Generally the oil charts look very positive with a giant base pattern approaching completion. Near term we may see a minor dip on the expected dollar rally.

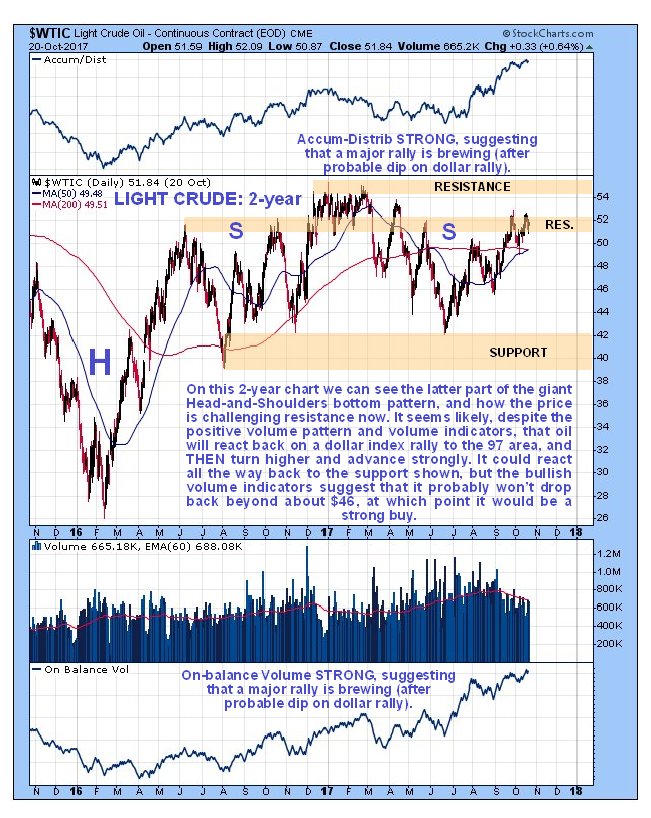

On the 5-year chart for Light Crude we can see that a giant complex Head-and-Shoulders bottom pattern has formed which looks very close to being completed. It is labeled complex because the right part of it is drawn out with multiple "Shoulders." An important bullish factor that strongly suggests that the base pattern is genuine and will resolve into a major bull market is the big buildup in volume over the past two years, in particular this year, especially because most of this is upside volume which has driven both volume indicators shown much higher, with the Accum-Distrib line close to new highs, and On-balance Volume at new highs. Breakout from the entire base pattern will be signaled by the price breaking above the resistance level related to the tight congestion zone that formed early in the year, i.e., by the price breaking above $55. It is close to achieving this, and while we can't rule out that it will happen very soon, it is thought more likely that we will see a mild reaction as the dollar advances towards its target in the 97 area, and THEN oil turns up and breaks out of the base pattern.

The 2-year chart for Light Crude shows the latter part of the giant

Head-and-Shoulders bottom pattern. On this chart we can see how the

price has been challenging the resistance up towards the top of the

pattern in recent weeks. Before breaking out above the key $55 level, it

is considered likely that it will first react back over the short to

medium term on the expected dollar rally. However, because of the strong

volume pattern and volume indicators it is considered unlikely that it

will back all the way to the support level shown in the $39-$42.

Instead it is thought likely that it turn up again at a higher level,

say from the $46 area where there is some support. Once evidence is seen

of it stabilizing in this area and turning higher, oil and oil related

investments will quickly become strong buys.

