To the extent that the market represents the sum of all of the collective opinions of every investor everywhere, I must declare myself to be a card-carrying misanthrope, carrying with me a complete revulsion of the current state of the financial markets into battle each and every day and night that markets are open for "trading" (if that what you must call it). I further wonder whether or not my current approach to stock investing is much different from the way my father used to view a Jimi Hendrix guitar solo or my mother contemplating the meaning of the rips in my perfectly torn blue jeans.

As I age, I am slowly coming to the realization that markets are now the eminent domain of a demographic far younger than I, a group far less concerned with the traditional means of securities analysis and more inclined to trust algorithms, pattern-recognition technology and "word clouds." As a group, these young centurions place their speculative dollars in new high-tech, social media endeavours rather than resource exploration. They feel more comfortable investing in a brand new legalized investment called marijuana just as our forefathers went after Seagram's or Anheuser-Busch after Prohibition ended in 1933.

The new wave of entrepreneurs that dominate the financial services landscape care not about "GAAP" or "sound money" or "deficits" or "inflation" because they have never had to worry about accounting "principles" because when the banks are in trouble, they just CHANGE them. To them, all money is "sound" because central bankers have no problem printing it to avoid "bad times." "Deficits" mean nothing because we have a military that protects everyone so the money represented by the American Military Machine can only be "sound." "Inflation" has been non-existent for years because the government has told us that it is running at 0.3% and that is the only proof we need.

So, with our superb banking systems, with the U.S. military as our Divine Protector, our rock solid "fiat" currencies, and our no-need-to-be-balanced-budgets, we can buy U.S. or French or Japanese or British stocks at nosebleed levels because all of the problems that caused stocks to fall in the past were "baby boomer" problems and don't apply to today's markets.

A brand new and supremely-qualified U.S. president has vowed to "Make America Great Again" and this youthful group of stock market newbies has taken his clarion call to arms and are striving to own every share of every stock ever created with all of the inherited, printed money that their grandfathers could ever bestow. The "cash is trash" mantra is being eaten, lived, and breathed every moment of every day as the word "savings" is stricken from Webster's and Funk and Wagnall's at an alarming rate.

If you look at a chart of the TSX Venture Exchange held up beside a chart of the Canadian Marijuana Index, you can see how "pot" has outperformed the resource sector, driving home my admonition that the new drivers of the speculative market for junior stocks are not the same demographic that drove Diamondfields from pennies to hundreds of dollars per share in the 1990s. One of my friends that loves the mining and exploration sector told me recently that he has never made more money in penny stocks than in the last two years—all in marijuana deals! "The younger generation understand the future of marijuana legalization just as they did the importance of Facebook and Google and now Amazon." he explained. "They have a hard time understanding gold or silver but they sure do 'get it' when it comes to how their peer group favors pot over Jack Daniels."

Accordingly, the charts tell me that the mining industry would be well advised to begin marketing to the Millennials with diagrams of the metals required to build a harvester or a Zippo lighter or an iPhone you will use to pay for that $300 ounce of weed that we used to get in the school parking lot for $25 in the 1970s. Perhaps of benefit would be illustrating how the purchasing power of currencies has been eroding by using an ounce of weed as the measuring stick rather than a loaf of bread or a gallon of milk.

Whatever the case, this Millennial Money Machine is completely ignoring the resource sector by and large and it is being felt and seen everywhere I turn. Will I join the CRUSH of investors charging into "Aurora Cannabis" at $2.58 sporting a market cap of $824 million any time soon? Not likely, but then again, teaching this "old dog" new investing tricks is going to be a tough task for the best of them.

I read tonight that a company called Canopy Growth decided to change its stock symbol to "WEED" in early February, resulting in an immediate pop in the stock from $10 to over $13 in seven trading days. This gave me a brilliant idea. I intend to change the name of "Stakeholder Gold" to "Big Bud Resource Corp." and change the symbol to "BONG" followed by Gem International changing its name to "Jamaican Red Diamonds" and change its symbol to "GNJA." Once accomplished, I will advertise on Facebook, Twitter, Snapchat, Instagram and on the roof of UBER vehicles and on TV during shows that have lots of vampires and zombies. I will hire Cheech Marin and Snoop Dogg to become spokesmen for the Canadian exploration industry based upon metal content used in pipes, bongs and lighters.

In gravitating back to my beloved precious metals, I have been made to look like an idiot once again by failing to pay attention to the vice-grip that the bullion banks have in place on paper silver, with the recent "breakout" above $18.50 being soundly rejected with July Silver now down 10 out of 11 sessions to $17.28.

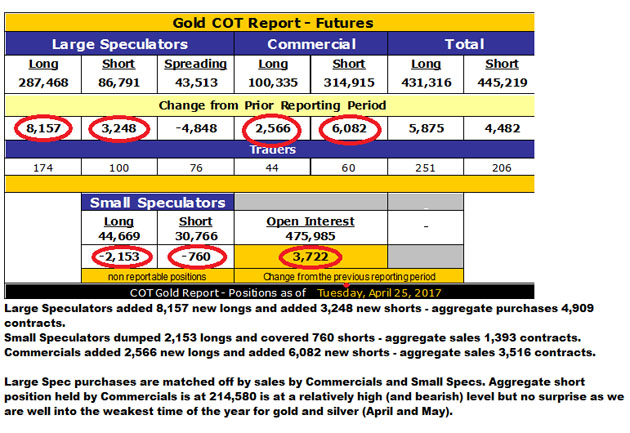

My only bragging rights are in the June Gold pit, where the recent $1,250-1,260 breakout has held soundly and is this evening is sitting at $1,272.20 back within striking distance of the April 17 high at $1.297.40. I really can't explain what is happening with this divergence between gold and silver other than the seasonal weakness inherent in the months of April and May, but what is astounding is the sheer volume of Commercial shorts in silver and the unfathomable blind eyes of regulators as to position limits and spec/hedge classifications when it comes to determining exactly who holds those silver shorts. The word "shenanigans" now a popular one in the blogosphere has long been my term for collusion, manipulation and fraud; no word better serves the current state of the paper markets in "good ol' Chicago."

