I believe my background as a gold mining analyst allows me to truly understand the value of Bitcoin because Bitcoin competes with gold.

In a normally functioning economy, things with the lowest use value tend to have the highest exchange value. For example, diamonds, which have little use, are priced significantly higher than water, which is life sustaining. This is, in part, a function of diamonds' scarcity relative to water. In a malfunctioning economy where exchange breaks down, the reverse is true. When exchange is no longer possible, one does not need money or gold, one needs food and water, shelter, and probably a gun.

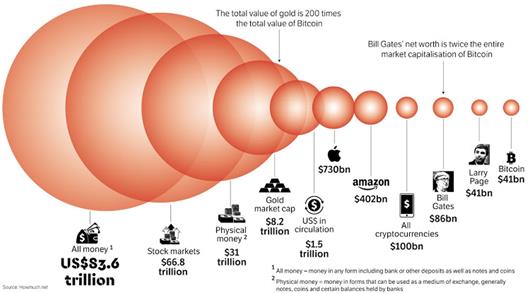

In today's global economy, the value of all the money in the world is $84 trillion, yet money is completely useless, other than being a medium of exchange. In addition to being useless, it generally depreciates over the long term due to inflation. This is shown in the 40-year chart of the U.S. Dollar Index ($USD) below. Furthermore, the destiny of all money is extinction.

So how do people protect themselves from inflation or monetary extinction? They buy hard assets.

For example, the greatest inflation in the history of Germany occurred mainly from 1918 to 1924 with the outbreak of WWI. When the war began, the German government increased the money supply extraordinarily in order to cover its cost. To protect themselves, the people began to buy and store hard assets. The flight from currency began with buying diamonds, gold, country houses and antiques. Then the buying extended to minor and almost useless items such as hairpins and pottery.

Gold has become the hard asset of choice as an inflation hedge due to its qualities that make it the most like money. Like money, gold is durable, portable, divisible, uniform, limited in supply, and acceptable (though not nearly as acceptable as money). In other words, if people use diamonds or paintings as an inflation hedge, they will be exposed to appraisal risk. If they use copper or grains, these are more perishable and difficult to store. This is why gold has become the most highly valued commodity, which is largely mined and stored in a vault that we pay people to guard. As depicted below, the value of all the gold in the world is $8 trillion. Note that gold, however, has never been a major threat to money because: a) the government does not require by law that people accept it, b) the government does not pay interest on it, and most importantly, c) using gold as currency would require people to keep a record of all of their transactions, profits and losses when using it in order to pay the relevant taxes.

Enter Bitcoin

The creation of Bitcoin marked the very first time that information in digital form became an asset. Previously, digital information could not be an asset due to the ability to simply copy and paste the information an infinite number of times, rendering it valueless. Bitcoin cannot be copied and pasted because it exists on a blockchain that contains only information to verify the owner. Therefore, the only thing that one may do is to transfer ownership to someone else. To transfer this ownership, one needs to verify that one is indeed the current owner, and the only way to do so is to hold a private key. Owning a private key is analogous to owning some gold. Transferring ownership also requires other people to contribute their electricity to process transactions, which is called "mining." They do this to receive transaction fees in the form of fractional bitcoins and newly minted bitcoins as well. The newly minted bitcoins will stop after 21 million bitcoins have been mined. After that, transaction fees only in the form of fractional bitcoins will be received as the reward for mining.

Now, because Bitcoin is a digit (divisible by eight decimals) and is more money-like than gold and is more limited in supply, fundamentally, it should be valued higher than gold. By taking the value of all the gold in the world ($8 trillion) and dividing it by the number of bitcoins that will ultimately be mined, we get a future expected price of $380,952 per bitcoin ($8,000,000,000,000/21,000,000). But because Bitcoin is inherently deflationary (people may forever lose their private keys) and gold is somewhat inflationary (it will be mined forever), our target price for Bitcoin is ultimately $400,000 per coin.

