An April 3, 2018, Laidlaw & Co. research report indicated that for billing purposes, the Centers for Medicare & Medicaid Services (CMS) issued a Q code, Q9993, specifically for Flexion Therapeutics Inc.'s (FLXN:NASDAQ) Zilretta, an extended release form of triamcinolone acetonide used for the management of osteoarthritis knee pain. "We view this update as a pleasant surprise since CMS issues such a code when they see a programmatic need to differentiate a drug from competition," and Flexion had not applied for a Q code, noted analyst Francois Brisebois.

The product-specific Q code is used when billing Medicare for a Zilretta injection done in a doctor's office, which is applicable to more than half of the United States market, Brisebois pointed out. It should facilitate faster processing of claims submitted to Medicare, now in a two- to three-week time frame versus the 30–60 days it would likely take under a miscellaneous code.

Further, Q9993 being issued and now existing likely improves the chances of CMS granting the corporation the product-specific J code it applied for in 2017. If that were to happen, the code could be effective as of Jan. 1, 2019. In the interim, while that's being determined, Flexion remains focused on the commercial launch of Zilretta.

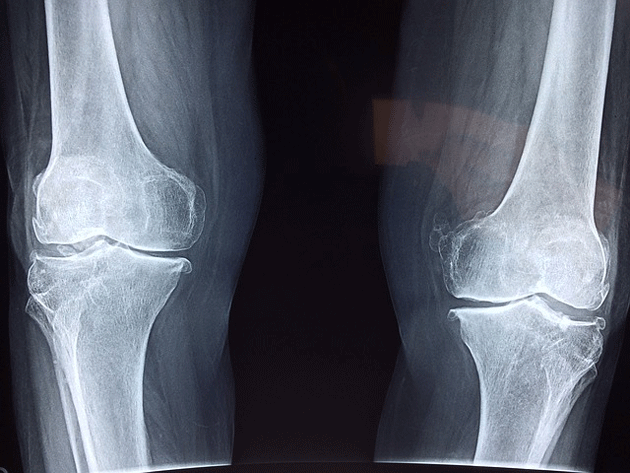

The company also might want to expand its pipeline. The recent discontinuation of its FX-101 program "could increase its mergers and acquisitions appetite as it maintains its interest in having three quality shots on goal," Brisebois purported. Three catalysts in the form of data readouts are expected this year: on bilateral osteoarthritis (OA) knee pain in Q2/18, on repeat administration for OA knee pain in Q3/18 and on OA shoulder and hip pain in H2/18.

Laidlaw remains optimistic about the company. "With increased confidence in Flexion ultimately getting its product-specific J code," Brisebois indicated, "we maintain our Buy rating and $38 price target" on it. Flexion is currently trading at around $24.59 per share.

Want to read more Life Sciences Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following company mentioned in this article is a billboard sponsor of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Disclosures from Laidlaw & Co., Flexion Therapeutics, Company Report, April 3, 2018

ANALYST CERTIFICATION The analyst responsible for the content of this report hereby certifies that the views expressed regarding the company or companies and their securities accurately represent his personal views and that no direct or indirect compensation is to be received by the analyst for any specific recommendation or views contained in this report. Neither the author of this report nor any member of his immediate family or household maintains a position in the securities mentioned in this report.

Laidlaw & Company has received compensation from the subject company for investment banking services in the past 12 months and expects to receive or intends to seek compensation for investment banking services from the company in the next three months.

As of the date of this report, neither the author of this report nor any member of his immediate family or household maintains an ownership position in the securities of the company (ies) mentioned in this report.

Associated persons of Laidlaw & Co (UK), Ltd not involved in the preparation of this report may have investments in securities/instruments or derivatives of securities/instruments of companies mentioned herein and may trade them in ways different from those discussed in this report. While Laidlaw & Co (UK), Ltd., prohibits analysts from receiving any compensation. Bonus or incentive based on specific recommendations for, or view of, a particular company, investors should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest.