In my recent article on the Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE) acquisition of various royalties and streams, we discussed the immediately accretive increase in cash flow, and we discussed the great pipeline of exploration and developmental assets. Between the immediate and the longer-term optionality, however, is a well-defined increase in cash flow from planned production increases.

Strong growth baked in the cake

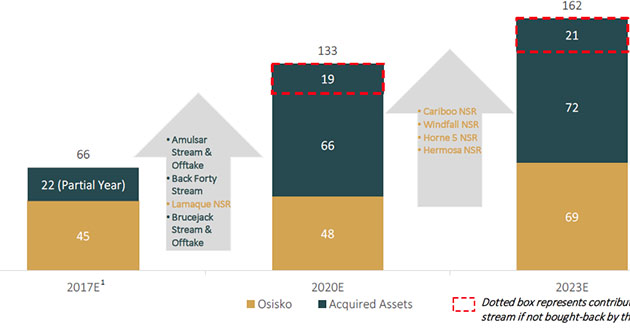

The graph shows the growth from both Osisko's existing assets and the new assets acquired from Orion, from 66 million gold equivalent ounces (GEOs) this year to 162 million by 2023. The contribution from the Pretium Resources Inc. (PVG:TSX; PVG:NYSE) stream is in dotted red lines; this stream can be bought back by Pretium by the end of next year. In all likelihood, the stream will be repurchased, adding another $119 million to Osisko's cash balance.

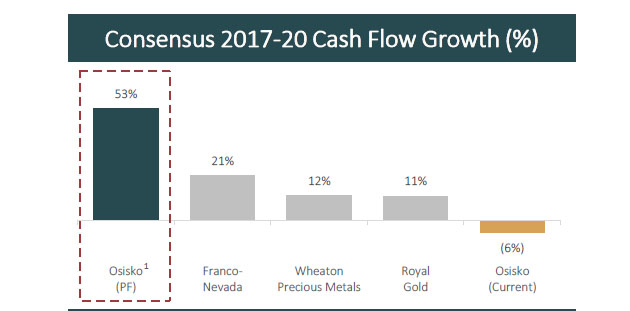

Even without the contribution from the Pretium stream, however, Osisko's cash flow is forecast to grow by over 50% by 2020, far higher than the growth of other major royalty companies. (Of course, these companies may make acquisitions, which would also increase their cash flow growth.) The acquisition also increases Osisko's taxable cost basis on its assets, meaning it is unlikely to be in a taxable position until 2020. These graphs are from Osisko's presentation.

Again, in sum, Osisko has experienced management, a strong balance sheet, solid near-term and medium-term growth, and a deep pipeline of projects at various stages, and yet is trading at a discount to its peer group. We suspect we will be holding Osisko (which we first received from our Virginia shares) for a very long time.

Adrian Day, London-born and a graduate of the London School of Economics, heads the money management firm Adrian Day Asset Management, where he manages discretionary accounts in both global and resource areas. Day is also sub-adviser to the EuroPacific Gold Fund (EPGFX). His latest book is "Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks."

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Adrian Day: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Osisko Gold Royalties. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management hold shares of the following companies mentioned in this article: Osisko Gold Royalties. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.