Liberty Gold Corp. (LGD:TSX) announced a maiden resource for its Goldstrike project in southwestern Utah. The resource totaled 1.139 million ounces (1.139 Moz) of gold. Of that, 865,000 ounces (865 Koz) were in the Indicated category and had a grade of 0.54 g/t. About 274 Koz were Inferred, with a 0.52 g/t grade. The cutoff grade was 0.25 g/t.

The company noted "that this resource estimate crystallizes three years of data compilation and drilling, and is a strong foundation on which to layer engineering, metallurgical studies, as well as ongoing expansion drilling. It is a key asset in Liberty Gold's portfolio of advanced-staged, Carlin-style gold projects in the Great Basin of the USA."

Mick Carew, a Haywood Securities analyst, in a Feb. 8 report, described the release of the initial estimate as "an important first step for Liberty Gold."

He reiterated that much of the Goldstrike property remains unexplored, "providing significant upside in terms of total resource growth. In particular, the Dip Slope zone remains open in several directions for expansion."

Consequently, Liberty will begin its 2018 drilling in early March. The program objectives are to test new targets and expand the resource.

Haywood's rating on Liberty is a Buy; its price target is CA$1. Liberty's shares are currently trading at around $0.40 per share.

Liberty's Goldstrike maiden resource, 1.139 Moz gold at 0.54 g/t, exceeded RBC Capital Markets' estimate of ~750 Koz at ~0.75 g/ton, relayed analyst Mark Mihaljevic in a Feb. 8 research note. He added that the resource estimate indicates the asset could become a solid economic project "given scale, potential to optimize grades and attractive metallurgy." It also provides a solid foundation upon which to further advance Goldstrike." Additionally, he said the project is "approaching the critical mass necessary to attract greater investor/corporate interest."

Michael Gray, a Macquarie Research analyst, in his Feb. 9 report, indicated Goldstrike could be a heap-leach mine. "We see potential for an eight-year, ~100 Koz Au per year, OP [open pit], run-of-mine operation at Goldstrike and await the technical report (in ~45 days) to confirm potential operational viability."

Macquarie has an Outperform recommendation and a CA$1.05 per share price target on Liberty.

Analyst Shane Nagle wrote in a Feb. 8 report that Liberty's maiden resource is "broadly in line" with National Bank of Canada's expectation of 1 Moz gold grading 0.6 g/t. He pointed out that much of Goldstrike's resource can be retained at higher cutoff grades, "providing optionality in different price environments and mine planning scenarios."

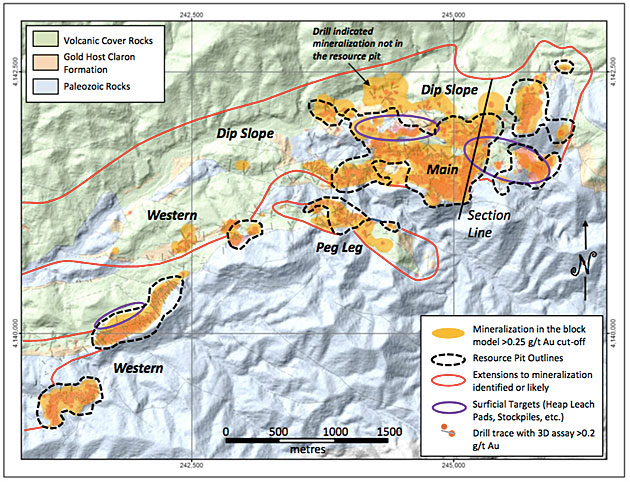

The analyst reiterated that the resource estimate encompasses historic and recent drilling, the latter by Liberty and incorporating results from 153,000m and 1,730 holes, from the Main-Dip Slope, Peg Leg and Western zones and some of the Mineral Mountain area.

National Bank has an Outperform rating and a per share price target of CA$0.70 on Liberty.

CIBC analyst Cosmos Chiu, in a Feb. 8 note, wrote that the maiden resource "is a solid foundation for continued progress at the project." CIBC has a Neutral rating on Liberty.

Just prior to the release of the initial resource, Liberty Gold announced the last set of results from its 2017 drill program at Goldstrike that encompassed 285 holes and 45,811 meters (45,811m).

In a Feb. 6 research note, analyst Mick Carew at Haywood Securities noted that the highlight from the eastern Dip Slop zone was hole PGS461. It intersected gold at a grade of 0.91 grams per ton (0.91 g/ton) at 13.7m, along with 2.39 g/ton gold at 7.6m.

