A very tight technical situation has developed in Lattice Semiconductor Corp. (LSCC:NASDAQ) that is expected to lead to a big move imminently, and for reasons that will be set out here, the move is expected to be to the upside. You will recall that we went for it on the 11th and also bought Call options.

First some fundamental insights. This from Palm Beach Trader editor Jason Bodner, via Casey Research:

"The sector has shot up nearly 30% in this year's first quarter—its best start ever. And the overall market has followed. But if you think you've missed the boat on semiconductors, think again. Jason says his system is continuing to signal institutional buying in the sector (semiconductors). And that means more gains ahead for investors in these companies…"

We can see how the sector has performed on the following 16-month chart for the Semiconductor index, and the important point to observe on this chart is that, although the sector is now overbought, it has not long broken out to clear new highs by busting through a band of heavy resistance in the vicinity of multiple tops last year. This makes it unlikely that it will react back much, if at all—more likely is that it continues to ascend, pausing to consolidate from time to time. This should therefore provide a bullish background for the stock in the sector that is the focus of our interest, Lattice Semiconductor.

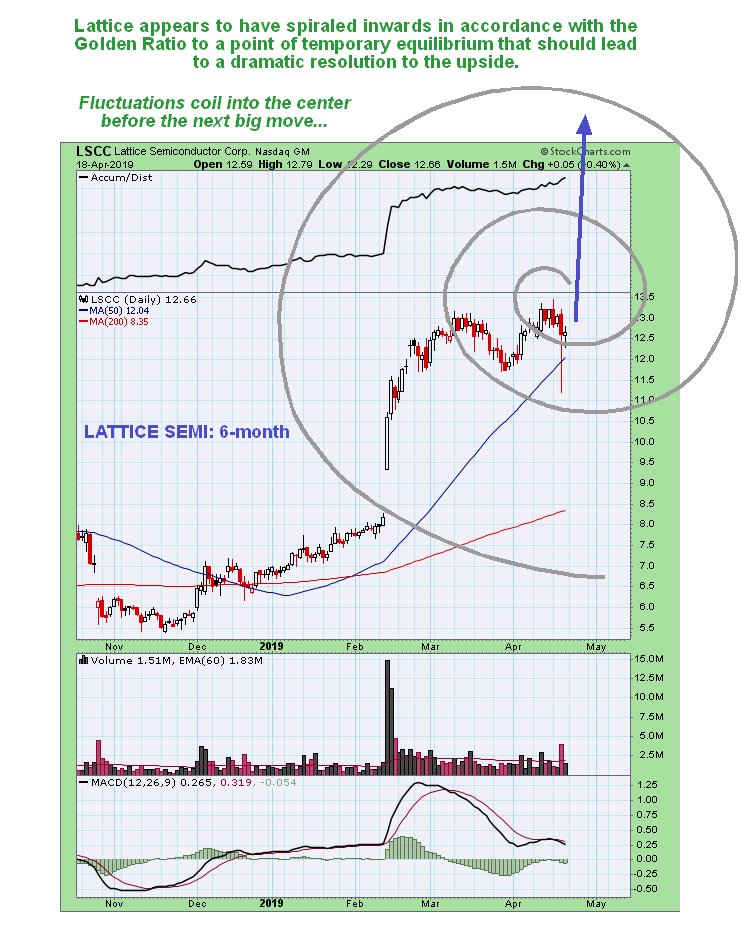

So now let's review the latest 6-month chart for Lattice to see how it is getting on. A big concern for many investors or would be investors in this stock is that it may be forming a Double Top with its March highs—this is what caused some traders to freak out when it plunged below its 50-day moving average during the morning on Wednesday, but by the close it had recouped most of the losses, and the day's action left behind a large bullish hammer candlestick on the chart. However, there are strong reasons for believing that instead of forming a Double Top it is marking out a very bullish "Running Flag" consolidation. One is that a high volume gap breakout of the kind we saw in the middle of February to new multi-year highs normally marks the start of a vigorous bull market that takes the stock much higher. Another is that while the stock has basically tracked sideways since its March peak, its Accumulation line has advanced to new highs, and the strength of this indicator at the time of Wednesday's intraday plunge is a telling indication of internal strength. What therefore appears to have unfolded from the March peak is an Elliott 3-wave A-B-C correction that Wednesday's intraday plunge served to complete. If this is a the case the stock should advance from here and a breakout to new highs now is likely to lead to a powerful advance.

Another interesting slant on the behavior of this stock in the recent past is that it appears to have coiled inwards to a point within a spiral that conforms with the "Golden Ratio" as shown on another 6-month chart below, and since it is unlikely to disappear into a black hole, we can expect the temporary state of equilibrium that now exists to catapult it strongly higher, for the other reasons that we have described above.

While we can never be 100% sure of anything in this game, the fundamental and technical factors that we have briefly reviewed here suggest a high probability that Lattice is going to break into another powerful upleg imminently that will result in substantial percentage gains for anyone buying here and big gains in the options that we bought earlier.

In the initial article on Lattice we went for the June $15 Calls which are at about the same price as where we bought them ($0.45 bid—$0.75 ask).

How high might the expected next upleg in Lattice take it? It is thought likely that it will be at least equal to the February upleg, which means it should ascend to the $17.50-$18.00 area minimum, with a high chance of a big overshoot.

FULL DISCLOSURE: I HAVE MAY $17.50 CALL OPTIONS IN THIS STOCK. The reason for recommending the June $15s for subscribers is that they are less risky. I am prepared to assume the much higher risk of failure inherent in the May $17.50s because I want the leverage. Curiously the spreads just widened dramatically on these options with a very high ask, which means that the market makers may be seeing "something coming down the pipe," although this is just speculation at this point.

Lattice Semiconductor website.

Lattice Semiconductor Corp, LSCC on NASDAQ GM, closed at $12.66 on 18th April 2019.

Posted at 8.40 pm EDT on CliveMaund.com on 21st April 2019.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

[NLINSERT]Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Lattice Semiconductor. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Lattice Semiconductors, a company mentioned in this article.

Charts and graphics provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.