The Gold Report: Louis, would you talk about the commodity supercycle and where you see it at this point?

Louis James: The data continue to support the commodity supercycle hypothesis. It's long been known that commodities tend to move together as a group. There's a very high correlation between them. Even the precious metals, which are often thought of as different and not like pork bellies—their correlation with commodities in general is also very high.

Since the devastating bear market of 2011–2015 for resources in general, we did see a bottom carved out. That has not been revisited, and we are seeing resources, and metals in particular, curving back upward—two steps forward, one step back, but they are recovering. Even zinc, which was once so unloved, has become a top performer. Another one that's been lagging has been nickel, and that has started to come around as well lately. Copper has recently performed very well.

The one that's giving that narrative the most trouble right now is uranium. That, too, is something that pretty much has to go in one direction. It can't be mined for current prices. Low prices will be the cure for low prices, as we saw with the recent news of Cameco Corp. (CCO:TSX; CCJ:NYSE) shutting down one of the biggest uranium mines in the world. It's super high grade, but the company just can't make the bottom line work out under current circumstances. That's 10% of the uranium supply of the world going offline there, and they are not the only ones. So, I think that lagging uranium will come around.

TGR: Where do you see the precious metals in this cycle at this point?

LJ: The supercycle argument is bullish for gold and silver, whether you're a goldbug or not, whether you see them as monetary metals as well as commodities or not. But, of course, they are safe haven assets as well.

The world is no less crazy than it was last month. Trump is over in China making nice and trying to soothe things over, but I don't think that will go very far with the Kim Jung-un in North Korea. We have a purge in Saudi Arabia doing who knows what in the Middle East, and plenty of other sources of disruption rocking the global economy.

We supposedly have a recovery going, with some rosy numbers reported and tech stars like Apple pulling things up. But we also have warning signs and a "recovery" without wage recovery. Without full participation in the labor force, I have to wonder how much of a real recovery that is. And companies can do a lot of things to report better earnings, but they're not sustainable, and I have to wonder how long the Wall Street rally can last.

Anyone who looks at the world and says, "Hey, everything is getting better and everything is going to be peachy!," well, they aren't going to be persuaded by the safe-haven argument for gold. I don't see the world that way. I see plenty of reasons to be cautious and to make sure that you have safe-haven assets in your portfolio. But if I'm wrong about that, that's a good thing the commodity supercycle is also bullish for precious metals. Either way, you have strong bullish factors for gold and silver.

TGR: Do you consider the new "hot" energy minerals part of the commodity supercycle or are they being driven by different demand, for energy storage and electric vehicles?

LJ: It's both. They are commodities, so they certainly fit within the commodity supercycle narrative. But there's also very specific and powerful trends behind these things. An interesting segue from precious metals to the new minerals is that silver is one of these minerals. As a group, the minerals aren't new and neither is the energy. What's new is the massive push in this direction toward what was once called "alternative" energy and is now fast becoming the new mainstream energy regime.

It's one thing for Volvo AB (VOLAF:OTC US) to say it won’t be producing internal combustion engine cars in two years. It's another thing for General Motors Co. (GM:NYSE) to go all electric. And it's one thing for France to say it's going to go all electric vehicles by 2040. It's another thing for China to say it's going to get rid of gas and diesel motors. They're a Communist dictatorship. They can make such changes faster than almost anywhere else on earth. The European Union is now proposing new tightening rules by 2030, which is a lot closer time frame and a lot bigger than just France. Even India is talking about this now. These are huge game-changing shifts.

So, this is a megatrend-type shift toward what was once alternative and is now going to be the new mainstream. This has massive implications for resources, particularly the hydrocarbons we’re ditching and the minerals and metals that go into this new energy paradigm. And it's not just the batteries. People like to talk about battery metals, and, sure, lithium and nickel and cobalt and these metals that are part of the batteries are certainly important parts of the story. But there's more than that. There's where is the energy going to come from.

Tesla Inc. (TESLA:NASDAQ) is out there wanting to re-roof the world. The average solar panel uses a significant amount of silver. The typical residential solar panel uses several ounces of silver. The average American roof would take a couple kilos of silver to cover. That's a lot of silver.

