I was poring over the Federal Reserve minutes from Feb. 21, and as I was rolling my eyes and looking around my den for something to throw, I was reminded of the comments from then-Fed chairman Ben Bernanke years ago when he was asked if the Fed was "monetizing debt." The reply was "No."

Yet here we are, years later, and the new mantra is now "Modern Monetary Theory," which says central banks and sovereign treasury departments can print any amount of money they so desire over any extended period of time and it won't create anything but rising stock markets and minimal inflation. Better still, for those who depend on either their houses or their retirement portfolios for late life safety and security can continue to do so because the Fed minutes revealed the "Greenspan Put," which was survived by the "Bernanke put," which morphed into the "Yellen Put," has now been replaced by the "awesomest" put of them all—the "Powell Put."

A put option gives the holder the right to sell a finite amount of the underlying security at a fixed price for a finite period of time, so for those stock market and real estate speculators, all they need to do to activate the central bank fire alarm is to simultaneously dump their portfolios "at the market," creating a stampede of selling large and violent enough to trigger circuit breakers, nightly news stories and Presidential tweets.

It was only 60 days and 3,000 Dow Jones points ago that the POTUS threatened to fire the chairman of the U.S. Federal Reserve (Jerome Powell) and the Treasury Secretary (Steven Mnuchin), resulting in a resounding call to arms that has since added over 10% to the S&P 500 and dropped the ten-year yield from 3.25% to 2.65%. Happy, smiling faces of Wall Street gamblers and online speculators are popping up everywhere as the Trump Presidency continues to groom its legacy with the iron fist of price management and interventions. "Balance sheet normalization" and "quantitative tightening" are now fragments of a distal threat, and margin calls are what your now-unemployed work mates got a few short months ago, but will never again stain the palette of the profit and loss (P&L) statement.

At all times, I try my best to use sarcasm and irony in an attempt to satirize this travesty of free market capitalism called "central bank policy," but it gets to the point where I want to literally take the closest heavy object, whether an obsolete ashtray or a half-full wine bottle or a computer monitor (or even the computer!), and hurl it off the balcony in the direction of the closest Bay Street banker sashaying his way down the street with his Au Bon Pain peppermint latte in one hand and the latest iPhone in the other, firing off an Instagram of the homeless guy on the corner. Taking in the vista of a computer monitor sailing through the air in a perfect trajectory for full facial contact with the vermin-child banker sends wave after wave of exhilaration through my veins, something for which I can be either extremely remorseful or wildly elated, depending on my mood and/or the price of gold.

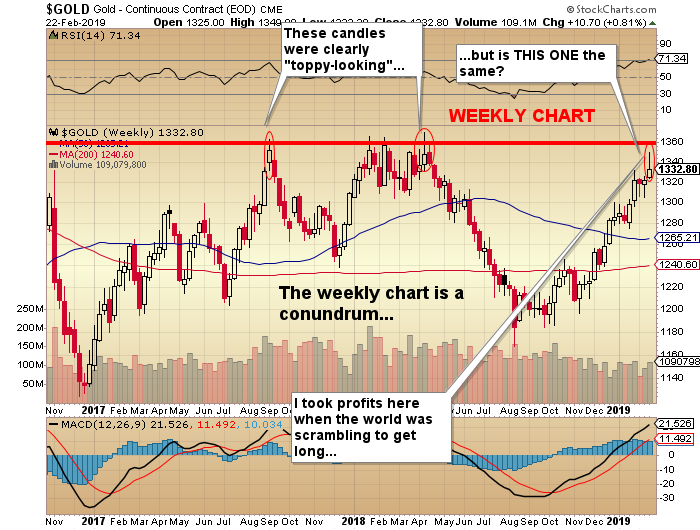

Once again, the use of my priority timing tool for gold and silver trading worked its magic as I offloaded the bulk of my leveraged precious metals investments late Thursday morning, very close to the high for the move. While the jury is still not exactly in yet, silver's pathetic performance was the negative divergence that spoiled the party, and while it was one of my best calls in recent months, I should, in retrospect, have blasted out the silver positions as well.

Instead, I tried to be "cute" by adding a few more of the SLV out-of-the-money April calls on the assumption that silver could move countertrend to gold's overbought condition. Guess what? I was wrong, deadwrong, in that silver's lagging behavior was the nagging fishwife calling you home for dinner while in the company of your rum-swilling mates. A true party-spoiler was never more present.

There are few people I admire and respect more than my former coworker, technical analyst, market historian, senior strategist and beer-league goaltender (still going strong in his 70s) David Chapman (Enriched Investing). You have all read Chappie's work over the years; his pro-bono gift to the numerous websites that cherish "free content" has been nothing short of spectacular. You have all read my constant "tweaking of noses" of most members of the "Society of Technical Analysts" over the years, but what you should know is that my jabs at technical analysis are actually an extension of after-work beer debates with none other than the "ChapMeister" himself.

We used to absolutely rage at each other over my contention that technical analysis is useless in rigged markets. while he would argue that all markets have been rigged in one way or another since the dawn of creation, so the "rigging" is still part of all of the data inputs through which the charts can see. I would argue that since the technical patterns tell the analysts whether to buy, sell or hold and are all well-known to all traders whether human or machine, they are also wonderful deceptions that can be fabricated by properly programmed algobots.

