Each year since 1987, I have always used the final two weeks of the month of August as a shopping period in a manner not unlike the “Back-to-School” kind only the wares I seek are junior precious metals stocks as opposed to school uniforms, pens, and books. It began after I had been speaking with one of the finest brokers I had ever had the opportunity to know, Edmonton’s late George Milton, whose claim to fame was being the early financier for Bre-X (Not to worry, he and the bulk of his clients were long gone by the time the fraud was revealed). George would tell clients around mid-May to raise cash because after June 1, he would be AWOL. Because there were no cell phones, internet, text messaging or Twitter, that meant that George would be out-of-contact until mid-August and, true to form, on August 15th, he would arrive at the office, open his Rolodex, and begin to call clients. By the time mid-August arrived, the first shares he would buy were the ones he sold in mid-May and amazingly, 90% of those names had fallen 50% (or more) due to the illiquidity and disinterest so typical of the June-July period in the Canadian junior mining markets. He would spend the next two weeks accumulating his list and then watch as the mid-September reversal of fortune arrived with heightened liquidity and interest and prices paid for his late summer shopping spree would advance.

Alas, here in 2017, some forty years after that fateful conversation and initiation of the “Midsummer Night’s Dream” buying opportunity, gone are the days of “going AWOL” for an uninterrupted eight weeks of golf and cottaging free from the irritations of client phones calls. In this new era of instant contact and immediate accessibility, you are always available lest you become either unemployed, redundant, or both. Furthermore, the “edge” of being the only buyer in the last two weeks of August has disappeared with the arrival of buyers all day and night operating from the realm of a data byte or virtual reality network. In other words, machines don’t take holidays so the advantage that once prevailed due to the absence of traders has been eliminated.

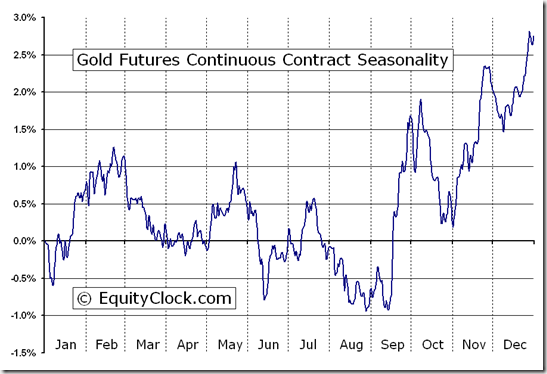

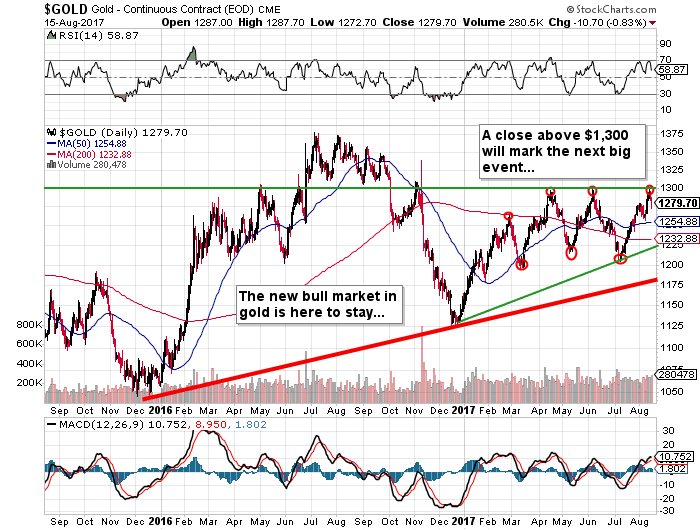

Nevertheless, I have found over the years that the late August period remains an excellent seasonal entry point for gold and silver investments and as the chart above shows, the September-January period yields the best historical returns for gold and therefore it stands to reason that a basket of gold and silver miners, split judiciously between seniors and juniors makes a great deal of sense as well as a dollop of your favourite “explorco” just to add a little excitement to the mix. In fact, in big bull market periods such as 2002-2007 and 2009-2011, being overweight the “little guys” was a preferable strategy because of the leverage contained in buying 1,000,000 shares of a $.01 stock for ten grand. This year, I am particularly bemused by the total insanity that is prevailing in the gold and silver markets as it pertains to the correlation with other markets such as copper, zinc, stocks, Bitcoin, and the U.S. dollar.

A few weeks back I wrote about the brilliance of the geek squad in creating a non-fiat replacement for currencies that would be off the radar of the banks (both bullion and central) and they did just that with the arrival of Bitcoin. Now trading north of U.S.$4,000, Bitcoin has actually done precisely what gold should have done had it not been for the invisible hand of the bullion banks acting under instructions from the central banks and treasury departments of the G7 nations. And led, I should add, by the U.S. Fed. The genius of creating a surrogate for gold and silver as a means of avoiding the criminal interventions of the elite class falls into a category not to far removed from the invention of the internet or the building of the Great Wall; it remains one of the great frustrations of this era for historians like me that the “inflation hedges of choice” in this period of unprecedented monetary inflation did not include gold and silver. The reasons for that are well-documented by many analysts but it all boils down to one very simple fact: there is nothing out there in the financial universe that can replace PHYSICAL OWNERSHIP of gold and silver. Since possession is nine-tenths of the law, having ownership of real money (gold and silver) is far safer and infinitely preferable to seeing a bitcoin credit on a website or a stock and bond portfolio all held by a bank with no certificates where the only proof of ownership is a computer entry.

