If this unfortunate character, who for a brief period became a BITCOIN BILLIONAIRE, had been a clivemaund.com subscriber, he would have known to get the hell out of Dodge and would not have ended up broke and pawning his underwear.

As you may recall we had some fun at the expense of those caught up in this mania around the time it peaked less than a year ago, starting with a BITCOIN TOTAL WIPEOUT ALERT on 13th December, and then calling the final top on the Monday after it occurred in The Bitcoin Market would like to thank The Greatest Fool for joining us to celebrate the launch of Bitcoin Futures on the CME, following up with a BITCOIN CRASH UPDATE on 24th and then gloating in the satirical SELL BITCOIN – BUY TULIP BULBS! posted in mid-January after the initial crash phase and finally rubbing it in with MUSIC FOR THE NEXT BITCOIN CONVENTION posted early in February. While all this may have seemed like cruelty towards those who got caught up in this scam, there was a serious purpose to it, which was to warn subscribers to steer well clear of it, and to expect it to fade into obscurity which is exactly what has happened. We haven't looked at it since last February because we have better things to do with our time than waste it on something that is finished. This article may therefore be regarded as a "post mortem" with the final "nail in the coffin" of Bitcoin being the sudden brutal plunge last week, which ended the illusion being put about by Bitcoin promoters in recent months that it was basing.

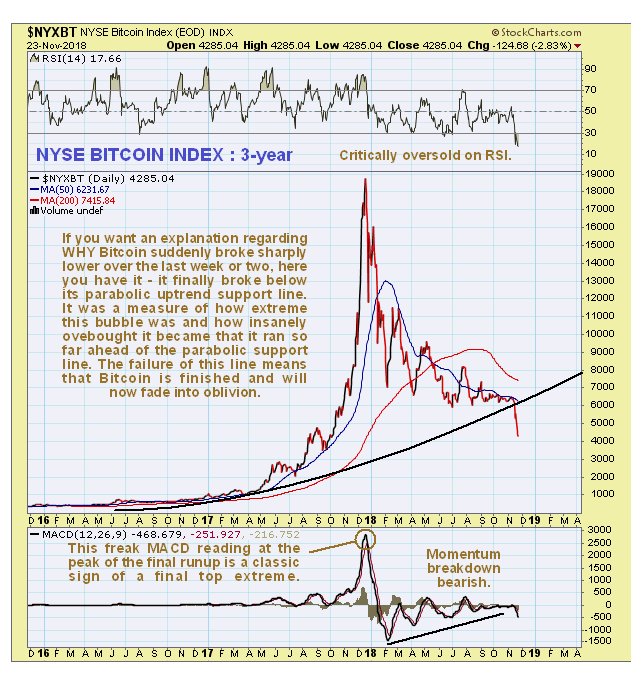

The following 3-year chart shows the predictable carnage that ensued in Bitcoin following the spectacular parabolic blowoff top, which was a classic. Bitcoin ended up with the dubious distinction of being the biggest mania of all time, even eclipsing the Dutch tulip bulb frenzy of the 17th century, the South Sea Bubble, the stock runup of the roaring twenties, the Florida land boom and the dot-com bubble. One of the most tragi-comic signs of this bubble being at its terminal stage was the pitiful sight of investors of modest means buying percentages of a Bitcoin at a vending machine, because they couldn't afford a whole coin. On the 3-year chart we can see how the decline decelerated so that it looked like it might be basing in recent months, but last week's drop put paid to that hope. For the benefit of readers outside of the UK some explanation of the term "monster raving loony" used as part of the description of the extreme MACD indicator reading at Bitcoin's peak is in order. The Official Monster Raving Loony Party existed in Britain in the 1980s and it devoted its energies to lampooning the political establishment. Its leaders would campaign in outrageous outfits including top hats and gigantic rosettes, and it was the brainchild of His Excellency Screaming Lord Sutch.

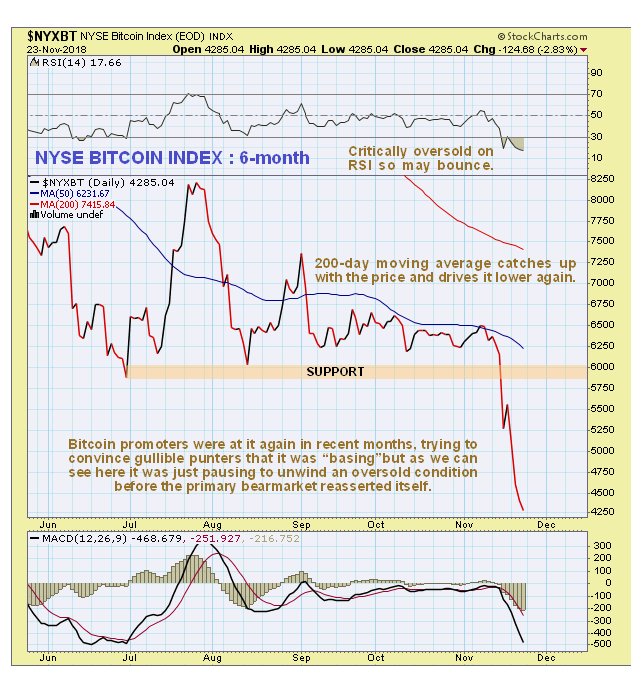

The 6-month chart shows more clearly that the drop of the past two weeks was substantial in percentage terms. Bitcoin should now continue to fade into oblivion and it is therefore of no interest to us – we prefer things of real value, like gold and silver.

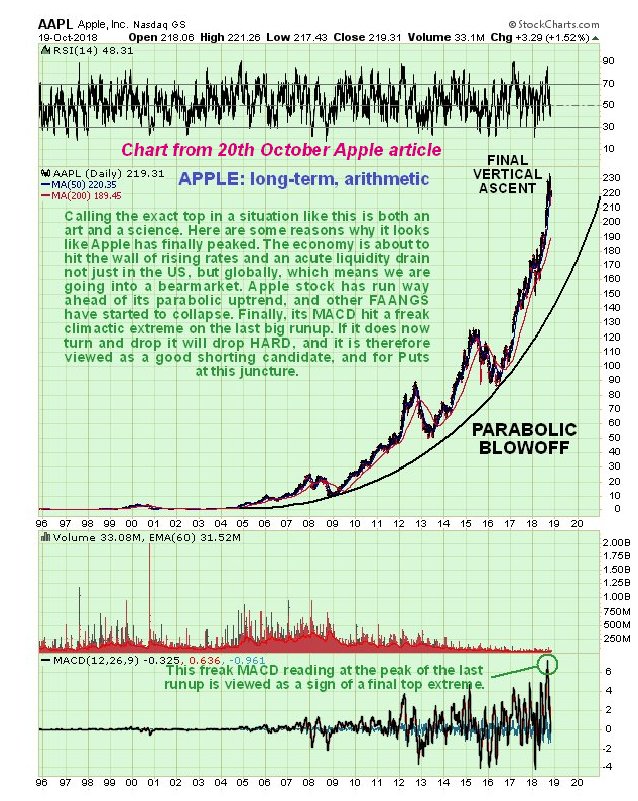

Once you learn how to spot these parabolic blowoffs, you find you can do it again and again, as we did much more recently with Apple, which is why we shorted it with Puts…

That BITCOIN BILLIONAIRE video is kind of catchy, isn't it? – let's play it again!!

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

[NLINSERT]Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.