- Q4 Q/Q growth rate at 14%—we suspect—Elixinol now fastest growing in hemp/CBD.

- We initiate a target price of $5.76 USD, which is realistic, within current values.

Elixinol Global Ltd. (EXL:ASX; ELLXF:OTCQX) reported quarterly (Q4) revenue at US$8.57 million, up a very strong 14% over Q3. Full year revenue growth was up 121% from December 2017.

We will have further analyst when the full earnings become available the end of February. Some Australian stocks pre-release a short "cash flow" number, before full earnings, offering a glimpse at critically important top-line sales.

Our takeaway: Robust growth continues. Elixinol is heavily investing in materials and production capacity. We expect strong growth continues in 2019, and we project upcoming Q4 earnings will confirm: Elixinol is the fastest growing hemp/CBD company.

Scientific case for CBD continues to grow

We have long proposed the ultimate CBD market (cannabidiol, a non-intoxicant) is much larger, and better, than cannabis. We believe CBD will become a health standard, available in a variety of OTC forms, and routinely carried by mass retailers. The OTC market for pain relief, stress and sleeping issues alone is massive, and CBD is a near-ideal fit.

In addition, scientific evidence for CBD continues to grow. One recent study published in the April 2019 Cancer Letter concluded, "Taken together, the results obtained in this study re-demonstrated the effects of CBD treatment in vivo, thus confirming its role as a novel, reliable anti-cancer drug."

The growing weight of accumulated evidence supports our thesis whereby millions of consumers will add a daily regimen of CBD. The OTC option allows easy access. We believe there are more millions interested in improving their health, rather than getting "stoned," on a daily basis.

Elixinol versus Charlotte's Web

Both companies produce high-quality products, both were early innovators, both are primarily in Colorado. Charlotte's Web Holdings Inc. (CWEB:CSE: CWBHF:OTCQX) has a stronger presence with independent retailers, while Elixinol is strong with professionals (physical therapists and doctors) plus a large wholesale market. Indeed, many CBD "brands" are repackaging Elixinol's CBD oils, so that, while CWEB has about twice the headline sales, Elixinol's gross retail sales are significantly larger than shown.

The main difference: CWEB trades for over 5X the valuation. However, Elixinol has roughly about half the sales, half the cash. Elixinol has a vastly superior growth rate: Q3 Q/Q sales were up 27% while CWEB basically flat—less than 3%. Therefore, we propose a one-half weighting is justified.

Our target price for Elixinol is one-half of CWEB's current valuation—discounted 10%—or $5.76.

This represents a potential 130% increase, and assumes no further increase in overall CBD valuations. We—along with many others, including CNBC's Jim Cramer and Tim Seymour—remain strongly bullish on CBD for 2019.

Both companies are primary-listed in foreign markets, have strong daily volume in their respective U.S. OTC listings. CWEB however, was underwritten in Canada by a firm more famous for floating gold mining scams, while Elixinol was invited to Cowen's recent invitation-only cannabis conference.

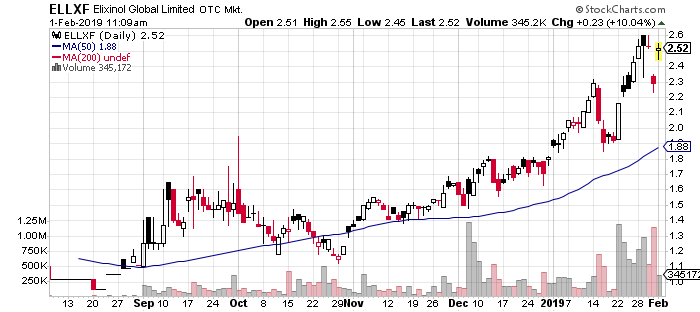

CWEB appears to have broken out of a triple top. Usually a bullish sign (charts source: Stockcharts)

Elixinol has appreciated nicely; still has catch-up opportunity. Dips being bought.

Elixinol was financed, and underwritten, in Australia, the U.S.'s most reliable, traditional ally. Its auditor is Deloitte. Over 80% of sales are in the U.S. Elixinol has begun a large-scale awareness campaign and is rapidly building up the U.S. team.

This offers Elixinol investors a "fresh" start—a new idea, one well-financed, and with established, growing sales. We believe dips can be bought—and that in 2019 Elixinol will become a better "known" hemp/CBD/cannabis participant.

Initial CBD stocking boom has matured

We believe most independent health retailers have pretty much already added CBD lines, and the great rush of stocking orders has subsided. We note CWEB's sales growth rate in Q3 slowed dramatically. Our industry contacts tell us CWEB began a month-long sale in January, discounting to retailers, for the first time. We doubt a company discounts if sales are "hot."

Therefore, we believe investors should have low expectations for CWEB's upcoming Q4 earnings. We will have further analysis after all earnings.

We believe, however, the CBD boom will continue, after any near-term lag—most likely toward the second half of 2019—as new, larger retailers, such as Whole Foods and the Vitamin Shoppe, and perhaps drugstore chains, etc., begin stocking product.