There is a logical underpinning to my current bullish stance for gold and silver and it lies in the thesis that this ocean of liquidity created around the world was not created from increased productivity or invention; it was created from DEBT. This debt has lifted the all-important stock markets to record highs everywhere and it has also saved the collateral behind the mortgage books of the global banking cartel but in the end, this is an ocean of debt that is going to undergo a day of reckoning. That day occurs when all central banks have to “square up” their books through normalizing balance sheets by selling the assets they acquired with printed currency units, whether euros or dollars or yen. It is at this point that the system seizes up for good sending the digital disaster hedges into a “no-bid” Armageddon where physical ownership is the base requirement for commercial transactions to be completed. Your Bitcoin credit will not buy food or water and you won’t be very happy when the shopkeeper tells you that all credit and debit machines are “down”.

Accordingly, and without trying to go to irrational extremes, I am a buyer of gold and silver at today’s prices because of the very existence of Bitcoin; people preferred to jettison digital cash in favor of Bitcoin ownership (not “possession”). That means that the next major secular target for the Interventionalists is going to be cryptocurrencies because they are rapidly becoming a major threat to “fiat” and as we have all grown to appreciate, the central banks and sovereign treasury departments detest anyone and anything that threatens “fiat” due primarily to the symbiosis fiat provides as the link between sovereign state and banker agendas.

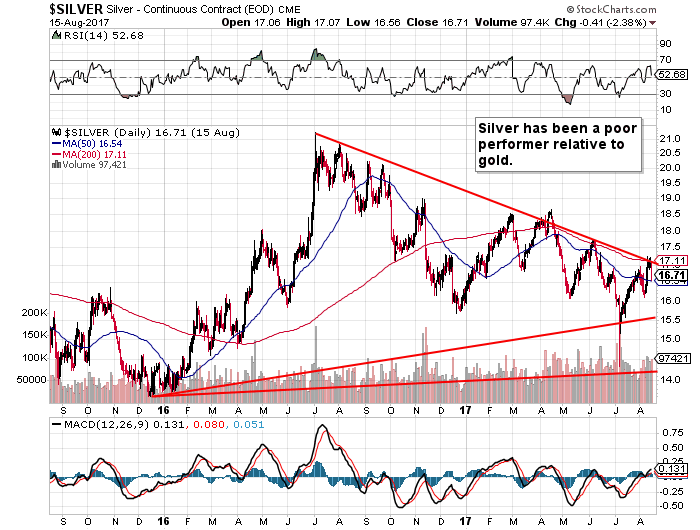

Silver has been a relatively lousy performer relative to nearly every other metal residing a mere $3.20 above the 2015 low of $13.62. In that same time period, zinc has advanced from under $0.65/lb to over $1.40/lb, while copper is up from under $2.00/lb to almost $3.00/lb. Year to date, the only commodity I follow which is actually DOWN is silver with the Silver Miner ETF (SIL) up a meagre 1.26%. If you concur with the thesis that physical ownership (“possession”) is the optimal investment alignment, then the inverse correlation between silver and virtually everything else is to be deemed an aberration and the likelihood of a regression to the mean (upward) in the silver price is highly likely.

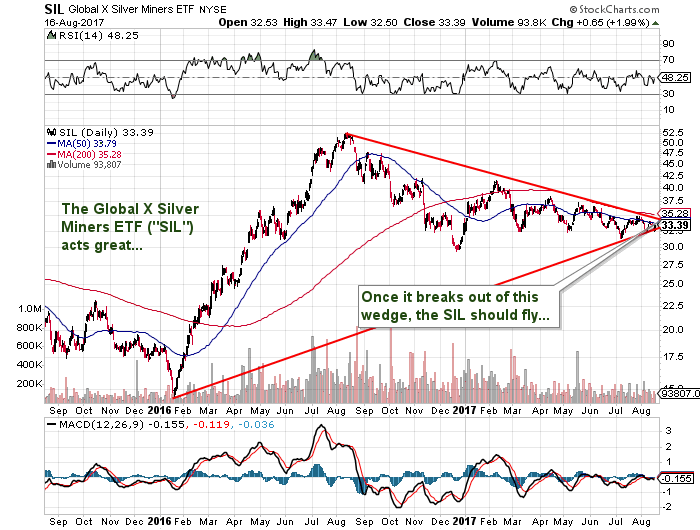

If I like the idea of silver outperforming gold and gold and silver outperforming everything else for the latter part of this calendar year, it follows that the Silver Miners stand a decent chance at breaking out of wedge that goes back to 2015 and being the superstar performer to close out the year. The SIL (Global X Silver Miners ETF) has been trading back and forth from beneath $15 in late 2015 to $52.50 in July 2016 with subsequent zigzag action creating a longstanding wedge formation which has now narrowed to a tight band around current levels. If we can get a close around $35 for a couple of sessions, the upside breakout could be breathtaking so I have decided to grab 50% position in the Oct. $35 calls for $1.00. The breakout from the wedge could easily take this ETF back to $52.50 and the calls to $20 – perhaps not by the third Friday in October but still the optimal “shot”.

Notwithstanding the fact that I have seasonality, valuation, and sentiment all working in my favour, Fido was threatening to take a chunk of flesh out of the postman today and despite the fact that he used to be a South Afrikaan police dog, he is usually quite benign when it comes to folks in uniform. This chap that ventured on to our homestead this morning was emanating some very off vibes because all it took was the van door opening and the sound of Eminem rapping some unintelligible song to evoke a Johannesburgian reaction from the beast. That he had the poor git up a tree jumping at his Michael Jordan Nikes was more a function of my early-morning rants at the gold price under $1,275 rather than it was anything the letter carrier had done. After all, these ARE trying times…

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts courtesy of Michael Ballanger.