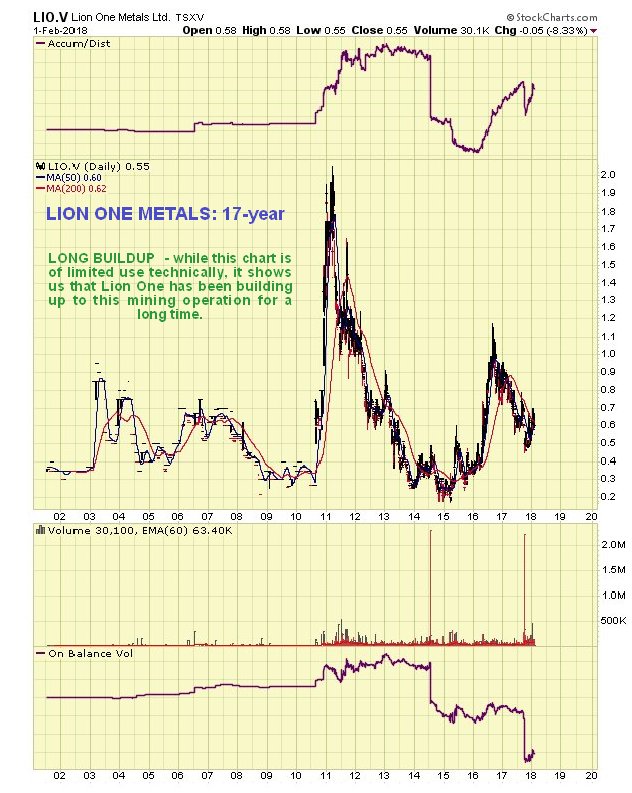

Lion One Metals Limited (LIO:TSX.V) has been working for years to develop a significant gold mine on Fiji, and is expected to bring it into production next year. Technically the stock is a buy in this area because it has reacted back over the past 18 months to the strong support at the upper boundary of a giant Head-and-Shoulders bottom that it earlier broke out of to embark on a major uptrend.

Key Fundamental points relating to the company and the project are as follows:

- The company is in possession of a fully permitted high grade underground gold project advancing to production in Fiji at Tuvatu.

- Tuvatu previously owned by Australian listed Emperor Gold (Emperor also operated Vatukoula gold mine in Fiji)

- Vatukoula gold mine produced 7m oz. gold since 1930’s; Fiji is seasoned and pro-mining jurisdiction

- Tuvatu taken through feasibility 1997-2000; over $20 million spent in 1999 dollars; Ivanhoe was biggest shareholder of Emperor

- Gold prices dropped under $300, Emperor taken over by DRD (Ivanhoe had moved onto Mongolian assets by then)

- DRD divested Fiji assets in 2006, acquired by Red Lion (Walter Berukoff)

- Red Lion sold Vatukoula gold mine in 2008, kept Tuvatu, took public with Lion One in 2011

- Wally Berukoff: founder of Miramar, Northern Orion, La Mancha—cornerstone asset bases still valuable and productive

- Emperor feasibility included over 1km underground workings & 100,000 meters drilling

- Lion One updated database and previous technical studies

- Obtained 21-year surface rights from landowners and native land trust

- Obtained 10-year renewable mining lease over 400 hectares surround Tuvatu resource

- Secured surrounding district scale land position—the Navilawa Caldera

- A 6x4 km caldera rivaling scale of most major volcanic occurrences in SW Pacific hosting likes of Porgera, Lihir, Vatukoula, Gosowong, etc.

Now we will proceed to look at the base pattern and subsequent action on the 5-year chart. This chart shows the fine large Head-and-Shoulders bottom that formed in the stock to advantage. Once the price broke out of this base early in 2016 it took off strongly higher as the entire sector recovered sharply, but after peaking in August of that year, it went into a stubborn downtrend that has persisted to this day, which means it has been going on for 18 months now—a long time, and we are at a good point for this downtrend to end, because the price has arrived back at a zone of strong support centered on the upper boundary of the Head-and-Shoulders bottom, which it dipped into late last year, before rallying back across its downtrend channel again.

The 2-year chart shows the downtrend in its entirety in more detail. On this chart we can see that a rather feeble countertrend rally back across the downtrend has been in force since late September. It looks like it is going to make another step down on this chart, and has already started to, but because of the important support not far below in the C$0.40–C$0.50 zone, there is a fair chance that it won’t drop to new lows, especially as volume has been building up in recent months, which is viewed as bullish, and the Accum–Distrib line is starting to look healthy, being not far off making new highs. There are two alternative potential developments here that would be buyers should look out for—one is a breakout from the downtrend on good volume, which will be a buy signal, the other is another dip into the support in the vicinity of the September lows at about C$0.45, which will also be a buy signal with the possibility of placing a close stop to limit loss if it breaks lower again. In this case we will be looking for bullish volume action.

The 6-month chart shows recent action in more detail, and on it we can see that the stock has gotten very close to making a bullish moving average crossover. Thus it is clear that if Lion finds support soon and turns up, we could quickly see a cross of the moving averages, leading to a breakout from the downtrend best seen on the 2-year chart, which is expected to trigger a new bullmarket in the stock.

Conclusion: after its 18-month long reactionary downtrend back to strong support, Lion One is basically in buying territory, with the remaining challenge being to buy at the best price possible, which would be if its reacts back to the C$0.45 area near-term, or with the assurance provided by its breaking out of its downtrend, which would involve paying a slightly higher price. We will keep it under observation with these scenarios in mind. There are 101 million shares in issue, which is acceptable given how long the company has been around, and the stock trades rather thinly on the U.S. OTC market.

Lion One Metals website.

Finally, one advantage that the company has over many mining companies is that it is easier to get mining analysts to go there, rather than to say, Fairbanks or Norilsk in Russia. It is not known why the company is named Lion One, since, to the writer's knowledge there are no lions roaming free on Fiji and never have been.

Lion One Metals Ltd, LIO.V, LOMLF on OTC, trading at C$0.54, $0.43 at 12.00 pm EST on 2nd January 18.

Read what other experts are saying about:

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Lion One Metals. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Lion One Metals.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Lion One Metals, a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction. Mr. Maund does not own securities of Lion One.