One of the things I love about investing in microcaps is the information arbitrage (InfoArb) opportunities they present. InfoArb is a term Geo coined a few years ago to define instances when publicly available information is either undiscovered or underfollowed by the market at large.

Repro Med Systems Inc. (REPR:OTC.MKTS), which conducts business as RMS Medical Products, is a story full of doses of InfoArb. It finally looks like the company has addressed regulatory bottle necks that have been keeping investors away. Below, we summarize all the events that have shaped Repro since I bought my first shares in 2007.

Brief History

Repro was founded in 1980. The following products are driving the company's growth:

- FREEDOM60, a syringe infusion system that is designed for medication infusions primarily in the home care market and hospitals.

- FreedomEdge is a similar product to the Freedom60 and is used for smaller more frequent doses.

- Precision Flow Rate Tubing and High Flo needle sets, both of which were designed to work with the company's infusion pumps. The needle sets are disposable, which creates a recurring revenue stream from the company.

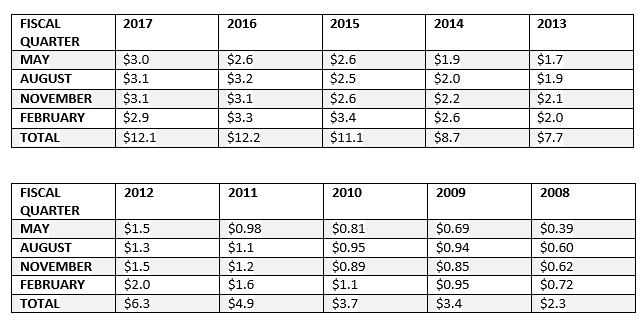

When I first stumbled upon Repro at ~$0.20 in 2007, the company was logging quarterly revenue of ~$500,000. After interviewing the CEO that same year, I was very impressed with his handle on the business, long-term focus and confidence in the road map for growth. Even though I did not think the stock was undervalued in 2007, the home healthcare angle really interested me, so I personally bought some shares to tuck away for a rainy day.

The company was making steady progress and in 2014, quarterly revenues comfortably reached $2.0 million.

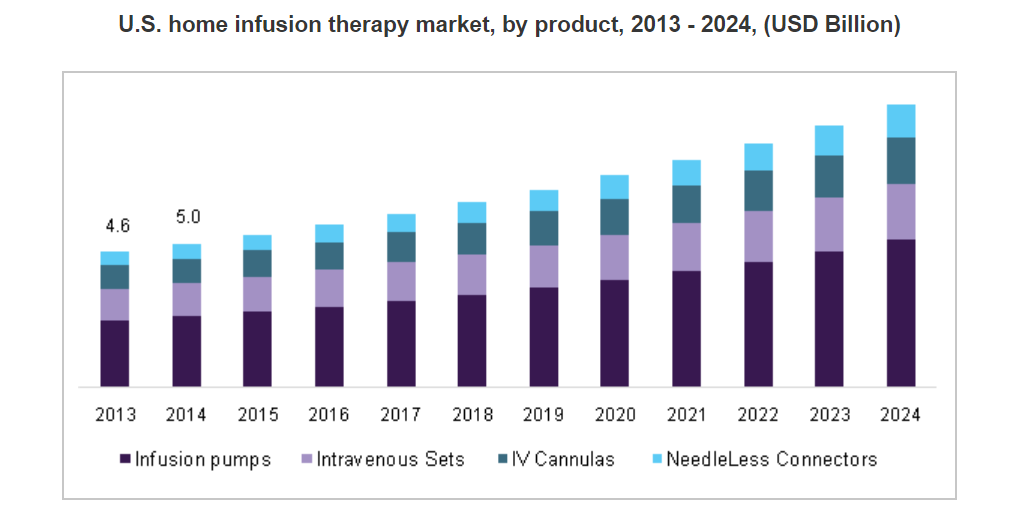

The global macro trends in the home health care market are in part fueling REPR growth, and in turn, my optimism.