For the Skeptics

Skeptics of our target price have the following counterarguments, which we will address.

Bitcoin is inflationary because it can be hard forked.

In cryptocurrencies, a hard fork is an intentional change in protocol. If one group of nodes (i.e., transaction processors) continues to use the old software while the other nodes use the new software, a split can occur, resulting in a copy of the original blockchain. For example, on August 1, 2017, Bitcoin was hard forked by the community to create Bitcoin Cash. Anyone who held Bitcoin at that time (Block 478558) became an owner of Bitcoin Cash. The Bitcoin Cash network supports a larger transaction block size that allows faster and cheaper transactions along with a development team researching how to make further improvements. The Bitcoin Cash protocol also ensures there will never be more than 21 million coins in existence. Bitcoin Cash is currently the fourth largest cryptocurrency by market cap ($9 billion, compared to Bitcoin of $114 billion).

In our view, this is not inflationary; hard forks are simply the birth of another cryptocurrency. Similarly, there is an infinite amount of hard assets that can be used as an inflation hedge. Unlike gold, which has taken the crown as an inflation hedge in the hard-assets world due to its money-like nature, the cryptocurrency that will take the crown as an inflation hedge will be Bitcoin due to its superior infrastructure, not its money-likeness.

For example, because Bitcoin benefits from a significant amount of free marketing globally as the first cryptocurrency to be created, people usually begin their journey into the world of cryptocurrency by first buying Bitcoin. This results in the necessity of all cryptocurrency exchanges to trade in Bitcoin; otherwise, they will lose money. This infrastructure growth has resulted in Bitcoin's becoming the first cryptocurrency to have futures contracts written against it. As the futures market for Bitcoin develops, Bitcoin will be the first cryptocurrency to receive approval by the SEC for an exchange traded fund (ETF). This is because a well-developed futures market controls the spot price of any commodity and, unlike unregulated spot markets, futures markets can be regulated without breaking the bank.

As infrastructure growth perpetuates further infrastructure growth, it becomes increasingly difficult for alternative cryptocurrencies (altcoins) to compete. Infrastructure growth fuels greater demand, causing Bitcoin's price to rise. The higher the price of Bitcoin, the easier it is for one to protect greater quantities of wealth from inflation. For example, it would be easier to protect millions of dollars of wealth if Bitcoin were at $400,000 per coin compared to the current price of $6,600 per coin. Furthermore, the length and strength of Bitcoin's blockchain is unbeatable, making it the inflation hedge of choice relative to altcoins. Investors that do not have much wealth to protect and do not require the same amount of liquidity may prefer to use a cryptocurrency with lower transaction costs, such as Bitcoin Cash, to protect their money. But the big money is what will take a cryptocurrency to its full potential as an inflation hedge.

New technology will render Bitcoin obsolete.

In addition to hard forks, an unlimited number of cryptocurrencies can be created. According to CoinMarketCap, there are over 2,000 different digital assets. However, features of any particular digital currency's enhancements can be freely co-opted by another digital currency. For this reason, Bitcoin maximalists hold that, although Bitcoin may have issues with scalability, smart contracts applications, and more for the time being, there will be a point in the future at which the Bitcoin network will provide everything that investors want in a digital currency, resulting in a Bitcoin monopoly. Given that the ultimate marker of success is the length and strength of a digital asset's blockchain, why would Bitcoin's blockchain not ultimately incorporate all of the latest technologies?

There are also altcoins that do not compete head to head with Bitcoin, providing greater utility. In fact, there are three types of commodities in the digital world that mirror the three types of commodities in the material world: mediums of exchange, raw materials and finished goods.

In the digital world, Bitcoin is an example of a medium of exchange, having no greater utility.

Ethereum, the world's second largest digital asset by market cap ($24 billion), is an example of a raw material (a utility token). Ethereum has embedded "smart contracts," or programs, which overlie its blockchain's native digital coin, ether. The programs work on a conditional basis, similar to a vending machine. If you put money into the vending machine, you will get a candy bar. This programming overlay provides greater utility.

For example, imagine a shopping blockchain network where buyers get paid directly from the manufacturers to view their advertisements (i.e., If you view my advertisement, I will pay you some ether) and can buy directly from the manufacturers without middlemen (i.e., I will send you ether if you ship me your car). This one blockchain could eliminate the need for Google, retailers and banks for those using the network.

This example reflects the true potential of the birth of blockchain technology: to eliminate the need for a trusted middleman. But remember, the more useful a particular commodity, the lower its scarcity and the less desirable its use as an inflation hedge. Why is this true? Because if one actually wants one's cryptocurrency to be used in transactions rather than as an inflation hedge, deflation is an undesirable characteristic. This is because deflation causes people to put off purchases since waiting can allow them to buy more in the future. In contrast to Bitcoin, the Ethereum blockchain has a linear supply growth model. This inflationary nature renders Ethereum less desirable as an inflation hedge.

< Examples of finished product digital assets are collectibles, such as CryptoKitties and security tokens (non-fungible tokens). CryptoKitties is a blockchain-based virtual game that allows players to purchase, collect, breed and sell various types of virtual cats (collectibles). It represents one of the earliest attempts to deploy blockchain technology for recreational and leisurely purposes. A security token is simply a digital asset that reflects an ownership interest in a company, such as a stock certificate. In fact, one can tokenize anything and trade it on a blockchain. These are not as useful as inflation hedges because they are subject to appraisal value, similar to art and diamonds.

Bitcoin is too volatile to be used as an inflation hedge.

It is true that if one's country is going to hell in a handbasket, as Germany once did, one does not want to store one's wealth in some asset only to find that after the economy has returned to normal, one's wealth has been cut by 80% due to the depreciation of the asset. Currently, Bitcoin does have this drawback due to its volatility. However, as the crypto's infrastructure grows and it takes its rightful place with gold, its volatility decreases—and it has been decreasing. Offsetting the current inherent volatility of Bitcoin is its relatively lower valuation compared to gold. People who view Bitcoin as undervalued gold should be more willing to accept its greater volatility.

For the goldbugs out there, we note that we do not expect the rise in Bitcoin to reduce gold's value. Gold should maintain its position as an inflation hedge because one does not need electricity or a network to transact with it, whereas Bitcoin does. Rather, we believe the price of Bitcoin will take another bite out of the value of all the money in the world.

The Bitcoin bubble has burst and Bitcoin will be of no interest to anyone.

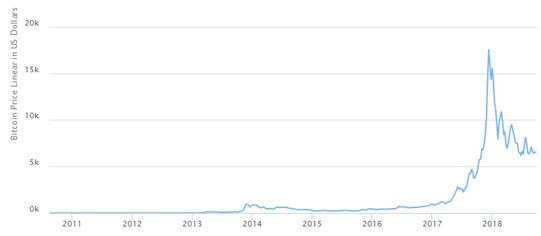

When people look at the linear chart of Bitcoin, they see what looks like a bubble that has burst, as shown below.

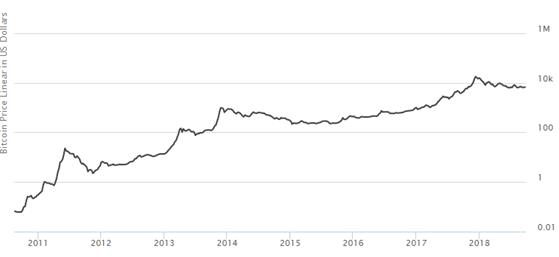

The appropriate scale, however, is the logarithmic scale. The difference between the two scales is that on a linear scale, the distance between the horizontal lines represents equal dollar amounts rather than percentage amounts on a log scale. For example, the distance between 10 and 20 is exactly the same as that from 20 to 30 on a linear scale. On a log scale, the difference between 10 and 20 is 100% and the difference between 20 and 30 is 50%. Percentage relations, it goes without saying, are the most important to traders. When the price of Bitcoin is charted on a logarithmic scale, an entirely different picture emerges. The picture is not that of a bubble bursting, but rather that of a continual bull market posting a series of higher highs and higher lows (as shown in the chart which follows). This is the picture we would expect to see if Bitcoin were truly undervalued gold.

