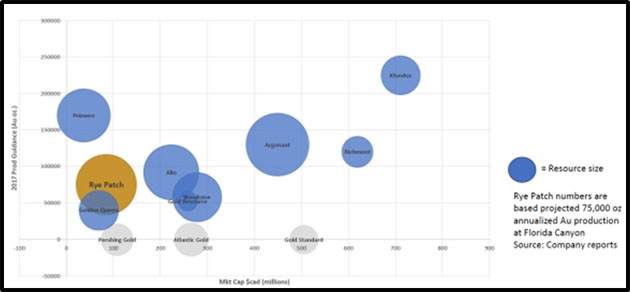

Many exploration companies announce an intention to be a "mid-tier gold producer."

Rye Patch Gold Corp. (RPM:TSX.V; RPMGF:OTCQX) has a clearly articulated plan to reach 200,000 ounces gold production.

In 2016, the company built a new leech-pad for the spluttering Florida Canyon Gold Mine in Nevada—and quickly changed the production profile.

Production highlights for Q3/17 (compared to the previous quarter):

- Gold production increased 13% to 7,982 ounces

- 45% increase of gold sent to pad (7,125 ozs per month)

- 57% increase in ore tons mined (810,000 tons per month)

- Strip ratio decreased 56% to 0.54

- 29% increase in ore tons crushed (660,000 tons per month)

- 10% gold grade increased to 0.011 ozs per ton

The company stated that "the gold recovery is behaving as modelled."

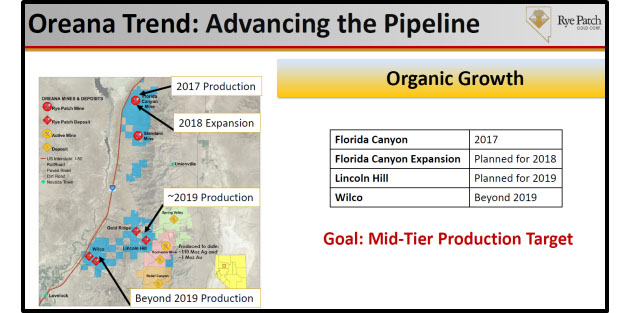

Rye Patch is focused on the development of gold and silver mines and projects along the Oreana trend in west central Nevada.

Rye Patch's portfolio has four geographically constrained components, which offer financial and logistical synergy. The company now controls a "trend-scale platform with operations, replacement assets and exploration upside."

On October 16, 2017, Rye Patch announced its intention to expand the oxide resource and delineate sulfide potential along the Oreana trend in west-central Nevada.

"The initial drill program will consist of 1,200 metres of core and 8,800 metres of reverse circulation drilling. Drill-hole depths will range between 150 to 300 metres for the sulfide program and 60 to 180 metres for the oxide program."

The $1 million drill program began in early October. "The Company is currently mining a 1.12-million ounce measured and indicated (M&I) oxide gold resource," stated Rye Patch President and CEO William Howald. "Management believes the sulfide resource beneath Florida Canyon has a similar number of ounces of gold but at a much higher grade."

A 1996 "Sulfide Project Pre-feasibility Study" revealed that 262 drill-holes had reached the sulfide body, yielding an average grade of 2.36 grams per ton of gold.

The metallurgical test work showed an overall recovery of 90% with flotation with 94% of the gold reporting to a sulfide concentrate.

On Oct. 11, 2017, Macquarie Research published a report on Rye Patch entitled, "Promising Leading Indicators for 1Q18 Florida Canyon Commercial Production." Macquarie put a 12-month price target of C$0.50—more than double the current share price.

Macquarie analyst Michael Gray noted that gold production is "likely turning the corner in 4Q17 via increased pad surface area and fast kinetic/'near plastic' pad space. . .with ~500kt overliner placed in 3Q, we estimate the pad surface area has increased by ~75% vs the winter contingency pad or ~60% of the ultimate pad surface area. RPM plans to complete the remainder of the pad overliner by mid-Dec/17. With stacking and irrigating of new pad surface area with fast leach kinetics/'near plastic' underway, we expect an improvement in gold production in 4Q17 and estimate 15 koz Au recovered."

"Rye Patch trades at a significant NAVPS discount at 0.3x NAV vs our global junior producer peers at ~0.7x NAV," stated Gray, "and we see considerable re-rating potential, particularly once commercial production is achieved (targeting 1Q18)."

The company believes there may be a significant sulfide resource beneath the Florida Canyon oxide deposit.

That theory will be tested with a 10,000-meter expansion drilling campaign designed to confirm the grade, character and extent of sulfide mineralization beneath the oxide ore body.

Read what other experts are saying about:

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Lukas Kane compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Rye Patch Gold. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Additional disclosures about the sources cited in this article