The global home infusion therapy market size was valued at US$13 billion in 2015. Key drivers contributing to market expansion include the rising geriatric population, increase in disease burden, and presence of high unmet medical needs in the low-income regions.

The introduction of smart pumps has enabled access to homecare infusion therapies. Such devices are enhancing the overall ease of use for patients. Moreover, rising demand for reduction in inpatient stay due to the associated hospital expenses has led to the development of infusion therapy in alternative healthcare settings such as homecare, thus resulting in overall market growth.

In October of 2014 we coded Repro a GeoBargain and published a related article titled, "Repro-Med Systems' Focus On The Home-Care Market Could Lead To Substantial Payoff Or Buyout." Shares were trading at ~$0.35 at that time.

Aside from favorable macro trends, Repro's infusion pumps have two really neat features that give it a nice competitive advantage and make them perfectly suited to the home care market:

- The pumps deliver drugs or medications subcutaneously (under the skin), and this can be self-administered. In contrast, intravenous (into the vein) drugs generally are delivered by a professional.

- Repro pumps are mechanical, which means they are not dependent on electricity and are great at delivering consistent flow rates through the company's special tubing system.

These unique functions make it possible for users to self-administer infusions, saving the healthcare system money. Repro's competitive advantages have helped it grow, retain its customer base and should continue to help it benefit from positive home healthcare trends.

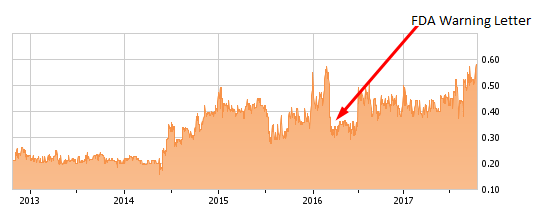

Shares of Repro slowly crept up as the company began to execute and drive top line growth at an accelerated pace.

Then, shares began to hit new highs as institutional investor Horton Capital Management (headed by Joseph Manko, Jr.) began to aggressively add to its already large stake of around ~10%. We still to this day cover the repeated Form 4 filings logged by Joseph Manko, who has since become a board member and currently owns a ~15.6% stake in the company.

At the end of 2015 shares closed at an all-time high of $0.55, poised for what I thought would be a breakout.

Unfortunately, instead of breaking out, shares broke down.

Warning Letter Setback (February 2016)

In March 2016 and out of the blue, Repro announced that it had received a warning letter from the FDA regarding the company's Freedom60 Syringe and FreedomEdge Infusion Pumps. Shares reacted by plunging 25% from around $0.60 to $0.375, eventually hitting a low of $0.28.

The company has been under a cloud of uncertainty since the FDA issued the warning letter and there is no question that this has been a temporary setback. This "scarlet letter" could, however, be a blessing in disguise. It seems that the FDA letter was addressing product labeling, documentation chain and overall quality control issues. There was also some concern that Repro would have to reclassify its devices, which would have resulted in significant capital expenditures to conduct clinical trials.

The silver lining here is that the letter has forced management to cure some of these problems early in its growth cycle such that they should greatly benefit the company going forward. It looks like Repro will not have to reclassify its products and should come out of this mess as a more focused and stronger company. In one of our updates to Premium Members, we mentioned:

- Appointment of a Chief Medical Officer. Repro did not have the internal resources to effectively deal with the issues raised in the FDA warning letter and brought in a highly qualified Chief Medical Officer, Dr. Fred Ma. Dr. Ma is not only experienced in his own right, but he also has relationships with external FDA consultants and investigators who are helping to remedy all issues raised in the FDA warning letter. If the FDA issues are resolved, we anticipate Dr. Ma being a vital resource for the company who will be able to drive new product development and bring products to market. Expanding the product portfolio will not only help grow the business but broaden Repro's appeal to customers, investors and possible suitors.

