Miramont Resources Corp. (MONT:CSE) is a brand new, only trading since November, exploration company focused on Southern Peru. Quinton Hennigh of Novo Resources and Irving Resources fame is the chairman of the board. I wrote about the company when they first went public.

The four-month hold on the shares ends on the 15th of March and the shares become free trading the next day. Miramont issued 30 million shares that are affected. We can safely predict there will be a price drop, actually it has already started. The shares were issued at $0.30 so that pretty much will act as a floor. Many people like to take a profit, even a small one, and hold the warrants. It makes sense but it also gives new investors a chance to pick up some cheap shares.

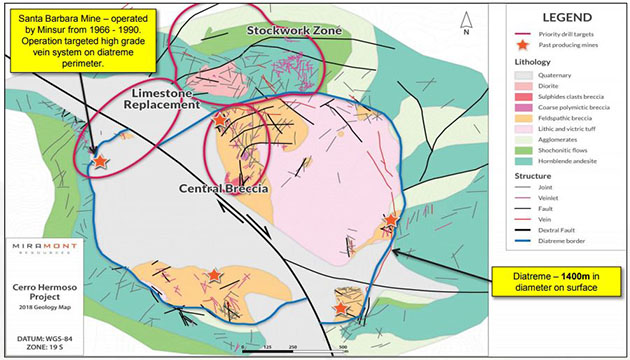

On the 26th of February company President and CEO William Pincus released the results of an IP and geophysical survey on their Cerro Hermoso diatreme property. As predicted the results verified much of the data already put together by Miramont. The area has a number of mines operating between the 1960s and 1990s. The next step is to file for drill permits.

Mapping has shown an expanded area of known mineralization at surface to about 4 square km. There are three primary targets: for gold, the Central Breccia Zone; for copper, gold and silver, the Stockworks Zone; and for zinc, copper and silver, the Carbonate Replacement Zone.

Samples from the Central Breccia Zone have shown values of up to 18 g/t gold. The Stockworks Zone has generated assays of 10 g/t gold, 500 g/t silver and 3.9% copper. Historic records from the Carbonate Replacement Zone show samples as high as 15%.

For the first phase at Cerro Hermoso the company has budgeted $1.5 million. Obviously with any apparent mineralization MONT will expand the drill program as appropriate. They expect to begin drilling in the April/May time frame; it's dependent on how long the drill permits take to be approved. The company is well cashed up with about $5.5 million on hand.

Quinton Hennigh is the Chairman of the Board and acts as a consultant to the company for geological purposes. He loves both of the company's projects. I've been to Southern Peru and seen similar projects. This is not a pie in the sky project. They have the geological data, money in the bank and broad company management. You are not going to have to wait five years to see traction.

I bought shares from a private investor in the predecessor company (Puno) and I participated in the private placement. I have a ton of faith in anything Quinton Hennigh is part of. And I have spent a bit of time with William Pincus on the phone. The company is a sleeper for now but that won't be true when the drill results come in. Meanwhile there will be a liquidity event next week and everyone has the opportunity to be buying shares at about the same price as the original investors four months ago.

Insiders hold 32% of the shares.

On the negative side, I am not a fan of C Exchange shares in Canada. They aren't very liquid. And the company needs a U.S. listing soon. I hate to whine but those are negatives that will make shares hard to buy for some investors.

The company is an advertiser. I am a shareholder from both Puno and in the PP and naturally that makes me biased. I plan on visiting the property in June. The company has an excellent presentation that I highly encourage all potential investors to look at.

Miramont Resources

MONT-C $0.34 (Mar 08, 2018)

50 million shares

Miramont Resources website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Miramont Resources. Miramont Resources is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.