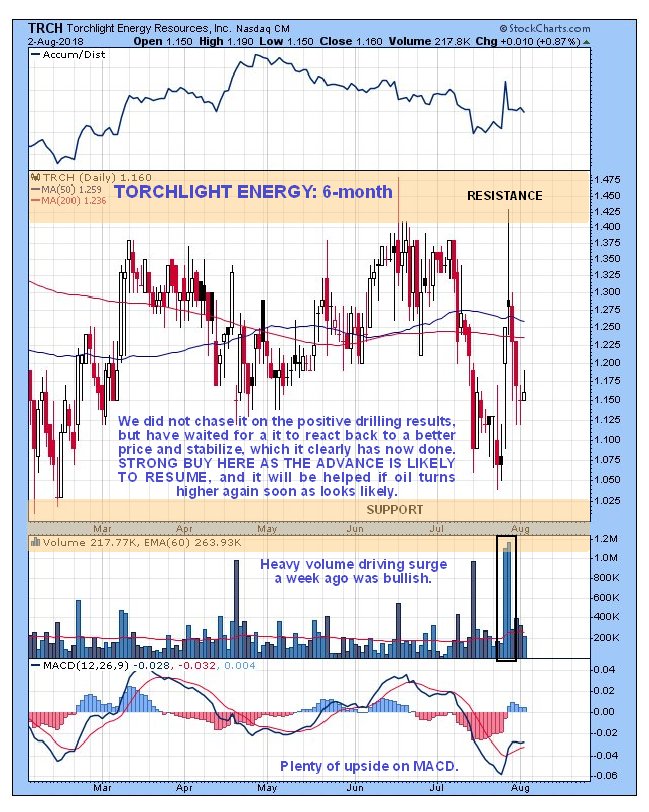

It's been a long wait for many investors in Torchlight Energy Resources Inc. (TRCH:NASDAQ), but it looks like the wait will soon prove to have been worth it, as the prospects for the company and the stock now look better than ever. While we are going to concentrate on the technical picture for the stock, as usual, you can read about the improving fundamental situation for the company in "Energy Firm's Early Test Well Results 'Very Positive'" and also in "Torchlight Illuminate a New Texas Oil Basin" and in "Why Four Wall Street Experts Are Recommending This Oil Stock." Not surprisingly, this plethora of upbeat articles on the company right after the positive drill results helped drive a spike in the stock, so we figured that it would react back to a better price once the excitement died down a bit, and that is just what it has done, and it is considered to be at a near perfect entry point here.

On the latest 6-month chart we can see how the positive drill results and ensuing publicity drove the stock sharply higher on big volume, which was bullish. The sudden spike in the price inevitably brought out selling by some jaded long-time holders of the stock causing it to react back just as we expected, but now it has stabilized at support at $1.12 and a little above, and is believed to be ready to turn higher again—and on the next advance there will be less overhanging supply to contend with so it should get further, and take out the resistance level shown. Now we will proceed to examine the longer-term 4-year chart on which we will quickly see that a MUCH bigger move is in prospect for Torchlight that will make last week's spike higher look like a minuscule blip, which is actually all it was in the larger scheme of things.

On the 4-year chart we see that the time is nigh for a really big move in Torchlight, which has been languishing in a huge Triangle since mid-2015, or for 3 years now. With this Triangle now rapidly closing up, it is clear that this move is imminent, and with things going so well for the company the likelihood is that the breakout will be to the upside, and it may be helped by another upleg in oil. After a buildup like this we can expect to see a big runup in the event of an upside breakout from the Triangle and the resistance shown near to the top of it. Note the persistent strength of the volume indicators, which is another strong bullish indication. After the dip of recent days we may be at an optimum entry point here, on what may well turn out to be the last dip before a major advance.

On the long-term 9-year chart, which shows the entire history of the stock, we can see that, in addition to being a Symmetrical Triangle, the base pattern also has the form of a giant Cup & Handle base that looks mature, with the Handle of the pattern looking proportionate to the Cup and like it is complete.

Conclusion: Torchlight is believed to be at an optimum entry point here after its dip of recent days as it is in position to start a major bull market advance, and is therefore rated a strong buy, and anyone holding should of course stay long.

Torchlight Energy website

Torchlight Energy Resources Inc, TRCH on NASDAQ CM, closed at $1.16 on 2nd August 2018.

Read what other experts are saying about:

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Torchlight Energy. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Torchlight Energy. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Torchlight Energy, a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.