When I played pro hockey in Richmond, Virgina, it was during the era of "Slapshot!" and the Broad Street Bullies when gooning (fighting) was fashionable and an integral part of the sport. Stocking your team with two-or three enforcers meant that the finesse players could sail around the ice doing pirouettes and triple axles and dipsy-doodles without the fear of some 250-lb lumberjack from northern Quebec impaling them. I learned quickly from our coach, the legendary Forbes Kennedy (one of the toughest NHL players ever) that the way to avoid getting into a donnybrook with someone you really did not wish to engage was "Don't fookin' look at 'em!" because if they caught your eye and were staring you down, you then were forced to drop the gloves. I made a habit of staring into the eyes of all the finesse players and upon the skates of the goons. Of course, there was the odd occasion I forgot and wound up holding on for dear life when one of the Neanderthals tricked me up and forced me to drop 'em but for the most part, old "Forbie" was absolutely spot on and you could stay safe if you avoided the glaring, maniacal eyes of the Gilles Bilodeaus and Billy Goldthorpes of the world but ONLY if you just "didn't fookin' look at 'em."

So, with trade wars breaking out everywhere featuring Donald Trump's bellicose insistence upon tackling the soon-to-be biggest economy in the world, it is as if the whistle has blown and play has stopped as the current POTUS stares directly into the piercing, engaged eyes of the biggest economic "goon" on the planet. It is analgous to watching Wayne Gretzky giving the "evil eye" to Bob Probert, an event that could and would NEVER happen in real life whether hypothetical or not. It is beyond surreal the interplay between a country whose super freighters are lined up offshore San Francisco and New Orleans and New Jersey and Miami just waiting to dump billions upon billions of reverse-engineered, Western-designed and very cheap Chinese goods into a completely shopping-addicted Amercian consumer pool while their political masters hold on to $1.06 TRILLION of U.S. debt, ready at the flick of a switch to be jettisoned into the global bond market causing all sorts of non-temporary dislocations. The image of Donald Trump pulling the jersey over the head of Xi Jinping (China's leader) and windmilling him into submission is simply not going to happen, so when we all read of the markets buckling under the weight of a possible "trade war," the infinitesimal collective wisdom of global market participants is handicapping this contest exactly as it should: it will NOT be a "war"; it will be a "beating" and the U.S. with all of its military might will not be the one skating first to the penalty box arms raised in victory.

The S&P barely escaped a weekly close below the 200-dma as a late-Friday intervention by the boys at 33 Liberty St. in New York engineered a last minute rescue. For now, this has all the trappings of a "correction" with the S&P down 9.3% from the all-time high of 2872.87. Mind you, the 200-dma was twice before broken intraday on both Feb. 9 and last Monday, April 2. I was listening to a podcast with CNBC's Fast Money options wizard Jon Najarian where he outright admits in the existence of a plunge protection team and nowhere was it more glaringly present than Friday afternoon. Stocks were in abject freefall with the S&P dropping a big 50 points between 1:00 and 3:00 p.m. until the orders were issued and the algos went to work. Unfortunately, I believe that there exists a much more pervasive directive that is going to eliminate any talk of an equity market "bubble" leaving the stockroaches high and dry.

Since we are soon arriving at the "Sell in May" month, I am of the opinion that many participants are going to exit early having just gone through a massive volatility spike and what can only be deemed a "mild" correction. After all, it was only 50 months ago that the S&P first topped 2,000, but what is incredible is that it was a little over a month ago on March 2, we had the ninth anniversary of the birth of the bull market with the low of 666.79. Nine years of intervention, price suppression, serial money-printing and government-sanctioned fraud has combined to form the greatest financial bubble in history and since the Deep State recognizes it for what it is, they have to pin-prick it gently in order to avoid a generational uprising, the likes of which we are already seeing in the cryptocurrency crashes.

Speaking of crypto-crashes, friends of mine that still attend meetings in the bistros of Bay Street tell me that the losses incurred in the cryptocurrency deals since last summer currently dwarf the losses in pot or mining deals. As I understand it, the brokers elected to all do "non-brokered" private placements so they could safely crowd out retail and institutional clients when the allocations were decided, the result being a "Divine Retribution" outcome where these massive drawdowns in net worth are owned by the greedy financiers that went "all in" to what was expected to be the "demise" of everyone else, including their clients. "What goes around comes around" is an old adage that certainly applies in this world of unbridled avarice.

Bottom Line: You want to be modestly short the S&P (via the SDS-ETF) into any early-week strength this week and consider a modest long position in the VIX (via the UVXY). I have purposely avoided the UVXY trade since I took profits in February above $25 hoping to replace it in the high single digits but it now appears as though the high teens will be about as good as it gets in the event that the SPY 200-dma caves in next week.

I have repeated this many times in my commentaries but when asked what event would put the gold price to $5,000 per ounce, I have long opined that it will be "when the USS Nimitz pulls into Gibraltar for a refit and they refuse the credit card." Late last week, China and Russia implored the Europeans to boycott American goods in order to pressure them on the tariffs and that is moving ever closer to the gas pumpers at Gibraltar refusing to accept the American currency and while I doubt seriously whether the Europeans will immediately side against the Americans, Mr. Trump is positioning his country's economy and his presidency precariously. American citizens can put up with Stormy Daniels and golden showers in Russia but if prices at Walmart or Dollarama start moving northward due to tariffs on cheap Chinese cell phones and toilet paper holders, there will be hell to pay, not to mention the wrath of the Deep State against whom he is continuing to rail.

