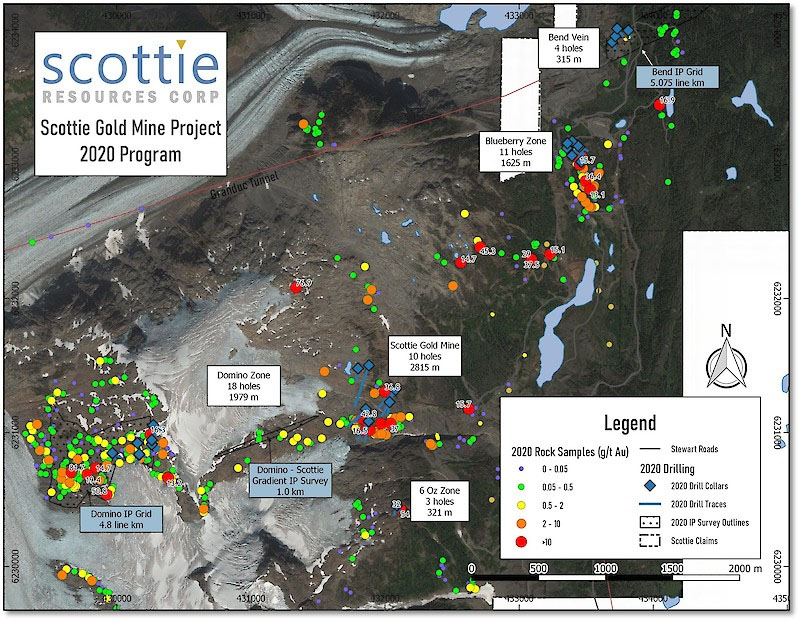

Drilling at Dean claystone project; Clayton Valley, Nevada

1. Introduction

Some juniors can be agonizingly slow on following up to their self-imposed timelines and ability to deliver results, however there are exceptions. Cypress Development Corp. (CYP:TSX.V; CYDVF:OTCQB; C1Z1:Frankfurt) is proceeding at breathtaking pace, going from its first drill hole at the Dean claystone lithium project in Nevada, U.S. to the very recent announcement of a maiden resource estimate on both Dean and Glory projects in just over a year. Not only this, the company also managed to beat various estimates in the field, including my own, with some margin, as it released a 6.54 Mt lithium carbonate equivalent (LCE) resource estimate. By doing this, Cypress established itself instantly as the holder of a 100%-owned world class sized lithium deposit, which is quite something for a junior with a tiny market cap.

The next step will consist out of two parts: developing and completing metallurgical testing for viable recovery methods (also known as met work in the industry) and doing a Preliminary Economic Assessment (PEA) to provide economics. The met work is ongoing and guided by very experienced CEO Bill Willoughby who holds a PhD in engineering and metallurgy, and the PEA is scheduled for the end of August or September. As the resource of Dean/Glory is quite large, the potential for a project with very impressive economics could be realistic. After talking to management and various industry experts, I will provide a hypothetical outlook on this potential, and together with this my view on valuation potential.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. Maiden Resource Estimate

Cypress Development released its maiden resource estimate on its fully owned Clayton Valley lithium project on May 1, 2018, and it sure was impressive. The total resource for the Dean and Glory properties came in at 6.54 Mt LCE, which consisted of an Indicated mineral resource of 597 Mt at an average grade of 899 ppm (0.09%) Li, which equates to a contained 2.857 Mt of lithium carbonate equivalent (LCE), and an Inferred mineral resource of 779 Mt at an average grade of 888 ppm (0.089%) Li, which equates to a contained 3.683 Mt of LCE. The total number of 6.54 Mt beat my estimate by about 20%, according to my estimated target of 5.45 Mt LCE, and also my top margin target of 6Mt.

Again, as a continuous reminder, examples of world class sized LCE deposits in each category are brine projects like Cauchari/Olaroz (Orocobre: 6.4Mt LCE, SQM/Lithium Americas 11.7Mt LCE), clay projects like Sonora (Bacanora: 7.2Mt LCE) or hard rock projects like Whabouchi (Nemaska: 4.06 Mt LCE).

The average grade of about 893ppm Li is somewhat lower than my estimated average of about 950ppm Li, but this isn't out of line and a normal deviation to my numbers as I am estimating without advanced software used by engineering firms. The cut-off grade was also set somewhat low at 300ppm Li, which probably helped to increase the resource but also lowered the average grade.

