NexGen Energy Ltd. (NXE:TSX; NXE:NYSE.MKT) announced its maiden preliminary economic assessment (PEA) of the "basement-hosted" Arrow Deposit on July 31. In its press release, the company outlined the following highlights:

· After-Tax Net Present Value (NPV8%) = CAD $3.49 Billion

· After-Tax Internal Rate of Return (IRR) = 56.7%

· Average Annual Production (Years 1-5) = 27.6 M lbs U3O8

· Average Annual Production (Life of Mine) = 18.5 M lbs U3O8

Based on a uranium price of $50/lb, the company anticipates Saskatchewan royalties over the life of the mine of CA$2.98 billion.

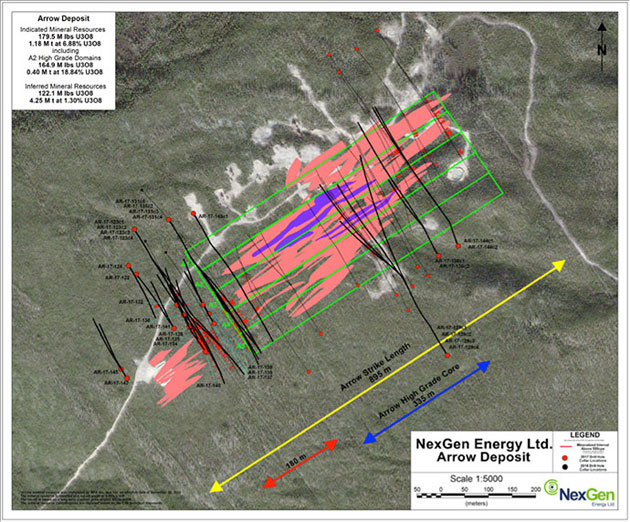

The PEA "is based on the mineral resource estimate announced by the Company in March 2017. . .that comprised an Indicated Mineral Resource of 179.5 M lb of U3O8 contained in 1.18 M tonnes grading 6.88% U3O8, and an Inferred Mineral Resource of 122.1 M lb of U3O8 contained in 4.25 M tonnes grading 1.30% U3O8," the company stated. "The PEA does not include the results of the Company's winter or summer 2017 drill programs, which will total over 66,000 m of additional drilling."

Reacting to NexGen's announcement in an Aug. 1 research report, Cantor Fitzgerald analyst Rob Chang declared, "This is the best uranium PEA we have ever seen. Moreover, the forecast annual production rate of 27.6M lbs U3O8 over the first five years would place Arrow as the largest uranium mine by production in the world and make NexGen the second largest producer behind only Kazatomprom. We are reiterating our Buy recommendation and increasing our target price to $5.65/share, or by 9%."

NexGen stock currently trades at ~CA$3.06 per share.

Chang also commented on the fact that the 2017 drill results have not been included in the PEA. "Note that thus far in 2017, approximately 66,000m of drilling (producing numerous high grade assay results) has been conducted at Arrow and a new discovery (South Arrow) has been recently detected. None of this data has been included in the PEA," he wrote.

"Over the first five years would place Arrow as the largest uranium mine by production in the world and make NexGen the second largest producer behind only Kazatomprom."

"Despite the high per tonne cost of Arrow, the deposit characteristics (high grade, vertical orientation, and competent bedrock) have led to industry-leading costs. . .for the first five years of production, only ISR production from Kazakhstan is expected to have a lower cost profile than that of Arrow," Chang continued. "The per pound cost is seen as the lowest of any conventional mine globally."

Looking to the future, Chang wrote, "By 2018, NexGen expects to update the resource model and continue with the engineering and environmental baseline studies. A maiden pre-feasibility study is expected to be completed, followed by a project proposal submitted to the EIA Board. Following the recent financing with CEF Holdings, the company has nearly $200M in cash on the Balance Sheet."

In conclusion, Chang stated, "The maiden PEA confirms our view that Arrow is a once-in-a-generation type of deposit."

Eight Capital analyst David Talbot views the NexGen PEA as "a major de-risking event. While looking past obviously impressive economics backed by a deposit that is likely unlike any other, completion of the PEA might just kick-start the M&A process. We speculate that Arrow could end up in the hands of a uranium producer or company looking to enter the sector."