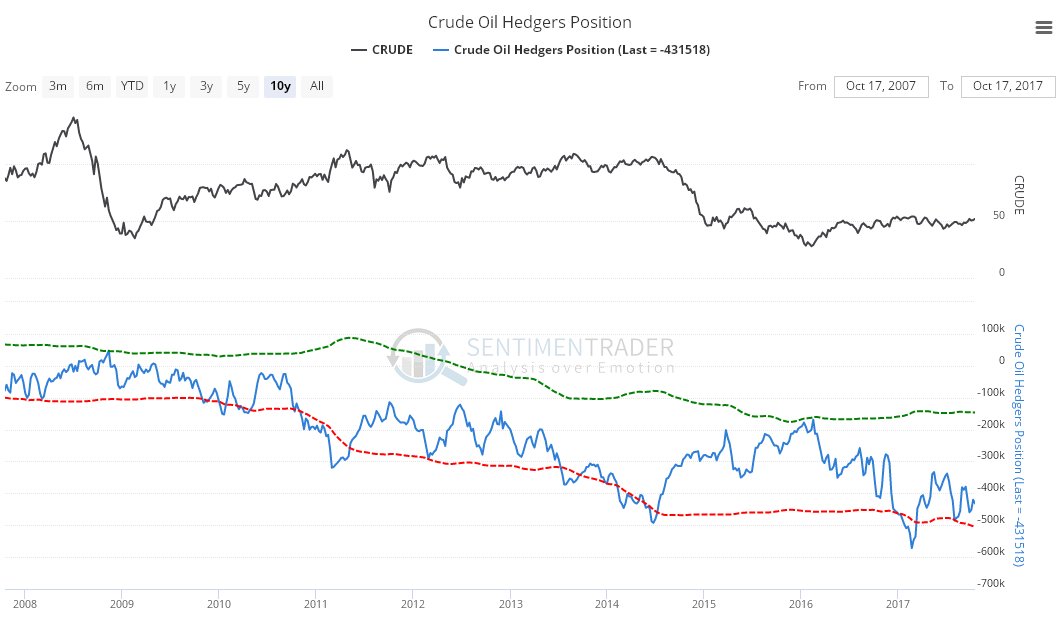

The Crude Oil Hedgers chart shown below is quite bearish, although not at wild extremes.

Click on chart to popup a larger, clearer version.

Chart courtesy of www.sentimentrader.com

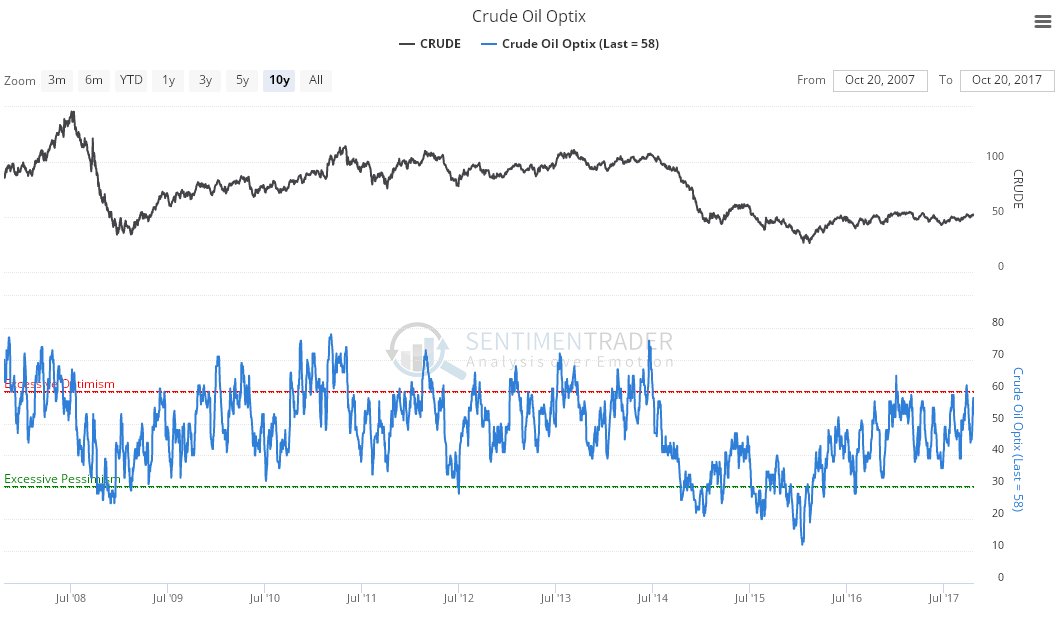

The Crude Oil optix or optimism index is likewise quite bearish, although it too is not at wild extremes, but both this and the Hedgers chart suggest that oil is more likely to drop over the short to medium term than rally, which fits with what the other technical factors observed above are pointing to.