High quality, innovative products

In terms of growth, Elixinol has several cutting-edge products hitting the market, ahead of competitors. Elixinol has invested deeply, in time and effort, over several years, with product development, which we project will benefit sales in 2019.

Our contacts in health-related retailing are enthusiastic over Elixinol's new additions and believe they could have a "smash hit" product on their hands.

Elixinol vs. CV Sciences

Both Elixinol and CV Sciences Inc. (CVSI:OTCQB) have strong controls and solid relationships over their supply chain. Elixinol, led by founder Paul Benhaim, has carefully sourced hemp for over 20 years, with key relationships and quality farmers. Elixinol products are mostly organically grown, while CV Sciences (OTCBB:CVSI) buys its hemp supply as a non-organic commodity.

Like CWEB, CV Sciences' majority revenue source is independent retailers. Since we believe the initial stocking rush has completed, we suspect CVSI declining growth rate continues. Investor's with high quarterly expectations should be cautious.

We have several growing concerns:

Retailers we have spoken with have complained about CVSI sales department having challenges. It took weeks, and several requests, just to get brochures or product sent.

CV management continues to insist on promoting its bizarre "pet project"—a CBD-laced smoking cessation drug. That would be fine, only without a patent, which hasn't been forthcoming, the idea is essentially worthless. Management gave away a tremendous amount of shares, for the drug, so perhaps feel obligated to justify the gift.

CVSI management stubbornly continues to split the company into two parts, confusing investors, none of whom (that we know) has any interest beyond CBD sales, especially with no patent. Yet, CVSI still devotes nearly half its precious presentation time and space to it.

In addition, management has pretty much decided to ignore its large base of retail shareholders, those responsible for building up share price in the first place. We dislike companies who treat people and shareholders with contempt. Many new "rookie" CEO's make mistakes—when their shares go up 10X, the head swells. Trouble usually follows.

CVSI shares have been consolidating; volume declining.

In summary, our investigation found Elixinol to be more open, aggressive, with a far better balanced team, and a strong commitment to enhancing shareholder value.

We do agree CVSI is most likely to become first to "uplist" to a senior U.S. exchange (having already applied to NASDAQ) and expectations of a subsequent bounce appear valid. We continue to hold shares in anticipation.

We further argue there are strong odds all of these larger CBD companies doing well in 2019—we believe there will be numerous announcements—and growing excitement, as deals with mainstream partners, and retailers such as Whole Foods, pop. Other, mostly Canadian cannabis competitors, rushing into the bonanza, will take at least two years to develop any serious supply.

Important Disclosure: Fincom Investment Partners and related accounts have purchased, and continue to purchase, Elixinol shares in the open market. In addition, a Director of Fincom Investment Partners has been an executive and business owner in the nutrition industry for over 35 years, developed numerous close relationships in the industry, and has a business relationship with CV Sciences and Charlotte's Web. Fincom Investment Partners has started helping Elixinol, as a consultant. We have introduced distribution relationships, key management personnel and made other suggestions, based on our long and direct experience in the retail and wholesale nutrition industry. For this we are receiving a modest monthly consulting fee. We are not insiders and our investment opinion continues to remain our own.

Frederick Lacy, President of Fincom Investment Partners, began as a Chicago commodity broker in 1984. In 1987 he joined Bateman Eichler, Hill Richards in Los Angeles, focusing on small to mid-cap equities, ultimately "retiring" in 2000 as a Managing Director of Investment Banking. Mr. Lacy has been involved in numerous investments, from arranging start-up capital for what became Petrohawk, which sold for $15 Billion, to mobile payments in India. Several long-time clients were founding investors of Cheniere Energy. Mr Lacy's decades in California technology includes arranging an early $13 million VC financing for "permanent ledger" software (now commonly known as "blockchain") led by top-tier fund Upfront Ventures. Other investments include 3D holographic display technology, early mobile applications, power conversion, along with multiple consumer health-related products: Canadian Glacier bottled water, Kinetin skin cream, a proprietary oxidative-stress formula, and UV purification systems. In 1989 Mr. Lacy hosted "the Venture Capitalist" which aired on (now) CNBC, and has followed the natural foods industry for 35 years.

Fincom Investment Partners Disclaimer

This report is for informational purposes only and is not a solicitation of any security purchase or sale. We use a .72 conversion rate for Australia to USD and .75 for Canada. Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, Fincom Investment Partners cannot guarantee its accuracy. Do your own due diligence. Any opinions or estimates constitute our best judgment as of the date of publication, and are subject to change without notice. We recommend investors conduct thorough investment research of their own, including detailed review of the related Companies' filings, and consult a qualified investment adviser. Fincom Investment Partners and its officers and directors own shares in the securities mentioned in this report and may buy or sell shares at any time without prior notice. Fincom Investment Partners has a consulting relationship with Elixinol.

[NLINSERT]Disclosure:

1) Frederick Lacy: Fincom Investment Partners owns shares of the following companies mentioned in this article: Elixinol. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: Elixinol. Fincom disclaimer above. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.