The price of zinc has been on a tear over the last year with its price rising from around $1.00/lb to as high as $1.45, before falling back slightly to $1.39. A decrease in supply is widely credited as being a major factor in the price rise; in 2015 Australia's massive Century zinc mine closed, followed by Ireland's Lisheen zinc mine in 2016.

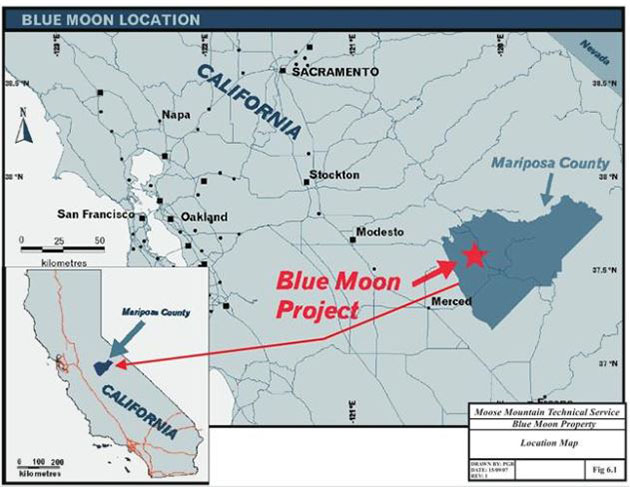

Blue Moon Zinc Corp. (MOON:TSX.V) is one of the companies focusing on filling the supply gap. The company's advanced-stage Blue Moon project in California, which produced zinc during World War II, saw exploration during the 1980s and into the early 2000s.

CEO Patrick McGrath started as a shareholder in Blue Moon and originally intended for it to be just an investment. But as the company's share price went south even as the price of zinc increased, McGrath led a management and board shake-up that saw him installed as CEO in May.

Under new management, Blue Moon has not been sitting still; the company just released an operational update. CEO Patrick McGrath stated, "The culmination of our historical data review continues to reinforce our opinion that the Blue Moon zinc project is a premium zinc asset. We've set out several short-term objectives to highlight the project's robustness."

Blue Moon reported that since May, "management and technical advisors have assembled and reviewed the extensive database prepared by past operators, including Imperial Metals and Boliden (formerly Westmin). The historical database includes extensive plans to put the Blue Moon project into production, including several scoping and optimization studies."

The NI-43-101-compliant resource assessment from 2008 estimated "2.62 million tons with a grade of 6.01% zinc for approximately 315 million pounds of zinc in the Indicated category and 2.68 million tons with a grade of 5.98% zinc for approximately 320 million pounds of zinc in the Inferred category plus significant values of copper, silver and gold," according to the company. "The resource is open at depth and along strike and historical metallurgical testing indicates favourable recoveries."

The pricing used in 2008 for the resource was $0.75/lb zinc, $2/lb copper, $600/oz gold and $8.50/oz silver. The company is updating the resource to use more current pricing and expects to release it in Q4/17.

Blue Moon is also working on a maiden preliminary economic assessment for the Blue Moon project and expects to release it in Q1/18.

The company is also focusing on permitting. The project is located in Mariposa County, an area that was part of the California Gold Rush and one that still has active mines and exploration projects. Blue Moon recently announced that it has engaged Sespe Consulting, "an environmental engineering firm with a successful record of permitting mining projects in California, including a key role in the permitting of the Golden Queen Soledad Mountain mine in 2015." Lutz Klingmann, former CEO of Golden Queen Mining who led that company's Southern California Soledad Mountain project through permitting, financing and construction, is an advisor to Blue Moon.

And to solidify its new persona, in July, the company changed its name to Blue Moon Zinc Corp. from Savant Explorations Ltd. and began trading on the TSX Venture Exchange under the ticker MOON.

The company's share price recently increased 75% from $0.04 to $0.07, before falling back slightly to $0.066.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, securities of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Blue Moon Zinc Corp., a company mentioned in this article.