The research for this moment started well before last week.

It goes back to May 3, when I obtained the estimated number of shares to be liquidated by the GDXJ ETF (VanEck Vectors Junior Gold Miners ETF) on a per-company basis by June 16.

What this scramble for junior mining shares really did was allow for a "takeover window" of 18–24 months going forward.

The ETF has basically liquidated out of juniors and bought mid-tier and large-cap miners instead. In essence, it breathed life and liquidity into the major producers at the expense of small-cap companies, and I absolutely love it, for this sector always comes alive and attracts funds with merger activity at higher levels, and that's what is about to be unleashed.

Yesterday, it dawned on me that my calculations have been too conservative regarding one company in particular, and I want to show how this mining legend opened my eyes to the intrinsic value of my top suggestion for this merger mania: First Mining Finance Corp. (TSX:FF & US:FFMGF).

For one of the most serially successful mining businessman of our era—Keith Neumeyer, the founder of the company—resource investing is about generating revenues. Don't get it mistaken: Keith is all about big, fat, and consistent cash flows and thick, monstrous margins.

First Mining Finance was Keith's brainchild, and when we spoke last night, he summarized it this way: "Lior, just think of scooping up 25 brand new Boeing 747s in a country where there are currently no airports, so you're getting them really cheap, knowing full well that they're about to build 25 new runways and will need your planes. We bought proven properties for distressed prices during the bear years, and we now hold all the cards and have all the options because our properties are becoming more valuable as the gold price rises."

The reason why I'm quickly accumulating shares right now is because the last financing, in which all the members of the management team participated, was done at CA$0.80. I want to lock in my position for less.

This is what will happen to unlock the intrinsic value and potential of their assets and generate revenues for the company:

- Joint ventures with cashed-up majors.

- Royalty deals.

- Streaming structures (the best business model ever).

- Spin-outs of properties for a premium and earn-in contracts.

When the company signs these value-creating set-ups, shares will explode fast and hard, and you know it.

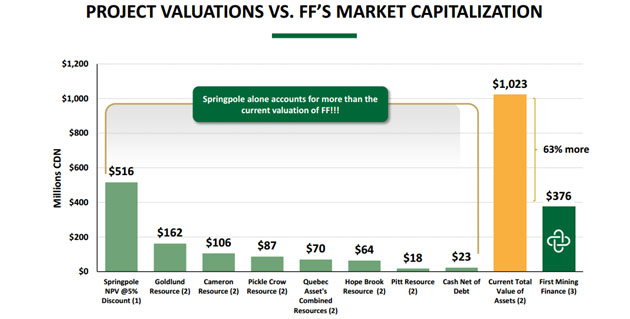

The baffling anomaly Wealth Research Group found in the form of a pocket of "free money" is the fact that Springpole, the company's premier Ontario, Canada, project containing millions of gold and silver inferred and indicated ounces in the ground, is worth more by itself than the total price you pay for the full package—the company's 20+ projects and their $20M+ cash position.

This is an extreme value moment created by a one-time event that will never repeat: the GDXJ rebalance.

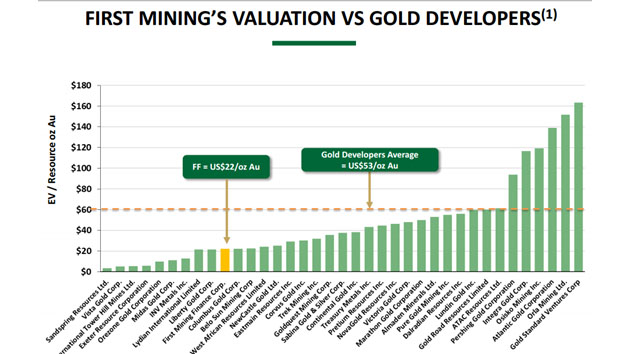

Even when you compare it to a slew of its peer companies, you can't shake the fact that all of their properties were acquired in the safest and most mining-friendly jurisdictions in North and Central America, with infrastructures in place, at incredibly attractive prices during the bear market years, and you've got Keith Neumeyer making the calls—an added value that puts the company on a much higher platform.

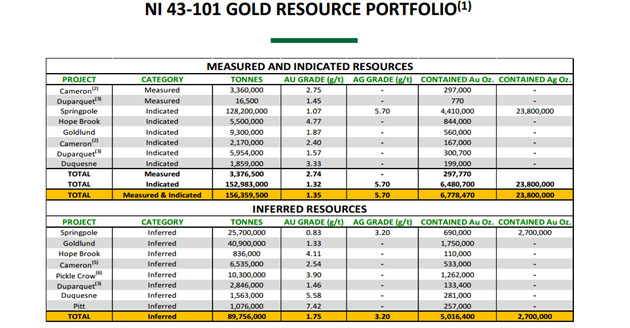

You want to own gold in the ground, but not only that.

What you really want is to own it now, without depleting the resource base until gold prices are much higher, at which point this NI 43-101 gold portfolio will be the envy of thousands of other gold juniors.

Right now, you can buy First Mining Finance, pay only for Springpole and get 24 additional high-quality assets for free, along with a treasury of CA$23M and Keith Neumeyer at the helm.

This is served to you on a gold platter.

The company has just recently graduated to the TSX, making it much more liquid, stable and available for institutional buyers and released new assay results from one of its tier-1 projects.

Lior Gantz, an editor of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Lior Gantz: I, or members of my immediate household or family, own shares of the following companies referred to in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies referred to in this article: First Mining Finance has a marketing agreement with Wealth Research Group.. My company has a financial relationship with the following companies referred to in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and images courtesy of the author