Almaden Minerals Ltd. (AMM:TSX; AAU:NYSE) was founded in 1980. AAU is listed on the NYSE and TSX with a total of 111.6 million ordinary shares in issue (June 30, 2018), plus 10 million options with a strike price of C$1.26 (against a current TSX stock price of C$0.71) and 13 million warrants with a strike price of C$1.92. Management and directors hold 5% of the stock. Other largest shareholders are as follows: Institutions 12%; Ernesto Echavarria 7%; Tocqueville Gold 5% and Sprott Asset Management 2%. The company has no debt and as at 30th June 2018 has $12.5 million in cash. Market capitalization stands at US$59.93 million. AAU's Enterprise Value is US$47.43 million.

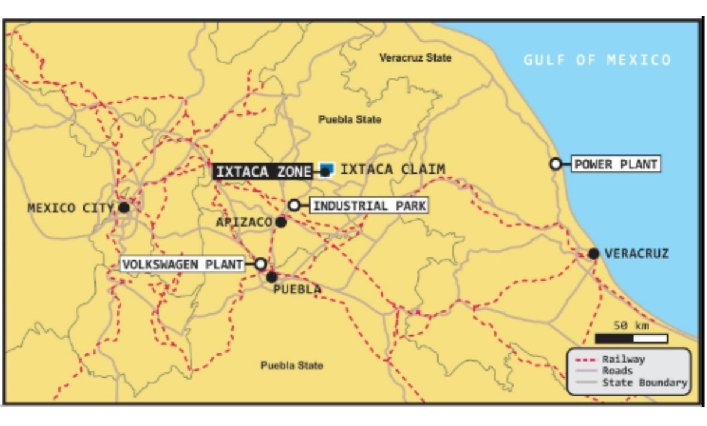

Almaden Minerals owns 100% of the Tuligtic project in Puebla State, Mexico. Tuligtic covers the Ixtaca Gold-Silver Deposit, which was discovered by Almaden in 2010. The location of the project is given on the figure below, where it is apparent that it is located amidst favorable infrastructure and sources of skilled labor, power and water, within a few hour's drive of the Mexican capital city, Mexico City.

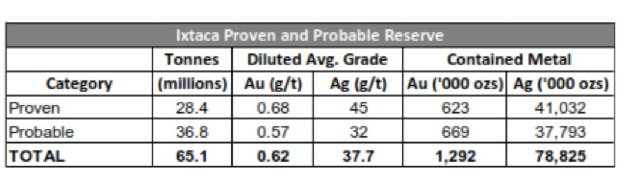

The Ixtaca deposit currently hosts a Proven and Probable reserve of 65.1 million tonnes grading 0.62 g/t gold and 37.7 g/t silver or 1.29 million ounces of gold and 78.8 million ounces of silver, as shown on the summary table below.

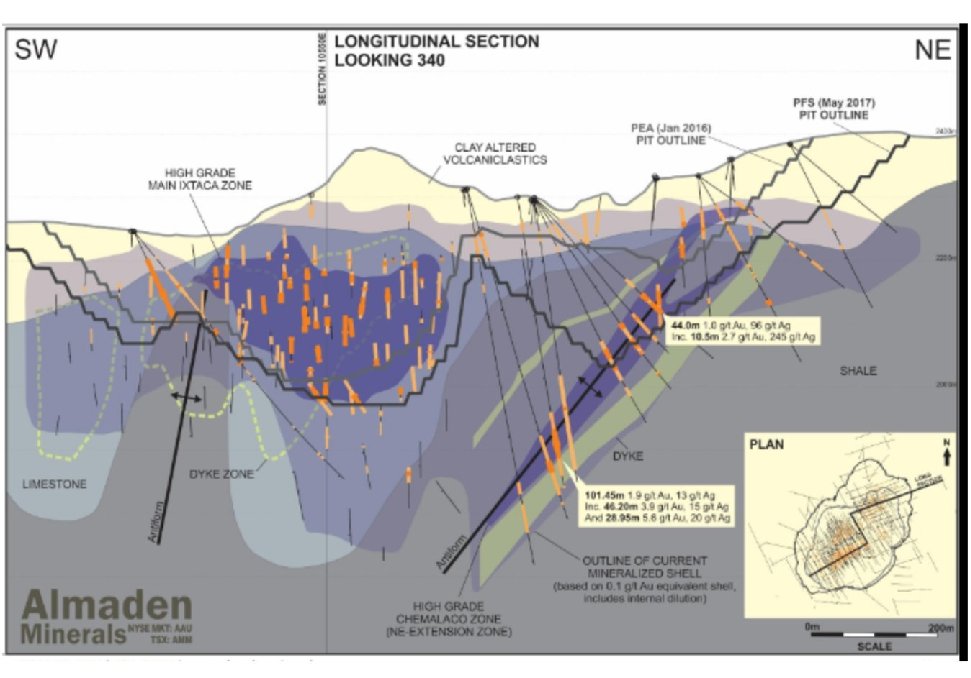

The Ixtaca epithermal gold-silver vein stockwork project occurs in deformed carbonate rocks about two kilometers southwest of the Tuligtic's porphyry copper zone (drilled in 2009-2010). The gold and silver are hosted within medium- to high-grade quartz–sulphide–electrum veins and veinlets within otherwise barren but hydrothermally altered limestone country rocks.

