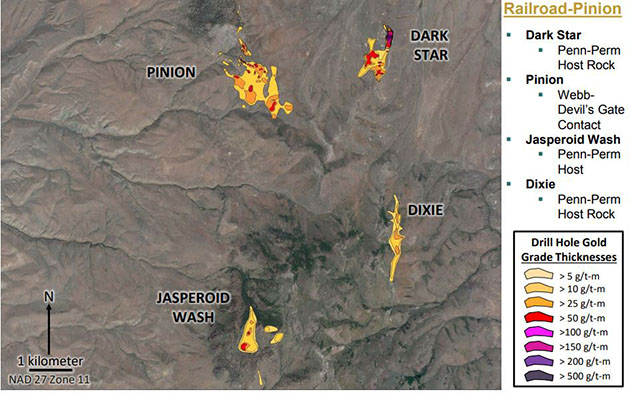

Gold Standard Ventures Corp. (GSV:TSX.V; GSV:NYSE) recently announced that four rigs have finished a significant amount of drilling on its Railroad-Pinion project in Nevada's Carlin Trend. Some 8,000 meters of infill drilling have been completed on 87 holes.

An estimated 74,800 meters of reverse circulation and core drilling in 381 holes comprise the overall 2018 US$25.8 million program. Of that, 40,800 meters of infill and development drilling in 296 holes is anticipated at Dark Star and Pinion, and exploration is the focus of another 34,000m of drilling in 85 holes.

According to the company, at Dark Star and Pinion the 2018 program objectives are decreasing drill spacing to about 30 meters, converting Inferred resources to the Measured and Indicated categories, and defining the limits of the gold zones.

"This is a very aggressive program designed to generate the data for a revaluation of the Railroad-Pinion Project. Over the past four years, we have demonstrated that the small Pinion deposit we acquired in 2014 was just a part of a much larger Carlin system. We have added discoveries, expanded them and proved that they are metallurgically receptive to high recoveries using heap leach technology," explained Jonathan Awde, CEO and director. "We aim to confirm this year that Railroad-Pinion can be the next successful mine on the Carlin Trend," he added.

On the western side of Dark Star, results were better than what was expected in the resource block model. Gold mineralization was extended to the west of the Ridgeline fault and below the current resource model.

"These were the first of the infill holes that were designed at tightening up the drill spacings of our Dark Star Project. Many of the holes actually exceeded the model in terms of grade or thickness. It was really good for us to see that. One of the things that can happen with infill drilling is that you can lose ounces or lower the grade and we're seeing the grade at bare minimum at least meet with what the model had in it, but in many cases exceed it," explained Awde.

"What's really exciting now is at the tail end of this month is that we're going to transition from infill and do some exploration drilling. We're doing to be drilling two exploration targets. One is Jasperoid Wash, which is about 3 miles south of Pinion," said Awde.

Don Harris, Gold Standard's senior development geologist, stated on April 17 that "results to date have generally met or exceeded the model expectations, with some areas of higher-grade (PR18-03) and some areas of higher AuCN ratios (80-90%) than currently modeled. These upgrades can have a positive impact to the PEA currently in progress on the project."

The company has stated that it expects to release a preliminary economic assessment in the second half of 2018.

RBC Capital Markets, in a March 26 report, noted that Gold Standard is among the junior miners that plan to release resource updates and economic studies this year. The firm noted that Gold Standard is "evaluating Dark Star-Pinion deposits as an open-pit heap leach operation with potential to add a High Pressure Grinding Roll (HPGR)."

Analyst Joe Reagor with ROTH Capital Partners commented on Feb. 26, "We are most encouraged by the company's plan to release an initial PEA on the project in H2/18 and we believe there should be a steady stream of catalysts between now and the release of the PEA."

Gold Standard announced in February CA$38,184,202 in gross proceeds due to the issuance of 18,626,440 common shares at a price of CA$2.05. Net proceeds are to be utilized for continued exploration and early-stage work at the Railroad-Pinion Project and as working capital.

Goldcorp now owns approximately 9.9% and OceanaGold owns about 15.6% of Gold Standard's issued and outstanding shares.

Brien Lundin, in the March issue of Gold Newsletter, noted that this "investment is a strong endorsement of the potential the smart money sees in Railroad-Pinon."

Read what other experts are saying about:

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Jake Richardson compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Gold Standard Ventures. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Disclosures from ROTH Capital Partners, Gold Standard Ventures, Company Note, Feb. 26, 2018

Regulation Analyst Certification ("Reg AC"): The research analyst primarily responsible for the content of this report certifies the following under Reg AC: I hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

Disclosures:

ROTH makes a market in shares of Gold Standard Ventures Corp. and as such, buys and sells from customers on a principal basis.

Shares of Gold Standard Ventures Corp. may be subject to the Securities and Exchange Commission's Penny Stock Rules, which may set forth sales practice requirements for certain low-priced securities.

ROTH Capital Partners, LLC expects to receive or intends to seek compensation for investment banking or other business relationships with the covered companies mentioned in this report in the next three months.

Disclosures from RBC Capital Markets, "Tracking the Junior Miners – Valuations, Transactions, and Catalysts," Mar. 26, 2018

Mark Mihaljevic, Stephen D. Walker, Sam Crittenden and Dan Rollins (i) are not registered/qualified as research analysts with the NYSE and/or FINRA and (ii) may not be associated persons of the RBC Capital Markets, LLC and therefore may not be subject to FINRA Rule 2241 restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account.

Analyst certification

All of the views expressed in this report accurately reflect the personal views of the responsible analyst(s) about any and all of

the subject securities or issuers. No part of the compensation of the responsible analyst(s) named herein is, or will be, directly or

indirectly, related to the specific recommendations or views expressed by the responsible analyst(s) in this report.

To access conflict of interest and other disclosures for the subject companies, click here.

Disclosures from Gold Newsletter, March 2018

The publisher and its affiliates, officers, directors and owner actively trade in investments discussed in this newsletter. They may have positions in the securities recommended and may increase or decrease such positions without notice. The publisher is not a registered investment advisor. Authors of articles or special reports are sometimes compensated for their services.