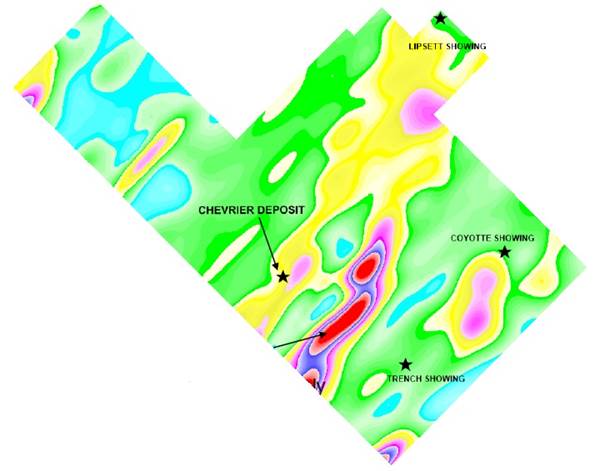

Chevrier Gold project; IP anomaly

In between exploration success stories (for example GT Gold) or possible myths in the making (Novo Resources) taking center stage, Genesis Metals quietly completed the Phase 1 drill program, consisting of 4,900m of diamond drilling. Results were announced on October 3rd of nine drill holes, and channel sampling. Management received two separate batches of results of the Phase 1 drill program, reporting eight out of nine holes testing greenfield IP anomalies in two target areas in (see image above in red) now in the first batch, and the remaining 13 drill holes focused on the Main Zone will come out in the second batch in about three weeks.

The balance of the first batch was just one verification hole of the historic Main Zone deposit. If the anomalies wouldn't return meaningful assays, the only thing left to report would be just this one verification hole and sampling results from trenching, which usually isn't very exciting news unless assays are spectacular and much better than expected.

Although the verification hole returned better results than the twinned historic drill hole from 2002, the drilling of the anomalies didn't return any gold mineralization, obviously disappointing some investors with short term high hopes, as can be seen in this chart (the news release came out on October 3):

Share price; 10 day time frame

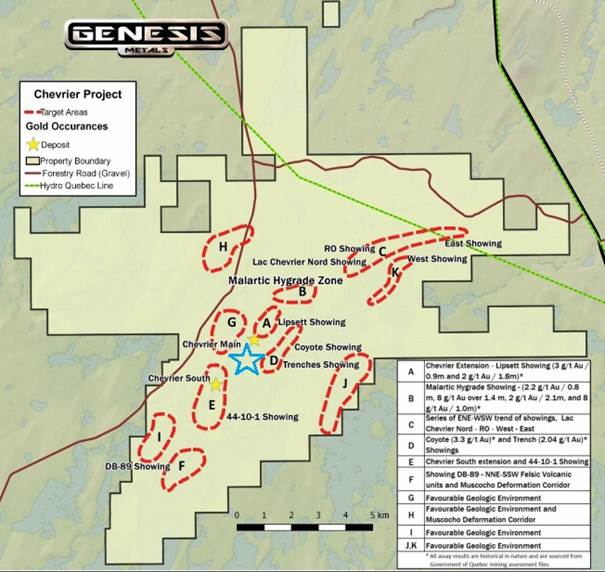

Management also indicated that a financing round had come free trading recently, which might have had some impact as well. The big question of course is, if this sell-off is justified. In my view it clearly is not warranted. Recovery of the share price has already set in at the time of writing, so other investors seem to share that view with me. The company has at least 8 prospective target areas to explore, as the mentioned anomaly targets (in blue) were just the first:

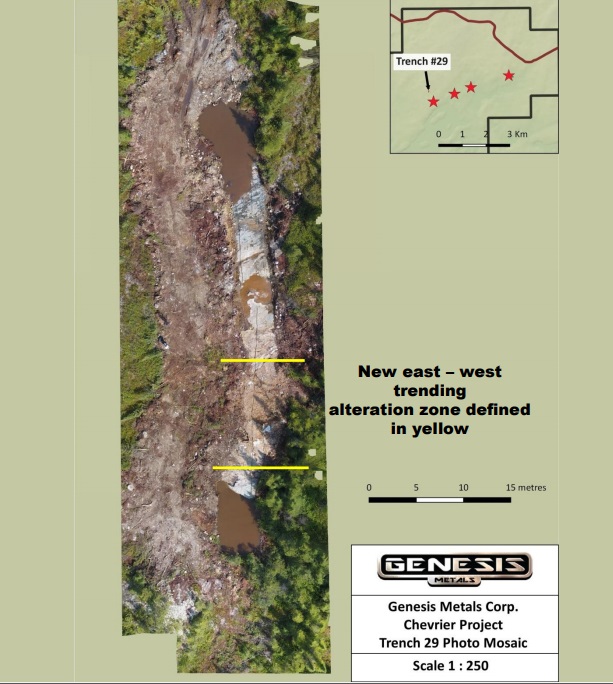

For example, as mentioned in my first article on Genesis, the East Zone is also an important target, as core shacks with core were found on the property when doing due diligence, eventually recovering 53 drill collar locations with often significant, corresponding assay results. Besides this, there are many more showings, and positive trenching and sampling results to explore, to generate even more drill targets. The company also reported good results at Trench 29 in the news release of October 3, encountering 2.55 g/t gold over 2.3m.

Notwithstanding all this, I strongly believe, as I also indicated in my first article, that the main value driver is the proving up and hopefully increasing of the historic deposits of the Main Zone and the South Zone. Genesis Metals has a few aces up its sleeve in this regard: it has modeled the mineralization according to a different and more realistic concept generating more ounces, it will use a lower cut-off to define more economic ounces, and sees a lot of possibilities to expand mineralization. One of these last possibilities is step out drilling, but also further infill drilling could return better drill results than the historic results, as was the case at the first verification hole GM17-09. This hole returned 2.94 g/t gold ("Au") over a true width of 37.40 m (starting at 74.60 m down hole) including 14.01 g/t Au over a true width of 4.07 m. The hole that was verified was hole GFA-201, done by Geonova in 2002, returning 2.62 g/t gold over 33.4 m including 6.67 g/t gold over 5.00 m. Calculating gram times meter, the difference is 56 gm versus 33.35gm for the high grade part, which is an increase of 68%.

I am definitely looking forward to the release of the mentioned remaining 13 assays of the Phase 1 program for the Main Zone. Of these holes, 10 were designed to test extensions of mineralized areas while 3 were holes twinned or drilled in close proximity to and paralleling historic holes. In the mean time, the company already announced on October 5 the commencing of the Phase 2 drill program of 5,000m, which is expected to be completed in early November. About 2,000m will be dedicated to more twin, infill and step out holes at the Main Zone, confirming historic results and looking for extension of mineralized zones. The remaining 3,000m will focus on targets identified by previous trenching, and the evaluation of the East Zone. The results of this Phase 2 program can be expected in 2 batches, one at the beginning, and one at the end of December.

As is hopefully clear by now, an exploration junior can experience misses, but it doesn't have to implicate the end of upside at all. Especially with Genesis Metals and its Chevrier project, they have a lot of historic data and resource estimates to prove up, which might very well pan out to be much more than a solid back stop for their greenfield exploration wildcard.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, and follow me on Seekingalpha.com, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Genesis Metals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.genesismetalscorp.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Chevrier Gold project; trenching

Chevrier Gold project; trenching

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long term commodity pricing/market sentiments, and often looking for long term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles with industry analysts and commentators, visit our Streetwise Interviews page.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Images and charts provided by The Critical Investor