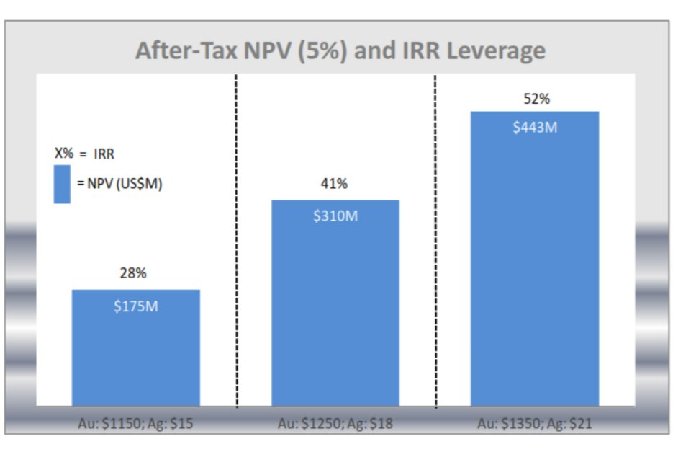

In May 2017, Almaden filed a Preliminary Feasibility Study (PFS) of the Ixtaca deposit, which estimates an economically robust project generating an after-tax IRR of 41% assuming US$1250/oz gold and US$18/oz silver prices (22nd October prices are US$1,227/ounce gold and US$14.63/ounce silver). The project would produce a total of 1,043,000 ounces of gold and 70.9 million ounces of silver over a 14-year mine life. It is worth noting, at this juncture, that as both precious metals are at a secular technical bottom, and the fact that silver is now grossly undervalued relative to gold, the Ixtaca project is highly leveraged to both the gold and even more to the silver price, given that the resources comprise a bulk tonnage low-grade open-pit mining project.

On a geologic note, Almaden has proven that there is a well-defined higher grade, structurally controlled, vein system that has been drilled off the NE flank of the open pit. Given the highly encouraging drill intersections made to date, some of which are located on the summary section presented in the Figure below, it seems apparent that Almaden should be able to define a significant medium- to high-grade underground ore resource at depths below the planned pit base. Furthermore, substantial partially explored "brownfields" exploration potential exists within close vicinity to the Ixtaca open pit.

Metallurgical test-work, undertaken as a part of the PFS, has demonstrated that the mill feedstock can be readily upgraded utilizing an ore sorter to separate the gold and silver bearing quartz veins and veinlets from the virtually barren limestone. This reduced the overall ore mass by 36% and increased feedstock grades to the mill by 39% for gold and 47% for silver. The ore sorting also reduces process tailings, water usage, energy requirements and CO2 emissions. Pilot metallurgical test-work for the PFS has demonstrated that 50% of the gold and 30% of the silver may be recovered in a gravity circuit following grinding of the ore to 75 microns using lab scale Falcon concentrators. Overall 90% of the gold and silver can be recovered from the limestone–quartz veins ore.

The availability of higher-grade ore in the upper part of the planned open pit means that at current precious metal prices project payback is currently 2.5 years in a mine life of 14 years. In the PFS the projects sensitivity to gold and silver price variance was tested between US$1,150/ounce gold and US$15/ounce silver and US$1,350/ounce gold and US$ 21/ounce silver, as shown on the chart below.

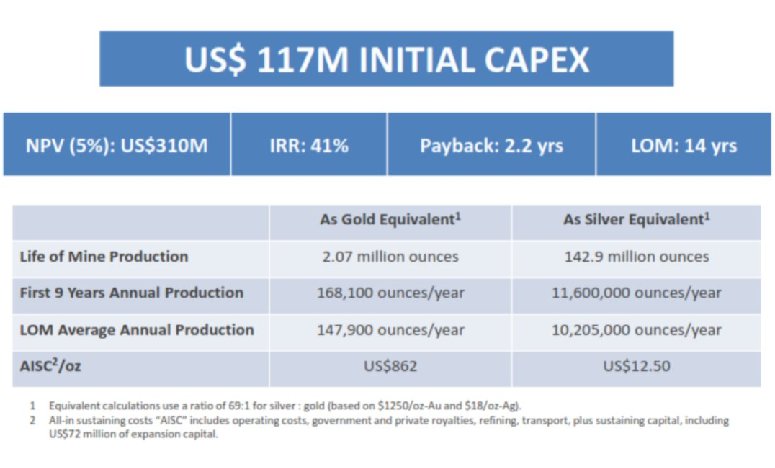

Finally, given the PFS assumptions in respect of precious metal recoveries and metal prices, Almaden allowed for US$117 million in capex for the mill, plant and mine infrastructure. The financials, and assumptions made, are summarized in the figure below.

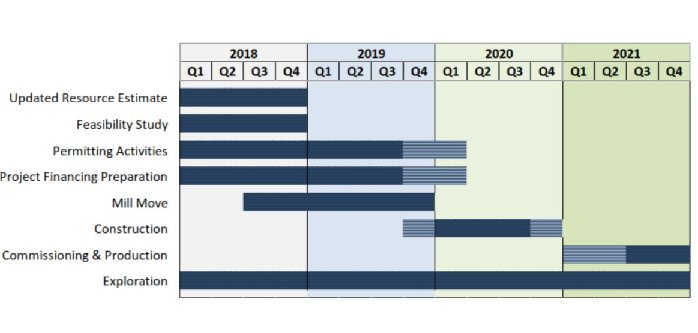

The project development chart is presented below:

Given the foregoing discussion, the Ixtaca mine should be commissioned by mid-2021. The project is strongly leveraged to gold and silver prices as the sensitivity analysis above shows. Any advance in the precious metal prices, expected during the latter part of 2018 and into 2019, will impact in a strongly positive manner on the Enterprise Value of the company and the stock price.

Nigel Maund is an economic geologist.

[NLINSERT]Disclosure:

1) Nigel Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Almaden Minerals, a company mentioned in this article.

Charts and images provided by the author.