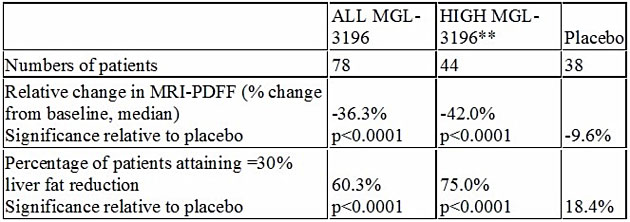

On Dec. 6, Madrigal Pharmaceuticals Inc. (MDGL:NASDAQ) delivered positive topline results from a Phase 2 trial in patients with biopsy-proven non-alcoholic steatohepatitis (NASH). In this trial, MGL-3196, a first-in-class, oral, once-daily, liver-directed, thyroid hormone receptor (THR) β-selective agonist, demonstrated statistically significant results for the primary endpoint, the percent change in hepatic fat versus placebo as measured by MRI-PDFF, a noninvasive imaging test.

Recent published data have shown a high correlation of the reduction of liver fat of 30% or more as measured by MRI-PDFF to improvement in NASH on liver biopsy. Importantly, MGL-3196 is reducing liver fat by much more than 30%, adding to our confidence that MGL-3196 has potential to be a safe once-a-day pill for NASH, a potential $35 billion market opportunity.

**Prespecified group of patients (44/78) with relatively higher MGL-3196 drug levels

Statistically significant reductions in ALT and AST were observed in MGL-3196 treated patients; greater reductions in ALT and AST, statistically significant relative to placebo, were observed in the prespecified group of 44/78 patients with relatively higher MGL-3196 drug levels. In drug-treated relative to placebo patients, statistically significant improvements were also seen in multiple secondary endpoints considered to be clinically relevant in patients with NASH, including LDL-C, triglycerides, apolipoprotein B (ApoB), and Lp(a). This is also important for MGL-3196, as it demonstrates that the drug candidate is a broad-acting lipid-lowering agent that is having a positive affect early in the NASH disease cascade. To date, MGL-3196 is the first NASH drug candidate to have both a statistically significant effect on liver fat and a broad lipid-lowering effect.

MGL-3196 has been well-tolerated with mostly mild adverse effects (AEs), and a few moderate AEs, the numbers of which are balanced between placebo and drug-treatment groups. There are no adverse effects of MGL-3196 on safety laboratory or vital sign parameters. There have been three serious adverse effects in the study, all considered unrelated to MGL-3196.

Next Steps for MGL-3196

The ongoing Phase 2 remains blinded, and safety, efficacy of NASH resolution by biopsy, and repeat MRI-PDFF will be assessed at 36 weeks, which is expected in late April 2018. Multiple inflammatory and fibrosis serum biomarkers at 12 and 36 weeks are also being and will be assessed.

In addition, the HoFh trial for MGL-3196 in patients with very high LDL will deliver Phase 2 data in late January. Given the statistically significant reduction already seen in LDL, in addition to the reductions seen in TGs, ApoB and Lp(a), our confidence has increased that the trial will be positive.

Madrigal is poised for two significant catalysts with the Phase 2 HoFh data due in late January and the Phase 2 liver biopsy data in late April. After the release of what we expect to be positive Phase 2 data in April, the company would have an end-of-Phase 2 meeting with the FDA and start the pivotal Phase 3 trial for MGL-3196 in NASH in the last third of 2018.

In our view, MGL-3196 is the most attractive drug candidate for the treatment of NASH, a $35 billion market opportunity, and has the potential to be a best-in-class molecule. This data significantly derisks Madrigal and MGL-3196 in the upcoming Phase 2 trials. As a reflection of the additional value created, we are raising our Madrigal Buy limit to $85 (from $45) and our target price to $110. Madrigal is now a Buy under $85 with a target of $110.

John McCamant is the editor of the Medical Technology Stock Letter, a leading investment newsletter. McCamant has spent more than 25 years on the front lines of biotechnology investing. He has established an extensive network that includes contacts throughout the investment banking and venture capital communities. His expertise in biotechnology investments is a subject of media interest. He is frequently consulted and quoted by The Washington Post, Reuters, Bloomberg, CBS and Marketwatch.

Want to read more Life Sciences Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) John McCamant: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Madrigal Pharmaceuticals. I personally am or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.