- Establishing pumps and related disposables as part of a delivery system, not individual products. Repro offers highly sophisticated mechanical pumps that require disposable needles and tubes, all part of a medication delivery system. Given the scope of the FDA warning letter, we believe the company is likely to update all of its filings with the FDA under one comprehensive 510(k) submission. While such an undertaking requires substantial effort and expense, it would bring all product filings current and clearly establish the pumps and related disposables as parts of a system, not individual products. If approved, all of the company's pumps and disposables will be under one FDA approved umbrella facilitating better understanding of pump systems for the FDA and of reporting and compliance requirements for the company.

- Solidifying relationships with customers. We understand that one of Repro's much smaller competitors has been having a field day trashing Repro by spreading rumors regarding the FDA warning letter and Repro's status. This has likely given at least some customers pause when considering Repro's products. The competitor's strategy, however, could backfire by stimulating a strong customer outreach program by Repro that could not only allay fears and uncertainty concerning the warning letter, but help cement relationships. The fact Repro generated $3.0 million revenue in fiscal Q1 2018 indicates customers are sticking with the company, maybe a reflection of the superiority of its product.

- If the FDA warning letter is lifted, the process will have solidified Repro's standing and market position. If the warning letter is resolved, the company will benefit in several ways. First, its products will have withstood the most severe scrutiny, lending credibility to both the company and its products. Its filings with the FDA will all be current and in good standing for years to come. Finally, management will have established lasting credibility and relationships with FDA staff. In the end, what doesn't kill you makes you stronger. Repro will come out the other side of this challenge stronger and its shareholders will benefit.

Continued support from Horton Capital Management:

In the months following the warning letter, I was anxious to see if Joseph Manko would continue to buy shares in the open market, despite the ongoing FDA concerns. I was pleased to see that he has indeed continued to buy shares and still continues to buy shares as of this writing. It's also encouraging that Fred Ma, the Chief Medical Officer brought in to deal with FDA, has bought shares in the open market, near the stock's recent highs.

InfoArb Opportunities:

SEC Filing Analysis: FDA Warning Letter, Part I

On several occasions, we highlighted slight changes in verbiage in the company's 10-Q and 10-K filings that were not in press releases. The wording indicated that the company is moving closer to a resolution with the FDA warning letter.

In our May 5, 2017, research note we stated that the company's 10-K (for its year ended 2017 March) was more specific in its growth outlook and more importantly, was clearer on its progress with its biggest thorn:

"We continue to have correspondence and dialog with the agency in order to address all of FDA's concerns cited in the Warning Letter and the FDA FORM 483s and to close the Warning Letter in the near future."

Podcast Interview

On July 18, 2017, we stated we came across an interesting Information arbitrage opportunity (InfoArb) in a recent Princeton Research Inc. podcast featuring the COO of REPR, Eric Bauer. Our three major takeaways from the video that we do not think have been widely recognized by the market include:

- The company announced that it inked an agreement with Shire Plc (SHPG:NASDAQ) and it can now start delivering some of Shire's approved drugs. Shire is one of the largest biotechnology companies ($47 billion market cap) focused on serving people with rare diseases.

- The COO stated that the company was having a great quarter.

- Eric discussed that it was actively looking for a new facility to facilitate growth.

On July 28, 2017, we highlighted some verbiage from the company's 10-Q (first quarter):

"On April 25, 2017, RMS met with the FDA Center for Devices and Radiological Health ("CDRH") Compliance team and the New York District Office to discuss the final resolution of Warning Letter closure. On May 23, 2017, the Compliance Office of CDRH issued a letter to RMS to acknowledge that RMS had successfully addressed all quality and regulatory issues cited in the Warning Letter. Prior to closing the Warning Letter, the FDA also needs to complete its review of our premarket submission (a pending 510(k)), which was accepted for review on May 17, 2017. On June 30, 2017, RMS received a written response regarding our pending 510(k) submission, and RMS is working with the Office for Device Evaluation of CDRH to address those questions in order receive the 510(k) clearance as expeditiously as possible."