Click on chart to popup a larger clearer version.

Chart courtesy of www.sentimentrader.com

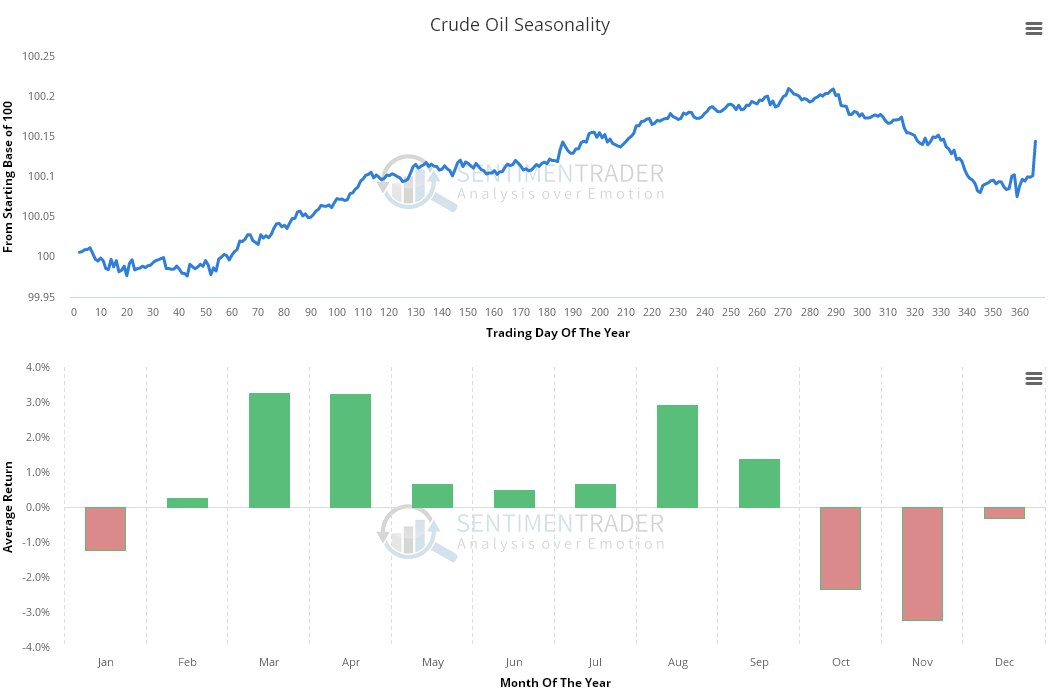

It is thus interesting to observe, in addition, that we are now entering the most bearish time of year seasonally for oil, although this of course is a background influence that can be overridden by other factors.

Click on chart to popup a larger, clearer version.

Chart courtesy of www.sentimentrader.com

Turning now to oil stocks, we see on the 5-year chart for the XOI oil index how it turned higher as predicted in the July update and has staged a significant rally. We thought that it might get as high as the resistance in the 1300 area on this run, but now it looks like it will first react back before continuing on to the 1300 area, due to a minor reaction back by oil over the short to medium-term as the dollar advances to its target. Once Light Crude itself breaks out of its Head-and-Shoulders bottom by breaking above the key $55 level, then of course the XOI oil index should vault above the resistance in the 1300 area, which would break it out of the large trading range it has been stuck in for about 18 months, bounded by approximately 1070 on the downside and 1300 on the upside.

On the latest 6-month chart for the XOI oil index we can see how the July breakout out of the downtrend in force from the start of the year was followed by a deceptive drop to new lows, before a steep orderly uptrend followed that ran out of steam at the end of last month, with the price then rounding over into what is suspected to be a "Dumpling Top." This suspected intermediate top pattern will be confirmed by a gap down move on the right of it to complete it, which should occur as a result of oil dropping back some in response to the dollar rallying.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by the author.