That’s why I say that silver is one of these new energy minerals. And of course, copper. It is going to take a lot of wires to carry this energy. It's one thing to have a central power plant that lights a city. It's another thing to have every house or every building generating its own electricity. There's a lot of new wiring to go with that. And electric cars, depending on which source you see, use anywhere from 50% to 300% more copper than a regular car—or an old car we should say.

There's a whole suite of new energy minerals, and some of them are booming already. Others are just getting going. Nickel, I mentioned, is among the latter. Some minerals have shot up in price, even though they are not really in short supply. For instance, lithium is actually still in supply surplus. I'm cautious about lithium in the immediate term because the price has run up and it's not in short supply, but bullish longer term. On the other hand, cobalt has run up as well, but it is actually in supply deficit. And a lot of it comes from the Democratic Republic of the Congo, which is a scary place to source your minerals from.

In sum, this new energy minerals paradigm shift is a major market trend that will go on for decades. And it's still at the beginning. You have to be careful exactly how you play it, but there are opportunities here to make a lot of money on these minerals.

TGR: Do you have any recommendations on how to play it?

LJ: In our introductory letter, the Casey Resource Investor, we've just taken the plunge on Albemarle Corp. (ALB:NYSE), which is one of the world's bigger lithium producers. The biggest producer, SQM (SQM:NYSE) in Chile, actually gets most of its revenue from other commodities than lithium. So even though it's the world's biggest producer, it's not the best way to play lithium. We like Albemarle because lithium is its biggest revenue segment and it has a lot of growth on tap. It has a new deal with the Chilean government to double its production.

In the immediate term lithium may correct, and that could be very bad for the juniors in the space. But for a big, profitable producer like Albemarle, it's not really a problem. If anything, a fluctuation would be a fantastic buying opportunity for those late to that story.

I'll put in a plug for my main newsletter, the International Speculator. We have a cobalt pick in there. It's a development story with a lot of things going for it, including permits, grades and not being in the DRC.

The main takeaway message for anybody, though, is you can't just buy everything. You need to be selective and look for the right companies with the right management working on the right commodities. Over time, they will do well. But it'll be two steps forward, one step back, and you don't want to buy something right before one of the steps back. Buyer beware.

TGR: When we spoke last time, you talked about your research into the preproduction sweet spot. In the intervening months, have you had further thoughts on it?

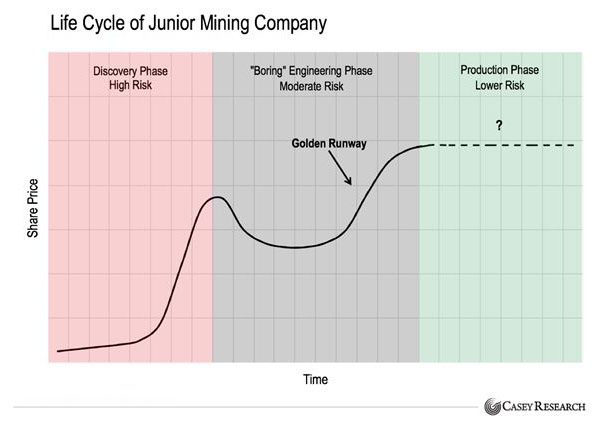

LJ: We call that the Golden Runway. Many investors have seen a cartoon of the life cycle of a junior mining stock. It starts at nothing and then spikes up when a company makes a discovery, slumps down to the boring engineering phase and then ramps up, with what happens next being a question mark. My research showed that the ramp-up from the "boring engineering phase" to production delivered much larger gains than anybody expected. They assumed that the added value when a company builds a mine was priced in. It's obvious when a company is building a mine. Everybody can see it. But it turns out that the added value is not priced in. We scoured online and offline records to find out what the average gain in this phase actually is. We gone through 30 years of records to back-test our findings.

The key finding is that the success rate—most companies that start to build a mine actually build it—is very high, and so are the average gains. About 95% of first-time mine builders succeed. The average gain from the decision to build the mine to pouring that first bar of gold or ingot of copper or whatever is about 100%. Those are tremendous odds on doubling your money.