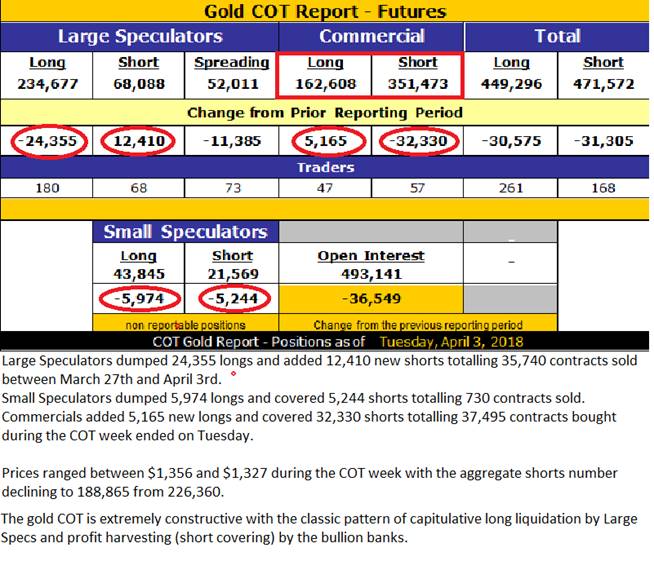

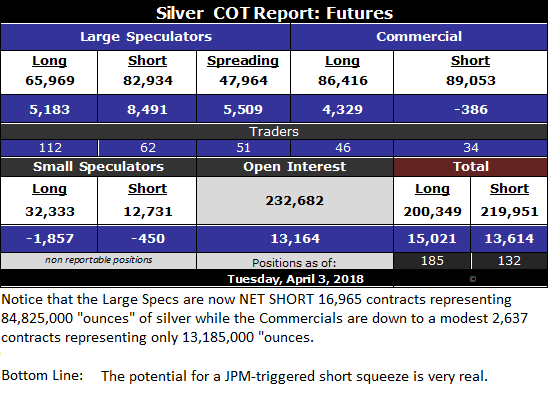

Watching gold prices this past eight weeks is like watching a five-year old at the candy counter; there is zero ability for either to make up their minds. The $1,310-1,315 level is now holding hard and true as support while the $1,365-1,375 level is like a cement wall of resistance. The algorithms that control prices have flipped from USD/JPY correlation to USD/EUR correlation while to a lesser degree the Gold/Dollar Index is just as easy to blame. Some of the gold mavens elect to completely discount supply-demand relationships as price determinants and over the past number of years that has been possibly true. Whatever your poison, gold is caught in a trading range and exiting that range will result in a violent move, whether it be up or down. The chart looks great looking back to 2016 but over the very near term, I am looking for an upside resolution to the trading range and the $1,355-$1,370 resistance AND I need gold to hold the breakout and power higher on volume such that the Commercial Cretins have zero ability to offer sufficient (phony paper) "supply" and cap the advance. As to silver, the set-up is significantly more explosive than gold due primarily to the COT structure but also based upon the historically-high gold-to-silver-ratio from whence most major bull markets have originated.

Bottom line: I own a significant long position in the SLV May $15 calls from $0.51 and having switched out of all of the April $14s at a 55% gain, I am looking to redeploy into the July $16s at around $0.40.

Gold COT:

Silver COT:

What is going to change the valuation environment for the juniors is ultimately going to be the prices for gold and silver. My validation for this is the recent 2016 advance in zinc prices from under US$0.70 to over $1.60 per lb and the coincident rash of financings, name-changes, and restructurings all contained in the zinc space that followed, not to mention the advances in share prices for anyone whose stock symbol had a "Z" in it. If I am right and we get the gold probe into the $1,400s with little brother silver as the superstar, anything with an "Ag" in it will do the same and that means that the names mentioned above are ideal candidates as micro-cap proxies for silver. Furthermore, since equities are under extreme "trade war" pressure near term, there may be ample time to accumulate these names by way of financings (SRC.V and BVG) or through capitulation by long-suffering and somewhat "tired" investors, of which I am certain there are more than a few.

I leave you all with a link to an excellent report on Stakeholder Gold produced by my German friend Maurice Howler, whom I have recently had the pleasure of meeting. A very bright young man whose thoughts on the Eurozone printing press fest (currency debasement) is aligned with everything you have read in this commentary going back decades. I offer a link for your review of this inciteful report.

https://mailchi.mp/9cb457e1c0fa/ir-firm-covers-stakeholder?e=f7507342fc

So let's see how this week unfolds with the all of the saber-rattling and trash talk and see if in fact Donald Trump is content with tweaking the nose of the man that runs a 2,285,000-man army versus 1,281,900 in the U.S. With numbers like these, I would hope that one of The Donald's aides takes him aside real soon and whispers into his soon-to-be-cauliflower left ear, "Don't fookin' look at him!"

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Stakeholder, Canuc, Buena Vista. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies referred to in this article: Stakeholder, Canuc, Buena Vista. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Canuc Resources, Stakeholder Gold and Buena Vista, companies mentioned in this article.

All charts and images courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.