highlights

- Consistently profitable for over 10 years

- Scalable tech platform with recurring revenue

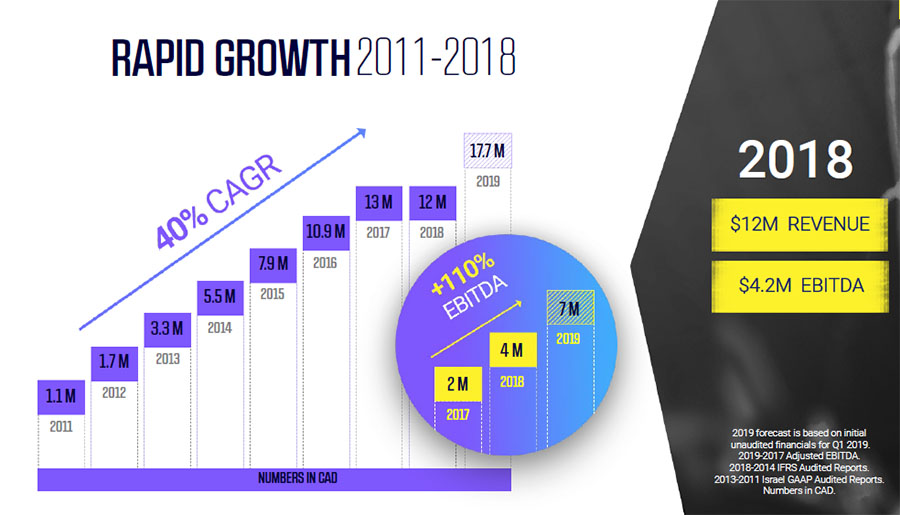

- High EBITDA growth of over 110% annually (no debt)

- 310% client growth from 2017 to 2018

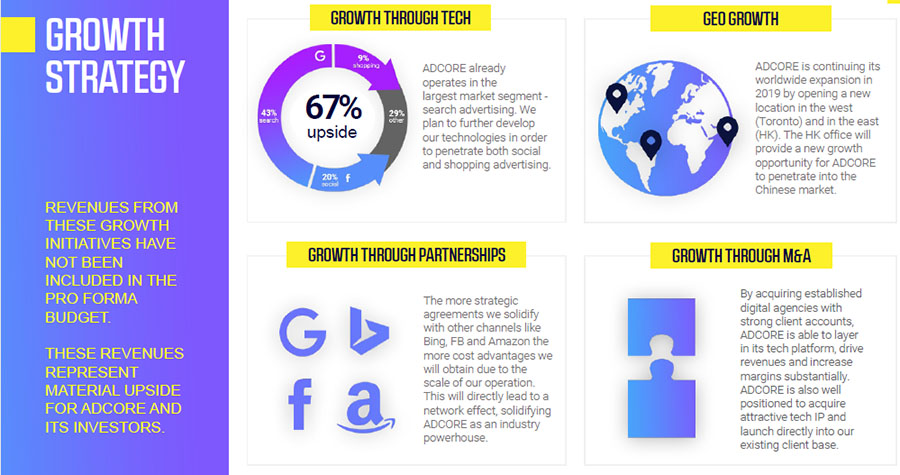

- Multiple organic and M&A growth opportunity

- Pre-money valuation of only $20.25 million

- Company posted $12 million in 2018 revenue and $4 million in EBITDA

- Estimated 2019 Revenue of $17.7 million and $7 million in EBITDA

Adcore is a search platform that helps existing Google and Bing advertisers buy paid-search ads more efficiently and on a larger and automated scale.

Global digital advertising is growing so rapidly that it is expected to be double the television ad spend in 2020, according to eMarketer, leaping from $450 billion in 2019 to $700 billion in 2023.

The company's artificial intelligence (AI) and machine-learning powered advertising technologies allow digital advertisers to enhance and maximize their Search Engine Marketing (SEM). "In-house marketing professionals, freelancers and advertising agencies use Adcore's technologies to scale their SEM activity and maximize their ROI," the company stated.

Adcore's platform allows small and medium sized businesses to harness AI technology to make the most from their digital advertising. The company has three main programs:

- Semdoc, a visual audit that provides advertisers with 52 key account and campaign metrics to identify inefficiencies and untapped revenue opportunities.

- Adcore, an automation tool that optimizes search engine marketing campaigns through an advanced machine learning solution.

- Feeditor, an "online based shopping technology that allows vendors to optimize and export their product data to over 200 shopping channels and price comparison sites with the click of a button."

Adcore earns a percentage of the advertising spend managed on its platform, and reports a compound annual growth rate (CAGR) of 40% since 2011. The company reported CA$12 million in revenue in 2018, with EBITDA of CA$4.2 million, and estimates CA$17 million in revenue and CA$7 million EBITDA for 2019.

Adcore has been named numerous times on Deloitte's Fast 50 Technology list and is a certified Google Premier Partner.

The company's hundreds of clients worldwide including digital marketing agencies, e-commerce businesses, travel, financial technology and gaming companies. It won its largest online tender to date in Israel, a CA$27 million contract with the Israel Government Advertising Agency.

The company employs over thirty people in its headquarters in Tel Aviv, Israel, and has satellite offices in Melbourne, Australia, and Winnipeg, Manitoba. It's founder, chairman and CEO, Omri Brill, has 20 years of experience in the online advertising technology industry.

Technical analyst Clive Maund wrote on CliveMaund.com, "With the founder and CEO of the company holding the majority of the stock and the balance tightly held, the stock price looks like it will respond very positively to any influx of new demand.

"As with many stocks starting trading in this manner it looks likely that Adcore's stock will advance smartly after it commences trading, then react back for a while, and after that form a base pattern before turning higher again. Due to the dynamic growth prospects for this sector, Adcore should be relatively immune from the vagaries of the broad stock market, which is a reason why it is of interest to us here. It looks like a good stock to add to a portfolio of New Tech stocks."

Upon completion of the RTO transaction, there will be approximately 55 million common shares issued and outstanding, 63.8 million fully diluted if all the options and warrants are exercised.

[NLINSERT]Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Adcore. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Adcore, a company mentioned in this article.

Additional Disclosures

Clive Maund does not own shares of Adcore and he or his company has not been paid by Adcore.