In order to become a successful mining investor, you must understand the playbook.

Today will boil down the various stages in the lifecycle of a typical mining company.

There's no logic in doing something that isn't battle-tested—there's only sense in sticking with what brings repeated and predictable results.

Portfolio Wealth Global always looks at the preliminary vision of the dealmakers to see the vision and plan of execution.

Be very cautious of under-deliverers and those who over-promise.

When we speak with management teams, the first question we ask is, "What's your plan, and who are the executors of it?"

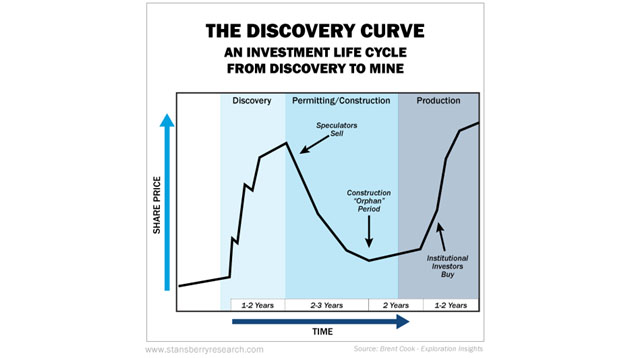

Here are the various typical stages all conventional companies go through:

1. Generative exploration is a desktop study with minimal field work.

Field mapping, prospecting, and sampling programs are conducted on promising targets.

What to watch for at this point:

Most important are the caliber and quality of the geologists involved—you want professionals, who are committed to a conservative point of view and the facts, as opposed to dreamers.

Government connections are important to verify if the data available is trustworthy as well.

2. Primary exploration involves drilling out the target location to delineate likely zones of mineralization. Drill cuttings will be sent to the laboratory to assay for geochemical analysis. The main aim is to broadly define the limits of the mineral deposit.

Portfolio Wealth Global will be releasing our No. 1 exploration play this summer.

3. Once a mineral deposit is identified, evaluation begins with a scoping study and ends with a feasibility study, on which a final investment decision is usually made.

The evaluation stage is lengthy.

Prefeasibility and feasibility studies are comprehensive studies that consider the technical and economic viability of a mining project, including the mine design, production schedule, operating costs and expenses.

What to watch for at this point:

This stage tires and bores most investors.

Sell your position on high volume days during this part of the cycle.

4. Development of the project begins after the regulatory permits have been obtained. This involves the construction of the infrastructure required for a fully operational mine. Important components include site access and services, mining production, and crushing facilities and ore handling facilities.

What to watch for at this point:

Similar to the evaluation phase. Be a buyer on dips here, when everyone else throws in the towel. I've done that numerous times (even on the same stock) and doubled my money in months during the 2009-2011 market roars.

Make sure the project manager is an expert. So many things can make this project go over the budget—have you ever seen a builder on a residential property finish the work on time and within the budget? Rarely!

5. Production processes are different from case to case, but they typically involve controlled blasting, hauling, crushing, and processing of the mineral ore. The final product is then transported.

What to watch for at this point:

Here, what matters are the bottom line margins, and I also want to make sure my profits are used to either pay out a dividend or acquire more "juicy" projects, because current ones are depleting.

I also want the mine manager to be the absolute best.

Next week, I will show you the three unconventional mining business models.

Tom Beck is founder of Portfolio Wealth Global. Known as one of the first millennial millionaires in the United States, Beck is a relentless idea machine. After retiring two years ago at age 33, he's officially come out of retirement to head up Portfolio Wealth Global. He brings a vision of setting a new record for millionaires with his seven-year plan to accelerate any subscribers' net worth who will commit to the income lifestyle. Beck delivers new ideas on the marketplace that were once only available to the rich. Traveling the world, he's invested in over a dozen countries, including real estate.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Tom Beck and not of Streetwise Reports or its officers. Tom Beck is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Tom Beck was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by Portfolio Wealth Global