The two new drilled areas, located 1.5 kilometers (1.5 km) northwest and 1.5 km south-southwest of the Beavertail pit, "confirm new gold discoveries," Carew noted. Hole PGS473, for example, hit 1.46 g/ton gold at 24.3m, including 2.25 g/ton graded gold at 13.7m.

"Particularly interesting," Carew added, are the holes drilled to the west of the Beavertail pit, where two holes showed the intersected oxide gold mineralization to be "potentially quite extensive and suggests significant expansion potential well beyond the areas that will comprise the initial maiden resource." As such, Liberty plans to conduct follow-up drilling this year.

These exploration results are "positive for Liberty Gold's shares, with the company continuing to demonstrate upside at the property," wrote analyst Mark Mihaljevic with RBC Capital Markets in a Feb. 6, 2018 research report.

He indicated that 2018 drilling aims to show "continuity between the various target areas at the property." Along with further exploration, the company this year aims to finish phase 2 metallurgical testing and expand permitting, as well as release a maiden resource estimate for Goldstrike, which it did two days later.

RBC rates the mining company Outperform and has a CA$0.70 per share price target.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Liberty Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Liberty Gold, a company mentioned in this article.

Disclosures from Haywood Securities, Liberty Gold Corp., Radar Flash, Feb. 6, 2018, Feb. 8, 2018

Haywood Securities, or certain of its affiliated companies, may from time to time receive a portion of commissions or other fees derived from the trading or financings conducted by other affiliated companies in the covered security. Haywood analysts are salaried employees who may receive a performance bonus that may be derived, in part, from corporate finance income.

Haywood Securities, Inc., and Haywood Securities (USA) Inc. do have officers in common however, none of those common officers affect or control the ratings given a specific issuer or which issuer will be the subject of Research coverage. In addition, the firm does maintain and enforce written policies and procedures reasonably designed to prevent influence on the activities of affiliated analysts.

Analyst Certification: I, Mick Carew, hereby certify that the views expressed in this report (which includes the rating assigned to the issuer’s shares as well as the analytical substance and tone of the report) accurately reflect my/our personal views about the subject securities and the issuer. No part of my/our compensation was, is, or will be directly or indirectly related to the specific recommendations.

Important Disclosures

Of the companies included in the report the following Important Disclosures apply:

▪ Haywood Securities, Inc. has reviewed lead projects of Liberty Gold Corp. (LGD-T) and a portion of the expenses for this travel may have been reimbursed by the issuer.

▪ Haywood Securities Inc. or one of its subsidiaries has managed or co-managed or participated as selling group in a public offering of securities for Liberty Gold Corp. (LGD-T) in the past 12 months.

▪ Haywood Securities Inc. or one of its subsidiaries has managed or co-managed or participated as selling group in a public offering of securities for Liberty Gold (LGD-T).

Other material conflict of interest of the research analyst of which the research analyst or Haywood Securities Inc. knows or has reason to know at the time of publication or at the time of public appearance: n/a.

Disclosures from Macquarie Research, Liberty Gold, Feb. 9, 2018

Analyst certification:

We hereby certify that all of the views expressed in this report accurately reflect our personal views about the subject company or companies and its or their securities. We also certify that no part of our compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. The Analysts responsible for preparing this report receive compensation from Macquarie that is based upon various factors including Macquarie Group Ltd total revenues, a portion of which are generated by Macquarie Group's Investment Banking activities.

Company-specific disclosures:

LGD CN: The primary analyst for Liberty Gold has visited its material operations and development assets within the past year; the company has furnished local transportation and accommodations as part of these site visits. MACQUARIE CAPITAL MARKETS CANADA LTD./MARCHÉS FINANCIERS MACQUARIE CANADA LTÉE. or one of its affiliates managed or co-managed a public offering of securities of Pilot Gold Inc in the past 24 months, for which it received compensation. MACQUARIE CAPITAL MARKETS CANADA LTD./MARCHÉS FINANCIERS MACQUARIE CANADA LTÉE. or one of its affiliates managed or co-managed a public offering of securities of Liberty Gold Corp in the past 12 months, for which it received compensation.

Important disclosure information regarding the subject companies covered in this report is available at www.macquarie.com/research/disclosures.

Disclosures from National Bank of Canada Financial Markets, Liberty Gold Corp., Research Flash, Feb. 8, 2018

Research Analysts – The Research Analyst(s) who prepare these reports certify that their respective report accurately reflects his or her personal opinion and that no part of his/her compensation was, is, or will be directly or indirectly related to the specific recommendations or views as to the securities or companies.