Quantum computers will be able to break Bitcoin security.

The cryptocurrency economy relies on a public ledger—the blockchain—which is maintained by all participants of the Bitcoin network to verify and record all transactions. In order to send Bitcoin, the sender must sign for the bitcoin being sent by revealing his public key. This proves that he is the current "owner" of the private key that controls the bitcoin. The network then verifies the transaction by making sure that the signature, or public key, is valid. While these signatures appear impossible to fake for today's computers, quantum computers can potentially solve them very efficiently. This is possible because quantum computers are not restricted to processing digital information, but instead perform calculations directly using the quantum mechanical interactions that dominate physics at a microscopic scale.

How would a thief with a quantum computer steal Bitcoin?

The current mechanics of Bitcoin mean the public key is revealed only when a transaction is proposed to the network. Hence, there is a very short window of opportunity for a quantum computer to calculate the private key from the public key and present an alternative signed transaction. We can think of this attack as analogous to robbing a customer just before he enters a bank to deposit money. Making things worse, for many Bitcoin transactions the public key is actually already known and stored on the blockchain. This removes the timing constraint for the above attack and allows a thief to steal funds even if no transaction is proposed. This affects approximately a third of the Bitcoin market capital.

Countering this threat, however, is the nature of blockchain technology, which crowdsources solutions for problems, including security threats potentially posed by quantum computing. Existing quantum infrastructure supports gate speeds that are relatively low compared to those needed to carry out an extremely complicated function like cracking a cryptographic key in a short period of time. In another 10 years, there is a possibility that hardware permitting gate speeds of up to 100GHz may be in existence, but at the same time, the already extremely fast ASIC hardware that is used for the Proof-of-Work blockchain functions will also continue to evolve and improve in that time. In other words, any theoretical advantage that quantum computing possesses over the blockchain is canceled out in practice by the constraints of existing hardware and continued evolution of blockchain security. In fact, quantum-safe cryptography is already under development. The technology that can successfully compromise a blockchain is always about 10 years away from successful development, so that by the time it comes out, it is effectively obsolete.

Conclusion

Bitcoin is digital gold, whose value is derived primarily as an inflation hedge. Because Bitcoin is more money-like than gold and scarcer than gold, its value might even exceed that of all the gold in the world. Although gold has become the go-to inflation hedge due to its similarity to money, Bitcoin will become the go-to inflation hedge in the digital world due to its growing infrastructure and the length and strength of its blockchain, with which no other altcoin can compete. Neither Bitcoin nor gold can seriously compete with money because governments of the world will tax its use as an alternative medium of exchange. Accordingly, our long-term price target for Bitcoin is approximately $400,000 per coin, based on taking the market cap of all the gold in the world and dividing it by the number of bitcoins that will ultimately be in circulation.

Rodney Stevens is a CFA charter holder with over a decade of experience in the capital markets, first as an investment analyst with Salman Partners Inc., then as a merchant and investment banker. While at Salman Partners, Mr. Stevens became a top-rated analyst by StarMine on July 17, 2007 for the metals and mining industry. Mr. Stevens was also a Portfolio Manager registered with Wolverton Securities Ltd. and over the course of his career, Mr. Stevens has been instrumental in assisting in financings and M&A activity worth over $1 billion in transaction value. Mr. Stevens is a founder of Digital Asset Management Corp., a private start-up, developing a cryptocurrency holdings company with the objective of providing investors with a convenient and more liquid way of gaining exposure to the cryptocurrency sector without sacrificing security.

[NLINSERT]Disclosure:

1) Statements and opinions expressed are the opinions of Rodney Stevens and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts courtesy of Rodney Stevens.