This was the first instance we've seen Repro acknowledge that it has successfully met substantially all the quality and regulatory issues in the warning letter. It seems they are now one or two steps away from officially putting the FDA warning letter behind it.

SEC Filing Analysis: FDA Warning Letter, Part II

In its 10Q filed November 3, 2017, (no press release issued as of this date), we found progressively stronger language that the lifting of the FDA warning letter could be imminent:

RMS had an inspection by the FDA in June 2015, which included, among other items, a review of customer complaints, quality controls, quality assurance and documentation. The FDA inspection was then expanded as a consequence of an extensive "trade complaint" filed on behalf of a competitor which resulted in the issuance of an FDA FORM 483. Eight months later, on February 29, 2016, we received a Warning Letter. Since that time the Company has successfully addressed all quality and regulatory issues cited in the Warning Letter and the FDA FORM 483. On October 2, 2017, the FDA conducted another inspection as a last step in closing the Warning Letter. We anticipate the Warning Letter to be closed in the near future.

Repro Receives FDA Clearance for 510(K)

On September 5, 2017, Repro announced the FDA issued a new 510(K) clearance for the RMS "Integrated Catch-Up Freedom Syringe Driver Infusion System" effective August 31, 2017. The Freedom System is the first and only fully integrated mechanical system cleared by the FDA for a wide range of medications and flow rates.

Comments from management:

"RMS continues to provide the highest quality devices intended to improve patient quality of life. Our System delivers an accurate flow rate, and considers everything in the fluid path as an entire infusion system, making the patient the only variable. In doing so, it leads to increased compliance, healthier patients and therefore, lower overall costs. RMS will continue to develop new devices and technologies upon this platform and will be filing additional FDA 510(k) submissions for new applications in a continuing effort to help patients throughout the world."

It seems the company is nearing the final resolution of the warning letter saga and will finally be able to purely focus on growing the business.

Caveats:

- FDA warning letter has to be officially lifted

- Customer concentration

- Product recalls

- Dependency on limited product lines

- Involvement in an ongoing patent litigation suit with a competitor (inferior, in my opinion).

Valuation:

Given the recurring revenue nature of its model, we think that REPR will command premium valuation measures.

Over the years, REPR has grown revenue at a nice clip, but profitability has not yet been consistently attained. However, REPR just reported quarterly results ended September 30, 2107, highlighting EPS of $0.01 on ~18% sales growth, maybe indicating revenue may be reaching a point to consistently take net income over the breakeven level. In fact, this is the second quarter in a row where REPR reported EPS of $0.01. Until the company begins reporting consistent profitability (we think they eventually will), we will value REPR on an EV/S ratio of 2 to 4. This would yield a price target range of $0.78 to $1.48. If the Q2 EPS run-rate is maintained (or an annual run-rat of $0.04), we think REPR could trade at a P/E of 20+, or in excess of 0.80.

If you want to keep following our research coverage on Repro and the other stocks we perform deep dive due diligence on, please visit this secure link.

Maj Soueidan is the cofounder of GeoInvesting, a premium newsletter for microcap investors that is now in its tenth year. The focus is on providing high quality bullish insights on microcap equities as well as portfolio protection research that highlights management misconduct. (You can go here for a free trial). GeoInvesting has been featured in Barron's, The Wall Street Journal and The Financial Times. Mark Cuban bought the rights to a documentary that chronicles some of its work in uncovering fraud; this is highlighted in a movie called "The China Hustle." See GeoInvesting “Terms & Conditions” here.

Want to read more Life Sciences Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Maj Soueidan: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Repro Med Systems. I personally am or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article or interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Repro Med Systems Inc., a company mentioned in this article.

Charts and graphics provided by the author.