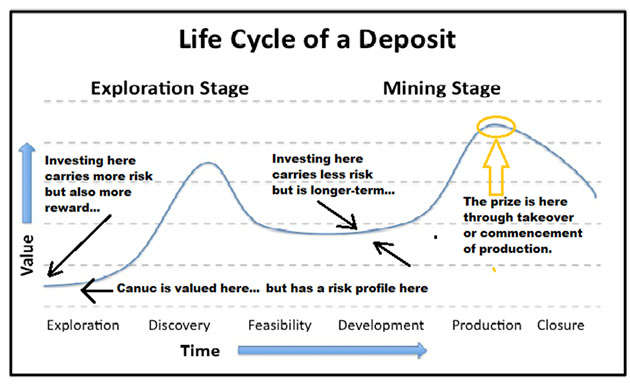

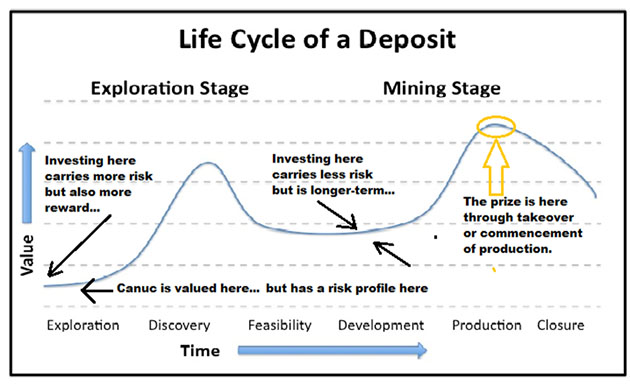

At the end of the day, the companies I own are the ones that I show in the list at the bottom and while the ones I TRADE are the ETFs GDXJ (VanEck Vectors Junior Gold Miners) and JNUG (Direxion Daily Junior Gold Miners Bull 3X), the ones I OWN as long-term investments are the penny stocks contained in the list below. The reasons I invest in these companies is that while they may have more risk than buying a Fortuna Silver or a B2Gold, the ascension from "explorco" to "developer" carries the biggest "lift" when investing in them. The chart included below shows the "Life Cycle of a Deposit" and relative to the four companies in the list, Stakeholder Gold Corp. (SRC:TSX.V) and Gem International Resources Inc. (GI:TSX.V) would fall into the "exploration" or "pre-discovery" stage while Western Uranium Corp. (WUC:CNQ) falls into the "feasibility-development" stage.

However, Canuc Resources Corp. (CDA:TSX.V) falls into the unique position of being valued at a "pre-discovery" market cap ($20 million) but because of the underground workings present at San Javier, is actually well beyond the discovery stage by way of the 43-101 report confirming the presence of extremely high-grade silver-gold mineralization in the breccia zone identified through underground sampling. Accordingly, the "lift" that accompanies a discovery has not yet been assigned to CDA but once the delineation program begins later this month, an initial resource calculation will be established that will bypass the time and work required to take it through the discovery stage and well through feasibility (due to the underground adits already in place) in advance of actual mining. (Mind you, it will take a lot of drilling and money to get there but nowhere near as much as if you were a grassroots explorer.) That is why I have CDA ranked #1 on my list and it is why I believe that the drill program will result in an immediate lift in valuation to "advanced exploration" levels north of US.$75 million in market cap later in 2017 (from the current U.S.$15 million today).

Finally, there is yet another YouTube John Titus production out there that is worthy of listening to IF you are prepared for outrage and disgust. The link can be accessed by clicking here and to summarize, it deals with all of the covert activities of the U.S. Justice Department as it essentially "pardoned" the big U.K. multinational bank HSBC despite having mountains of evidence on it for its role in aiding and abetting money-laundering, drug-smuggling and terrorist activities in the world of international finance. If you need an impetus for launching household items such as pencil sharpeners and beer steins through windows or screaming maniacally at one's pet and/or spouse with intermittent but equal consistency, take the 45 minutes and walk with Mr. Titus through the presentation as he CLEARLY paints a landscape that depicts the global banking cartel for exactly what it is—a SYNDICATE—a criminal organization that transcends national boundaries and Rule of Law. Make sure you give yourself an hour or so to cool off because I did NOT and now my beloved Fido is shaking like a leaf out in the woods somewhere while the other inhabitants of this residence are in hiding underneath the tool shed.

Gold: $1267.85 up $1.95 2017-04-28 10:57:20 AM

Silver: $17.23 down $.10

GTSR: 73.58 (↑)

Copper: $2.5857 up $.0180

Zinc: $1.1849 up $.0139 (down 12% from Feb top)

GDXJ: $32.33 up $.64

JNUG: $4.57 up $.20

SRC.V: $.49 up $.005

CDA.V: $.44 down $.01

GI.V: $.05 unch'd

WUC: $1.70 up $.09

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Michael Ballanger: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Stakeholder Gold Corp., Gem International Resources Inc., Western Uranium Corp., Canuc Resources Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Stakeholder Gold Corp., Western Uranium Corp., Canuc Resources Corp., Gem International Resources Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Stakeholder Gold, Gem International and Western Uranium, companies mentioned in this article.

All charts courtesy of Michael Ballanger.