British Columbia's Golden Triangle is home to huge mines like Eskay Creek, which was once the world's highest-grade gold mine and produced 3.3 million ounces of gold at an average grade of 45 g/t and 160 million ounces of silver at an average grade of 2,224 g/t.

Last season's gold-silver discovery at the Saddle prospect by GT Gold Corp. and high-grade gold results at Colorado Resources' Golden Triangle properties have renewed interest in the area.

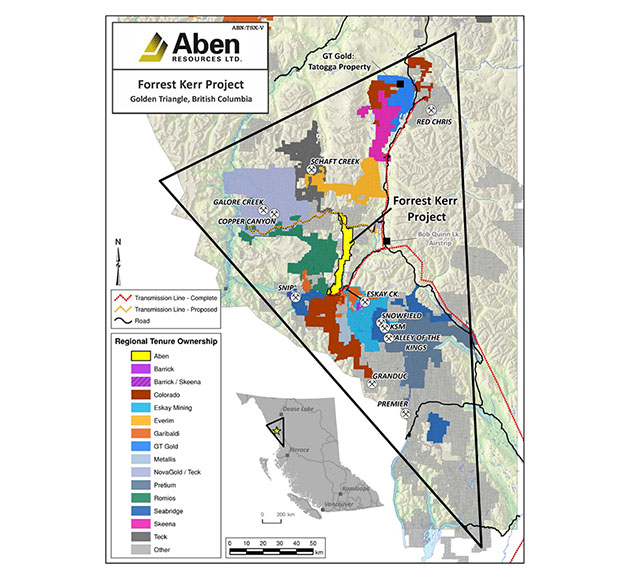

Aben Resources Ltd.'s (ABN:TSX.V; ABNAF:OTC.MKTS) Forrest Kerr Gold Project is located in the heart of the Golden Triangle and the company is gearing up for this summer's exploration.

Fresh off a private placement that raised CA$2.32 million, Aben Resources has a treasury with over C$3.5 million, which it plans to deploy for summer exploration at Forrest Kerr.

"Aben is in a good position now with cash in the bank and a very clear exploration plan for the summer." - Gwen Preston, Resource Maven

Drilling at Forrest Kerr in the early 1990s returned assay results that included 9.87 g/t gold over 29 meters in the Carcass Zone and 33.4 g/t gold over 11 meters in the Boundary Zone, but high drilling costs and limited accessibility precluded significant follow-up.

However, major infrastructure improvements have made the Golden Triangle area, once considered very remote, much more accessible, as well as more cost effective to drill. The Galore Creek access road is on the north end of Aben's property; at the south end roads and powerlines provide access and electricity from low-cost hydroelectric facilities.

Last summer, Aben drilled nine holes at Forrest Kerr, which returned highlights of 10.9 g/t Au, 14.6 g/t Ag and 1.5% Cu over 12 meters with a high-grade core of 21.5 g/t Au, 28.5 g/t Ag and 3.1% Cu over 6 meters.

Early to mid-June is the target date for the beginning of drilling at Forrest Kerr. The company plans to start announcing drilling results mid-summer.

Aben CEO Jim Pettit told Streetwise Reports, "The drill results continue to reveal the near-surface high-grade gold mineralization present at the underexplored Boundary Zone and demonstrate that the area has immense potential for new discoveries. The Boundary Zone mineralization remains open in multiple directions with numerous soil geochemical anomalies and geophysical targets yet to be drill-tested. Aben will aggressively target the new discovery in 2018 with drilling this summer and a focused geological ground program."

Resource Maven analyst Gwen Preston, wrote on April 25, "Aben will start by testing along the fault to extend the Boundary North zone. They will also test a series of targets to the south, along presumed parallel structures that offer gold-in-soil anomalies and rock samples. All told there is a 4-km long corridor of soil anomalies and rock samples that deserves a closer look, especially because it runs right along the boundary between the Stuhini and Hazelton groups (a stratigraphic boundary that almost every gold occurrence in the Golden Triangle is related to) and is bordered on the other side by a major fault, which creates a kilometer-wide corridor with the right structural attributes to host gold."

"All told, Aben is in a good position now with cash in the bank and a very clear exploration plan for the summer," concluded Preston.

In addition to Forrest Kerr, Aben is acquiring an up to 80% interest in the Chico Gold Project in Saskatchewan and holds a 100% interest in the Justin Gold Project in southeast Yukon.

The company boasts has veteran management with lots of experience in the region. The company chairman, Ron Netolitzky, is a well-known mine finder, and is associated with major discoveries in the Golden Triangle such as Eskay Creek and Snip. This area is near where Aben's flagship Forrest Kerr project is located.

President and CEO Jim Pettit has a long history in the mining field and served as the chairman and CEO of Bayfield Ventures Corp., which was bought by New Gold. Vice-President for Exploration Cornell McDowell has worked for numerous companies including Gold Reach Resources, where he took the Ootsa project from the initial stage through a positive PEA. Geologist Tim Termuende is the CEO of Eagle Plains Resources and was involved with early exploration of Forrest Kerr. He also comes from a geological family and he has been in this field for decades.

Aben Resources has caught the attention of industry watchers. Rick Mills, in Ahead of the Herd on May 7, wrote, "investors are aware of the [Golden Triangle] play, but they are eager for another discovery like Garibaldi's to keep driving interest forward into the summer drilling season. Who could that discovery hole come from?" Among the possibilities he lists is Aben Resources.

Mills noted that among the historical drilling on Aben's Forrest Kerr property, "the most promising intersection was in the Boundary Zone hole, which returned 33.4 g/t gold over 11 meters including 326 g/t gold over 0.45 meters. A nine-hole drill campaign that started last summer showed continuous mineralization in the first three holes of the North Boundary Zone."

"The North Boundary Zone mineralization remains open in multiple directions with numerous soil geochemical anomalies and geophysical targets yet to be drill-tested. Aben anticipates doubling the 2017 drill program at Forrest Kerr this year, as the company chases more high-grade mineralization found in the new North Boundary zone in a southerly direction up to possibly 12 kilometers," Mills stated.

Aben has 63 million shares issued and outstanding and its market cap is approximately CA$11 million.

Technical analyst Clive Maund profiled Aben on April 10, writing, "Aben is believed to have an active drill season coming up, and speculative interest is expected to mount as it progresses, resulting in potentially big gains from the current low price. Great entry point here at the long-term trendline. Tactics are to take profits, or partial profits, before any drill results are announced—partial because you never know, they might find something, and there's actually a good chance of it considering they are drilling in British Columbia's Golden Triangle as well as Saskatchewan and the Yukon."

Read what other experts are saying about:

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Jake Richardson compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Aben Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Aben Resources.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aben Resources, a company mentioned in this article.

Disclosures from Resource Maven, Apr. 25, 2018

Companies are selected based solely on merit; fees are not paid.

The publisher, owner, writer or their affiliates may own securities of or may have participated in the financings of some or all of the companies mentioned in this publication.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None.