Furthermore, because "start-up is likely to correspond with a dramatic uranium supply vacuum mid-next decade, timing is good," Talbot stated. While acquisition may be in the wings, "meanwhile management will be moving forward as if it plans to do it alone. And why not? Each successive milestone such as PEA, PFS, FS and permitting helps de-risk Arrow while potentially providing all that much more value."

"The maiden PEA confirms our view that Arrow is a once-in-a-generation type of deposit."

Going forward, Talbot anticipates that the company's focus will "continue on Arrow with mid-2018 PFS planned. Another $35 MM of its $200 MM may be spent to upgrade resources by then. Developing a potential exploration shaft may run in parallel to permitting. It may help confirm resources and feed into final permits. Management suggests permits will be influenced by Arrow's strong technical characteristics and sound environmental planning including clean metallurgy, 100% land-based, basement host rocks, and plans to return all tailings underground in a paste backfill." If NexGen continues on its present course, Eight Capital predicts "start up in 2025."

All this confirms Talbot's belief that NexGen's Arrow represents the "world's largest uranium mine potential," as he stated in a July 31 research report.

"Shares of NexGen were glowing on Monday after the company reported positive results of its independent Preliminary Economic Assessment (PEA) of the basement-hosted Arrow Deposit, located on the company's 100%-owned Rook I project in Saskatchewan's Athabasca Basin," Canaccord Genuity stated in its Aug. 1 Morning Coffee update.

The PEA announcement was the latest in a string of reports updating NexGen's progress. On July 25 the company announced that assays on step-out drilling during the winter drilling program at Arrow had confirmed "high grade uranium mineralization" in a new area on the property.

"Step-out hole AR-17-136c2 which intersected a new area of semi-massive to massive pitchblende mineralization in the A3 shear has returned high grade assays," the company reported. “This high grade uranium mineralization was intersected 40 m outside the current resource, and 70 m outside the current A3 High Grade Domain."

In addition, "first pass drill testing of the Southwest Gap intersected numerous lenses of high grade uranium mineralization that has connected the 180 m Southwest area with the Arrow Deposit. The Southwest Gap represents a material resource expansion opportunity as it was not included in the March 2017 updated mineral resource estimate," the company stated.

In a July 27 research report, Haywood analyst Colin Healey commented on results the company had announced that same day with regard to its Rook 1 project.

"NexGen has announced that the first two exploration holes of the summer drill campaign at its 100%- owned Rook 1 project have resulted in a new discovery zone, which includes narrow high-grade intercepts of uranium mineralization 400 metres south of the Arrow Deposit on a parallel structure that was previously almost entirely untested," Healey wrote. "The rocks reportedly exhibit many of the same characteristics of the main Arrow deposit including 'dense massive pitchblende veins', occurring 'within at least three stacked high strain or sheared intervals, which is a common characteristic of the Arrow Deposit.'" Healey noted.

In its release, the company reported, "The first two exploration holes of the summer drill program have resulted in the discovery of a new zone of off-scale radioactivity approximately 400 m south of the Arrow Deposit. This new area of mineralization has been named the South Arrow Discovery and is located on an Arrow-parallel structure that remains almost completely undrilled."

"This new discovery further highlights the potential for additional discovery at Rook 1," Healey wrote. "We expect NexGen will continue to deliver positive news flow as its seven-rig, 25,000 m summer drill program progresses in preparation for the PFS due in early 2018 . . . We continue to believe NexGen is significantly undervalued given its comparative deposit scale (global resource >300 Mlb U3O8), grade (165 Mlb U3O8 grading 18.8%), and quality (entirely hosted within competent basement rock)."

Haywood also believes that "NexGen is peerless in the Athabasca Basin and globally as an exploration/developer play, as it controls a large, world-class, high-grade uranium deposit in a proven operating district, with the scale (301.6 Mlb U3O8) to be standalone economic right from the maiden resource."

Read what other experts are saying about:

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles with industry analysts and commentators, visit our Streetwise Articles page.

Disclosure:

1) Tracy Salcedo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She owns, or members of her immediate household or family own, securities of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) NexGen Energy Ltd. is a billboard sponsor of Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Additional disclosures about the sources cited in this article