How many times have we discussed the now-legendary "technical breakouts" and "technical breakdowns" that have entrapped thousands upon thousands of unsuspecting traders and investors over the years? The bullion bank mob of unregulated traders stand in there and sells carload after carload of phony, counterfeit, paper gold and silver until demand has been satisfied, causing upside momentum to dissipate while downward pressure magically appears. This is exactly what we have witnessed in the months of January and February, as this upside probe in the mid-$1,300s has once again pushed bullish sentiment numbers, the Relative Strength Index (RSI) and the moving average convergence/divergence (MACD) into the "danger zone," while silver has failed to even threaten to do the same.

During this thrust, aggregate short interest held by the bullion banks has once again exploded. As has been well broadcast, I never play around trying to trade my physical metal nor senior miners, but I have been known to get fairly aggressive with the derivative products to generate additional alpha through leverage. It is in the derivatives that the banks are able to play their games, completely unsanctioned and totally condoned by both regulators and compliance officers. The profits these well-known shenanigans have contributed to their desks' P&L numbers are the stuff upon which legends are built, so all I can do is use the tools available to me to mount as effective a defense as I am able to avoid being forced to eat out of a dog food tin for the rest of my days—and believe me it has not been easy.

So, I refuse to use these "technical set-ups" that we all read about on GoldSeek or Kitco or Gold-Eagle, such as "head and shoulders" or "golden crosses" or "gravestone dojis" because I just know they have been weaponized by the bullion banks. Like the cheese that sits on the trigger of the trap, they are designed to lure the mice manning the money management keyboards into a certain performance oblivion.

The COT for Feb. 5 was uneventful, with a few more shorts being added by the Commercials during a week that had gold in a range between $1,306 and $1,323, closing on the higher end of that range. Until we are caught up from the log jam created by the government shutdown, the utility offered as a predictive tool by the COT reports is fairly useless, as all I can do is look at what prices did in response to the participants’ actions. Driving from point A to point B by looking into the rearview mirror does not always produce optimal results.

The Gold Miners, as represented by the HUI, put in a decent performance for the week, but the $64,000 question is whether they are going to do a repeat of 2016, where the HUI climbed from 99 to 280 in eight months, or whether they blow a tire in the first quarter as they have done in every single year (except one) since 2011.

It is amazing how sales in February, right before PDAC, are among the surest trades anywhere, and how every gold bug and junior mining promoter will try to convince us that "it really is different this time." Whether because of the U.S. debt level at $23 trillion, or due to Chinese and Indian demand and/or the Love Trade, or the "Fear Trade," or because of the "I need to sell you some of my paper" trade, you can usually fade these worthy opinions with abject clarity—with the exception of 2016, where the massive capitulation of the Norwegian Sovereign Wealth Fund gave us a generational low in the miners in January of that year.

However, it didn't even last one full year, as the precious metals complex topped out in August and has never since seen daylight.

PDAC is just around the corner so, as I preach every year, probabilities favor those that raise cash in the last two weeks of February in any and all junior exploration and development issues traded on the TSX Venture Exchange or its far riskier counterpart, the Canadian Securities Exchange (CSE). The CSE is a complete waste of time and effort, and I long for the moment when Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX) and Getchell Gold Corp. (GTCH:CSE) vacate these porcine premises in favor of the QV or QX exchanges, where shareholders are valued and protected as opposed to disdained and abandoned, as is the case with the CSE. Now, 2019 might turn out to be another 2016, with the miners, both senior and junior, powering ahead into the summer. But make no mistake, the odds are with the sellers, and even more blatant than the HUI are the TSX.V and CSE in being Q1 "sells."

One of the more noteworthy billionaire gold bugs recently cited the option expiries of Thursday, Feb. 28, as being the reason for the current sell-off in gold. But it is more appropriately month-end window dressing that will keep pressure on gold next week, as the bullion bank behemoths prefer monthly statements that reflect inflated P&Ls. And since they have total carte blanche in massaging prices through the Crimex paper market, odds favor lower prices into next week.

Turning to the broad market, next week I look to add to the Goldman Sachs (GS:NYSE) shorts, as it had a down week despite the S&P 500 putting in yet another maddeningly rigged advance. Despite being stopped out for a small S&P hit at 2,761, shorting the 200-dma at 2,742 seemed like a good move at the time. But the momo created by the dovish Fed has RSI about to go "red-line"(above 70), and with the MACD at the highest level I have ever seen, the rollover could come as soon as next week. When that happens, I want to be short the weakest stock within the weakest group, and GS certainly fits that bill. The April $180 puts are slightly underwater at $2.40, so I am adding with a $175 initial target for the stock and a $5 target for the puts. Mind you, a test of the December lows at $151.70 would have these puts at $28.30, a beautiful punt by any measure.

I think this upcoming week is going to be an interesting one for the metals. Copper tapped its highest close since last July, but with RSI into the 70s, I see limited upside from here. I am looking for a pullback to $1,310-$1,315 for gold, and silver to $15.50, where I will most certainly be looking to revisit the leveraged positions.

For now, however, I eagerly await the return of the two other inhabitants of this manse as a sign that "the coast is clear." When I see a 150-pound Rottweiler asleep on my slippers again and a woman in the kitchen with her rolling pin back in the drawer, I will be firing up the buy orders. For now, I continue to wear my hockey helmet, and wait.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Goldman Sachs, Getchell Gold Corp. and Western Uranium & Vanadium Corp. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., Western Uranium & Vanadium Corp., companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.