NBF compensates its Research Analysts from a variety of sources. The Research Department is a cost centre and is funded by the business activities of NBF including, Institutional Equity Sales and Trading, Retail Sales, the correspondent clearing business, and Corporate and Investment Banking. Since the revenues from these businesses vary, the funds for research compensation vary. No one business line has a greater influence than any other for Research Analyst compensation.

All of the views expressed in this research report accurately reflect the research analysts’ personal views regarding any and all of the subject securities or issuers. No part of the analysts’ compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report. The analyst responsible for the production of this report certifies that the views expressed herein reflect his or her accurate personal and technical judgment at the moment of publication. Because the views of analysts may differ, members of the National Bank Financial Group may have or may in the future issue reports that are inconsistent with this report, or that reach conclusions different from those in this report.

Additional Company related disclosures for Liberty Gold Corp.

National Bank Financial Inc. has provided investment banking services for Liberty Gold Corp. within the past 12 months.

National Bank Financial Inc. or an affiliate has managed or co-managed a public offering of securities with respect to Liberty Gold Corp. within the past 12 months.

National Bank Financial Inc. or an affiliate has received compensation for investment banking services from Liberty Gold Corp. within the past 12 months.

Liberty Gold Corp. is a client, or was a client, of National Bank Financial Inc. or an affiliate within the past 12 months.

An associate analyst attended a visit of Liberty Gold’s Goldstrike project in Utah and Black Pine project in Idaho on December 13 and 14. A portion of the expenses were covered by the issuer.

National Bank Financial Inc. has acted as an underwriter with respect to Liberty Gold Corp. within the past 12 months.

Disclosures from CIBC, Liberty Gold Corp., Intraday Note, Feb. 8, 2018

Analyst Certification: Each CIBC World Markets Corp./Inc. research analyst named on the front page of this research report, or at the beginning of any subsection hereof, hereby certifies that (i) the recommendations and opinions expressed herein accurately reflect such research analyst's personal views about the company and securities that are the subject of this report and all other companies and securities mentioned in this report that are covered by such research analyst and (ii) no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.

Potential Conflicts of Interest: Equity research analysts employed by CIBC World Markets Corp./Inc. are compensated from revenues generated by various CIBC World Markets Corp./Inc. businesses, including the CIBC World Markets Investment Banking Department. Research analysts do not receive compensation based upon revenues from specific investment banking transactions. CIBC World Markets Corp./Inc. generally prohibits any research analyst and any member of his or her household from executing trades in the securities of a company that such research analyst covers. Additionally, CIBC World Markets Corp./Inc. generally prohibits any research analyst from serving as an officer, director or advisory board member of a company that such analyst covers.

In addition to 1% ownership positions in covered companies that are required to be specifically disclosed in this report, CIBC World Markets Corp./Inc. may have a long position of less than 1% or a short position or deal as principal in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon.

Recipients of this report are advised that any or all of the foregoing arrangements, as well as more specific disclosures set forth below, may at times give rise to potential conflicts of interest.

Important Disclosure Footnotes for Liberty Gold Corp. (LGD)

--Liberty Gold Corp. is a client for which a CIBC World Markets company has performed investment bankingservices in the past 12 months.

--CIBC World Markets Inc. has received compensation for investment banking services from Liberty Gold

Corp. in the past 12 months.

--CIBC World Markets Inc. expects to receive or intends to seek compensation for investment banking services from Liberty Gold Corp. in the next 3 months.

Disclosures from RBC Capital Markets, Liberty Gold, Feb. 6, 2018, Feb. 8, 2018

Non-U.S. analyst disclosure

Mark Mihaljevic (i) is not registered/qualified as a research analyst with the NYSE and/or FINRA and (ii) may not be associated

persons of the RBC Capital Markets, LLC and therefore may not be subject to FINRA Rule 2241 restrictions on communications

with a subject company, public appearances and trading securities held by a research analyst account.

Conflicts disclosures

The analyst(s) responsible for preparing this research report received compensation that is based upon various factors, including total revenues of the member companies of RBC Capital Markets and its affiliates, a portion of which are or have been generated by investment banking activities of the member companies of RBC Capital Markets and its affiliates.

A member company of RBC Capital Markets or one of its affiliates managed or co-managed a public offering of securities for Liberty Gold Corp. in the past 12 months.

A member company of RBC Capital Markets or one of its affiliates received compensation for investment banking services from

Liberty Gold Corp. in the past 12 months.

A member company of RBC Capital Markets or one of its affiliates expects to receive or intends to seek compensation for

investment banking services from Liberty Gold Corp. in the next three months.

RBC Capital Markets is currently providing Liberty Gold Corp. with investment banking services.

RBC Capital Markets has provided Liberty Gold Corp. with investment banking services in the past 12 months.