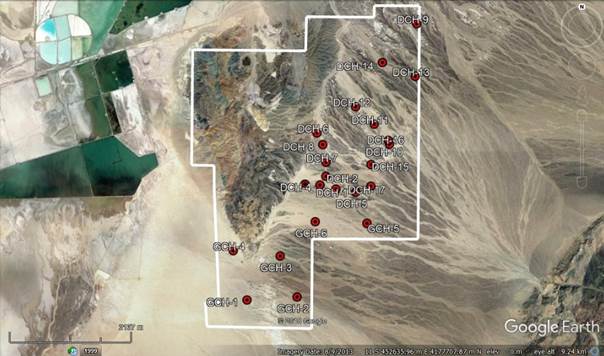

The deposit is outlined by 23 core holes for 1,891m drilled during 2017 and 2018. As the deposit is lying at surface and is pretty superficial (no deeper than 150m, usually starting at surface) and mineralization appears to be very continuous, drilling it off is relatively very cheap to build tonnage. The deposit remains open at depth, with 21 of the 23 holes ending in lithium mineralization. As this mineralization at the endings of drill cores averaged 300 ppm Li, my view is that the company will not find much more economic mineralization (assuming 800–900ppm Li) at depth, and will focus on infill drilling and advancing the current mineralized body, which is already world class.

Management estimates that an additional 30 drill holes are required to upgrade the Inferred portion of the mineral resource to the Indicated category. The large tonnage of the deposit lends potential to target higher grade lithium mineralization for the PEA, as is seen within the intercepts between GCH-06 and DCH-13:

After discussing this with management, it seems that enough of the deposit is eligible to mine at a higher grade compared to the average grade of the maiden resource. All in all, an average grade of 1,000ppm Li seems to be realistic, and I will use this as a base for my hypothetical PEA estimates later on.

Preliminary test work conducted at SGS Canada Inc. (Lakefield) and Continental Metallurgical Services LLC has shown the material exhibits high lithium extractions with short leach times. Lithium extractions greater than 80% can be achieved in 4 to 8 hours using conventional dilute sulfuric acid leaching. Currently, Hazen Research Inc is conducting additional leach tests and preliminary results confirm high lithium extractions for new mineral zones.

The presence of acid leachable lithium presents significant cost savings by avoiding calcine and regrind of material during processing. Preliminary results also show the consumption of sulfuric acid and other reagents are relatively low, to the tune of 100kg/t LCE.

It was also stated in the news release that the production of high-purity lithium carbonate (a typical salable product) was demonstrated in the laboratory using conventional recovery methods, but the big question always remains costs on a commercial scale with these kinds of bench scale tests, and the potential for economic removal of impurities. This is the next big step Cypress is facing through continuing with its ongoing met work, and as mentioned in earlier updates, if the company succeeds in this department the resource all of a sudden becomes commercially viable and minable, implying vast upside for valuation.

At the same time, Cypress also plans to proceed immediately with a PEA based on the current resource and is also evaluating ways to accelerate the project through additional drilling and related studies.

The treasury currently contains about C$600k, and management estimates it needs about C$100k for met work, and C$250k for the PEA, so there is no need for a financing soon. This PEA is scheduled for completion in August or September of this year, which is earlier than I expected.

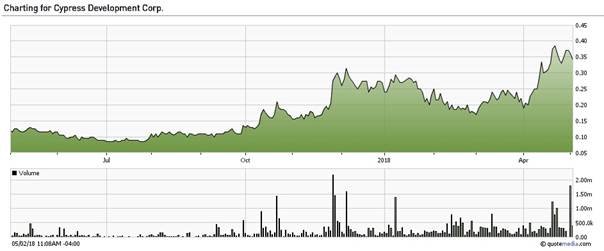

The road show recently completed in the U.S. could have had something to do with the recent run-up of the share price, and maybe the brand new (April 20, 2018) OTCQB listing helped as well in this regard. It seemed that the release of the maiden resource estimate also served some investors as a liquidity event, as the share price didn't appreciate as expected by many but hovered around the same levels on huge volume, which was kind of disappointing as the resource estimate was impressive:

Share price 1-year time frame; source tmxmoney.com

Hopefully the selling will stop soon, and the stock can appreciate further, as I do feel Cypress deserves quite a bit better valuation soon. My feelings are based on discussions I had with management and industry experts on potential economics. It is still early days with a lot of forward-looking assumptions and statements, but if Cypress manages to come close to those guesses, the potential upside is definitely very significant.

