The latest dollar Hedgers charts make clear that the dollar is unlikely to drop soon, and that it is more likely that the recent rally will continue. How can that be, given the U.S. has proportionally more debt than most other countries in the world?

Put yourself in the shoes of the cabal that runs the United States. The two key pillars of their strength are the global dominance of the dollar and the Treasury market. The way that this works could not be simpler—the rest of the world swaps goods and services, the product of real work, for piles of dollars, which can be electronically created by means of a few keystrokes on a computer, and they are then encouraged to convert these piles of dollars into Treasuries. This system works great for the U.S., which can get what it wants in terms of products from the rest of the world in unlimited quantities by simply handing over piles and piles of paper, and in this system trade deficits don't matter—the U.S. can run them for ever, knowing that it can inflate away its obligations in the future.

The current problem for the cabal running the U.S. is twofold. On the one hand, domestic debt has become so massive that it is undermining the dollar, and on the other we have seen an intensifying "buyer's strike" among the habitual mule-like buyers of Treasuries, who have finally put 2 and 2 together and realized that when they buy Treasuries they are footing the bill for an enormous military machine that would like to come and bomb the **** out of them if they make moves towards abandoning the dollar system. So they are ceasing buying Treasuries, and also laying the foundations for abandoning the dollar system, which they can dare to do in the case of Russia and China because they have advanced militaries and nukes. This they are doing by buying all the gold they can lay their hands on so that in the future they can back their currencies with it, and they are also creating a viable alternative to the SWIFT system for use by countries in the emerging Asian trading bloc.

The diminution of foreign buying of Treasuries has resulted in a demand shortfall, which is the reason that the Treasury market has had to be propped up in recent years by the Fed, that has had to step in on a massive scale and buy trillions of dollars of this worthless sludge, which it is now desperately trying to get off its books. This is another big reason that Treasuries have been weakening in the recent past and interest rates rising.

On the economic front the obvious way to buttress the dollar and Treasury market is to allow interest rates in the U.S. to rise sufficiently to create a big enough differential with most of the rest of the world to attract the funds necessary to prop up both these markets.

There will be a price to pay for these higher rates: the economy will stall and the stock market will crash, current high earnings notwithstanding, but, since the bond market is much much larger than the stock market and much more important to the U.S. elites than the stock market, this is a price considered worth paying.

So the immediate scenario is this: a continuing trend of rising rates that serves to save the dollar and perhaps the Treasury market, but crashes the stock market and gets Trump booted out at the next election.

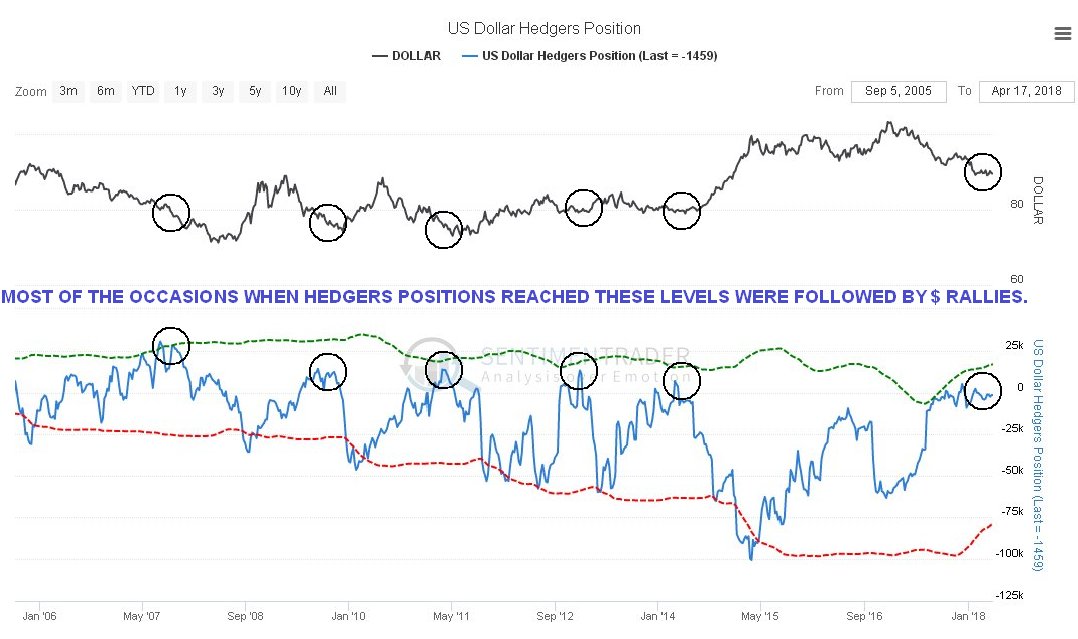

Now we will look at the latest dollar chart, and most importantly the Hedgers' chart, which shows how traders are positioned.

On the 2-year chart for the dollar index below we see that the dollar has just broken out of its downtrend in force from early last year. Going on this chart alone it looks like it is "up against it" here as it has to contend with resistance near to a still falling 200-day moving average, and with this morning's further gain is now starting to get overbought.

However, the latest Hedgers' chart supports our theory of the manufactured interest rate differential to save both the dollar and the Treasury market. For on this chart we can see that Hedgers' positions are at levels that in the past have been bullish and led to significant rallies.

Chart courtesy of sentimentrader.com

Finally, just because there is the prospect of a growing interest rate differential between the U.S. and the rest of the world does not mean that fiat as a whole is not decreasing in value; it is, at an ever increasing rate as the problems associated with debt continue to be "solved" by the creation of more debt. Gold and silver, which have intrinsic value as money, will therefore continue to increase in price, and the rate of increase will accelerate dramatically once China "throws the switch" and backs the Yuan with gold, sending the dollar reeling into oblivion. This they will do when they are fully prepared for a potential backlash involving the use of force.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stoc kmarket analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.