Since we last spoke, we've had a couple more cases. One is Pretium Resources Inc. (PVG:TSX; PVG:NYSE), Bob Quartermain's super high-grade, monster-sized gold project in northern British Columbia. The stock has colorful history already, with plenty of ups and downs, but it rose about 85% from the price when the Construction Decision was announced to First Pour. In this case, that seems to be just the beginning, as the mine ramps up to expectations—and those expectations are phenomenal. It's still a great story.

"Pretium Resources Inc.'s stock rose about 85% from the price when the Construction Decision was announced to First Pour."

At any rate, Pretium's "official" Golden Runway gain was a little lower than average, but it still validated my model. Eighty-five percent isn't a bad gain at all.

Another recent case was Atlantic Gold Corp. (AGB:TSX.V). The company didn't actually issue a press release on its construction decision. It issued a press release when it got the money it needed, and then the next press release, it was already building. We used the "we got the money we needed" press release because it was clear at that point that it went ahead and greenlighted construction. The gain there was 192%, between that point and the official First Pour.

We found another one in Australia, a tiny little miner called Empire Resources Ltd. (ERL:ASX). With a one-year mine life, it was tempting not to count it, but it built its mine, so we are including it in our sample. The stock went nowhere from Construction Decision to First Pour.

Our expanded sample averages out to about the same result, and that's an important point. Our models still works after this year's new data. But remember that these numbers are averages. The Golden Runway doesn't guarantee that any one particular stock will double your money. But the right ones will—and can deliver much more.

We've refined our model. We're looking for the best of the best. Incidentally, Atlantic Gold was one of our picks in the International Speculator. We did very well on it.

An important thing is that this method gives us a very clear buy and sell signal. You buy at the Construction Decision and you sell at First Pour. Or, if you've got a double or higher, you can take profits and go risk free. Depending on the story, you may not want to hold the stock until you find out if the mine actually makes money. A lot of them don't, at first. Some never do. There are a number of spectacular disasters along these lines in recent history. Rubicon Minerals Corp. (RBY:NYSE.MKT; RMX:TSX), for example. The deposit just wasn't the way it was modeled. If you had owned that stock and followed our Golden Runway strategy, you would have gotten out before it crashed.

TGR: Do you like some companies even though they may not fit the model?

LJ: As much as I love this Golden Runway research and as much as the experiences from this year are validating our findings and giving us ideas for how to improve on our model, we still love exploration. That's still where the tenbaggers are. A little junior company that has nothing and then discovers something significant can give you a tenbagger or a hundredbagger. Look at Novo Resources Corp. (NVO:TSX.V; NSRPF:OTCQX)—its market cap is a billion dollars and it hasn't even started drilling yet.

For one that hasn’t done that yet, I like Balmoral Resources Ltd. (BAR:TSX; BALMF:OTCQX). It's got a serially successful team doing what it does best in the area it knows best with several significant discoveries already in hand. The company is well financed and working away on crossing that threshold of making a discovery big enough to get the market's attention. These are people who have done it before. That doesn't guarantee they'll do it again. But if there's a way to bet on exploration, it's to go with people who've done it before.

"Balmoral Resources Ltd. has a serially successful team doing what it does best in the area it knows best with several significant discoveries already in hand."

Balmoral isn't a prospect generator, however. It is the right guys doing the right thing in the right address. It's elephant country and these are elephant hunters, so I like it.

TGR: Last time you spoke about prospect generators. Do you still like them?

LJ: The best strategy for going after tenbaggers on discoveries is to mitigate your risk by putting other people's money to work on your behalf. That’s what prospect generators do. One of our favorites in this space is Renaissance Gold Inc. (REN:TSX). That's Ron Parratt's spinout from AuEx Ventures Inc. (XAU:TSX), which was a tenbagger for many people. This is the most rational way to go about betting on exploration.

TGR: Thanks for your insights, Louis.

Louis James is at Casey Research, where he's the senior editor of the International Speculator,Casey Investment Alert and Conversations with Casey. Fluent in English, Spanish and French, James regularly takes his skills on the road, evaluating highly prospective geological targets and visiting explorers and producers at the far corners of the globe and getting to know their management teams.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new interviews and articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this interview are billboard sponsors of Streetwise Reports: Pretium Resources and Balmoral Resources. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Louis James: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I, or members of my immediate household or family, are paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this interview: None. I determined which companies would be included in this article based on my research and understanding of the sector. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Pretium Resources, a company mentioned in this article.