3. Hypothetical Economics

The news release on the maiden resource estimate contained an interesting passage on current estimates by management on potential economics:

"The mineral resources reported use a cut-off grade of 300 ppm Li (0.03%), reflecting a $1/tonne mining cost, $0.50 G&A cost, and a $3,800/tonne LCE processing cost (~$13/tonne processed). These costs reflect a 10,000–15,000 tonne per day mining operation in soft sedimentary material that does not require blasting. The resource estimate used a process recovery of 80%."

The processing cost here is a combined figure of processing the ore to concentrate and converting this concentrate to LCE. In order to calculate the amounts, I would like to refer to this handy table that I found at the website of Rocktech Lithium, another lithium junior. The conversion ratio from Lithium (Li) to LCE stands at 1 to 5.323, meaning that 1t of Li converts to 5.323t of LCE.

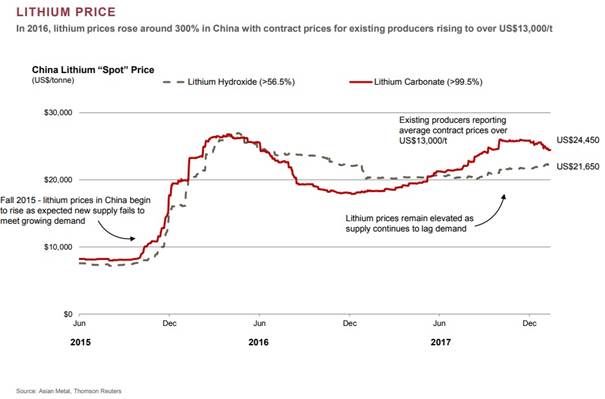

Following this, the assumed conservative average grade of 1,000ppm Li (as estimated earlier on by me) for the hypothetical PEA or 0.1% Li converts to 0.532% LCE. So, 1 tonne of material/ore contains 1000 grams of lithium at 100% recovery and 800 grams at 80% recovery, or the equivalent amount of lithium to produce 4.25kg LCE. This is currently worth US$55.25 taking into account average contract prices of US$13,000/t LCE, or US$103.9, according to the current spot price of US$24,450/t LCE, according to this sheet taken from the presentation of Lithium Americas:

For 1t of LCE could be needed 235.3t of material/ore at 80% recovery. Dividing the processing costs of US$3,800 over this number generates US$16.15/t material/ore, adding to this the already stated US$1/t mining costs and US$0.5/t G&A could result into US$17.55/t operating costs. On the other hand, total opex for 1t LCE could be US$4129.5/t as mining is extremely cheap. Comparing this to the contract price of US13,000/t LCE, or hypothetical revenues of US$55.25/t ore (assuming producer contracts as the amounts possible at this project would destroy the spot market pricing completely), it can be seen that Cypress has a significant margin for error. In order to be conservative and in line with other recent economic studies, I would like to use an estimated average contract price of US$12,000/t.

For the record, I would like to emphasize that all estimates and assumptions are my numbers only, so any mentioned hypothetical PEA outcome is very preliminary in nature and cannot be relied upon.

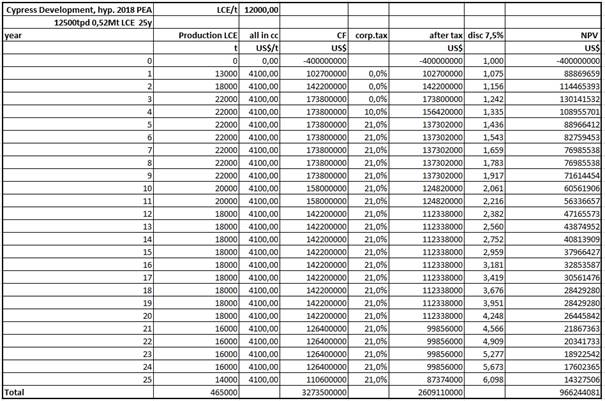

Total production can be calculated by using the stated throughput capacity. When using midpoint capacity of 12,500tpd, annual throughput would be 350d * 12,500 = 4,375,000tpa, resulting into 18,594tpa LCE, resulting into US223.1M revenues per annum. Considering there is a resource of 6.54Mt LCE, this would hypothetically result in a life of mine (LOM) of 312 years at 80% recovery. As this isn't realistic, I will use an already long life of mine of 25 years.

A very important item is capex. As mining doesn't require blasting or first processing of the sedimentary claystone doesn't require heavy crushing or milling, capex on these items can be relatively modest. Infrastructure is hardly needed, as the project is located next to Albemarle's Silver Peak lithium mine. When talking to management, it is anticipated that large volumes of water have to be transported to site by a pipeline coming from nearby sources. When taking everything into account, a US$400M capex seems realistic as a first guess.

