I have followed Columbus Gold Corp. (CGT:TSX; CBGDF:OTCQX) since I first wrote about them in 2014. Their main gold project is in French Guiana and is part of a JV with a Russian company. It's a great project with 2.75 million ounces of proven and probable reserves of gold. Columbus Gold owns 45% and Nordgold owns 55%. At $1200 gold the project has an after tax IRR of 23% and an NPV of $324 million US. Owning 45% should make CGT's interest worth $145 million US or about $185 million CAD. Instead Columbus has a market cap of right at $100 million CAD.

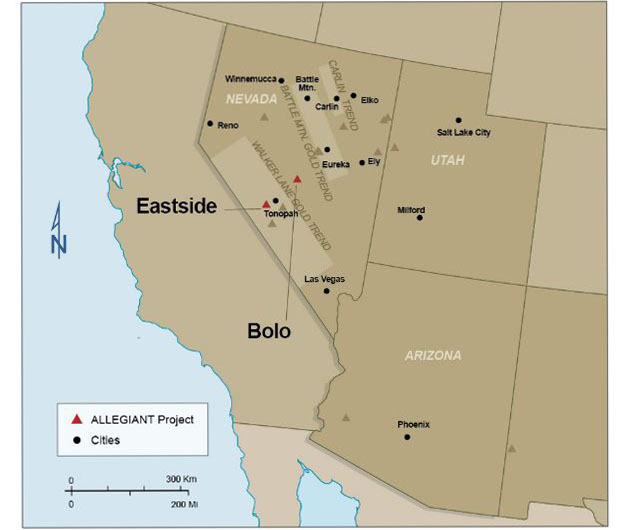

And they own 14 projects in Nevada including one with a 721,000 gold equivalent ounce resource. Management realized they are not getting any value out of the Nevada projects so they are spinning them off into a new company named Allegiant. That's where the free shares come into the deal.

Columbus is holding a special meeting the 20th of November for shareholders to vote on the spinout. Shareholders as of the Share Distribution Record Date will receive 1/5th of a share of Allegiant for every Columbus share held. The company anticipates the record date to be four business days after the meeting or the 24th of November. So if you own 10,000 shares of Columbus on the Record Date, you will be handed 2,000 shares of Allegiant.

That's a hell of a deal for a couple of reasons. Andy Wallace is going to be the CEO of Allegiant. As a manager and now owner of Cordex, he helped the company find an incredible eight gold mine discoveries in Nevada including the five million ounce Marigold Mine, the twelve million ounce Lone Tree Mine and the Daisy Mine.

Allegiant plans on drilling ten projects of the fourteen in the first twelve months. Their two most important projects are Eastside with an existing 721,000 gold equivalent ounce resource and a historic gold resource of 270,000 ounces and the Bolo project northeast of Tonopah. Columbus recently drilled 14 RC holes at Bolo about 500 meters south of a historic hole returning 30.5 meters of 3.24 g/t gold, 12.2 meters of 3.05 g/t gold and 19.8 meters of 1.1 g/t gold. The company is not going to release the results of the drilling until after the spinout is complete. They anticipate assays being back about mid-December.

Columbus is in the process of setting up a non-brokered private placement with terms not yet disclosed. The shares will be free trading right out of the chute.

The spinout is brilliant for creating more value to both Columbus and existing shareholders. Columbus will get 13% of the new shares, existing shareholders will get 52% and new investors will receive about 35% of Allegiant. Allegiant will be well funded for a major 2017-2018 exploration program.

Columbus Gold is not an advertiser. I bought shares in the open market that I intend to hold through the record date and I am participating in the private placement. Do your own due diligence.

Columbus Gold

CGT-T $0.65 (Oct 20, 2017)

CBGDF-OTCBB 153 million shares

Columbus Gold website

Read what other experts are saying about:

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Columbus Gold. Columbus Gold is not an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: Columbus Gold. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.