According to management, there will also be cost savings through cheaper soda ash coming in from Wyoming. This is a big cost for brine producers down in South America as they have to import the soda ash from Wyoming. Given proximity to Wyoming and in the U.S., there could be significant cost savings, although it is too early to say to what extent.

An interesting item is the new corporate tax rate of 21%, lowered from 35% by the Trump administration. Usually a state levies their own taxes on top of this, but Nevada, together only with Ohio, South Dakota and Texas, has a state corporate tax of 0%, so the total corporate tax rate is 21% for Cypress, which is of course beneficial to economics.

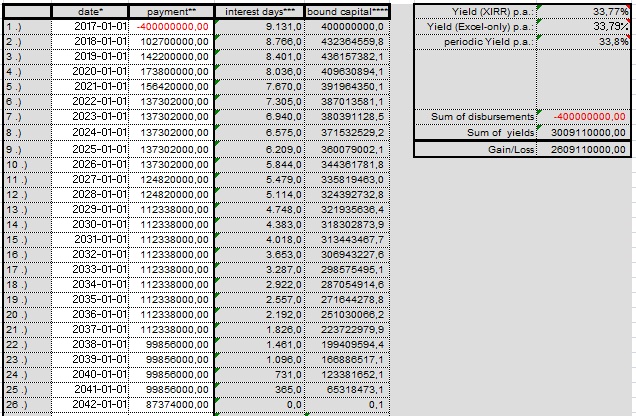

This all results into the following basic discounted cash flow analysis:

As can be seen, the hypothetical NPV7.5 would come in at US$966M, and the hypothetical IRR at 33.8%, which is pretty impressive for a large-scale lithium project:

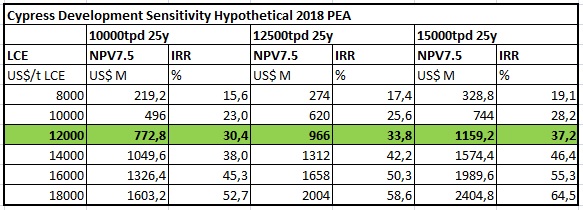

Keep in mind that I am using a conservative average contract pricing of US$12,000, in line with competitors. In order to see what happens at different LCE prices, have a look at my hypothetical sensitivity table right here:

A PEA is early stage, so it usually gets discounted quite a bit, depending on the various parameters and economics of the project. With Cypress, the recovery method needs proof so I can imagine the markets are willing to give an increased discount for this as long as the method hasn't been proven on a commercial scale.

For this, Cypress could probably need to go the route of a pilot plant first before it can get rid of this additional discount. Management is looking into this and is contemplating the possibility of standard leach and precipitation steps as the recovery process seems relatively straightforward. As a consequence, it is anticipated that any pilot plant should not be complicated, expensive or time consuming. A pilot plant might be something Cypress has to do for the Feasibility Study (FS) and/or financing of capex, but this is still uncertain. This issue will likely see more clarity after the PEA comes out.

If a potential pilot plant is needed and succeeds in proving up a commercial method, it is certainly not far-fetched to see a future potential market cap of 25–30% of NPV7.5. If we would take a (very) conservative but still hypothetical US$500M, this translates into a C$658M NPV, which would result into a C$164–197M market cap, which would almost be a ten-bagger from today's levels. I can certainly imagine the share price starting to appreciate towards this point when ongoing met work points towards the right direction, the PEA economics and costs seem convincing and the following test work proves up the coveted method as being commercially viable.

4. Conclusion

The maiden resource estimate on the Clayton Valley lithium project provided the markets with impressive tonnage, coming in at 6.54Mt LCE, which ranks among the world's largest deposits across various types of deposits. According to management, met work is progressing well, and this will hopefully generate a commercially viable recovery method to render the project economic. Several assumptions point towards the direction of a hypothetical NPV7.5 of over CS$1B, which is colossal compared to the current market cap of C$21.2M, even discounted for the PEA stage and recovery methods. It will probably come as no surprise that I am tracking this company in my portfolio with above average interest.

Lithium bearing claystones at Glory project; Clayton Valley, Nevada

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at http://www.criticalinvestor.eu/, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and has a long position in this stock. Cypress Development is a sponsoring company. All facts are to be checked by the reader. For more information go to Cypress Development Corp. and read the company's profile and official documents on Sedar, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Read what other experts are saying about:

Want to read more Energy Report interviews and articles? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Cypress Development. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.