It looks like we got back into Torchlight at an opportune moment some days back, because yesterday it spiked quite dramatically above resistance on good volume as shorts panicked, and now looks good.

The shorts miscalculated—they thought that because Torchlight had broken down from a head-and-shoulders top, which we incidentally spotted in time and sidestepped, it was done for, and an automatic short on a rally to resistance at the underside of the pattern.

The problem was they didn't spot that the pattern in recent days was morphing into a cup-and-handle base, which we did—a subtle difference, but subtle differences in this business can mean the difference between a whacking great profit and a terrible loss. Furthermore, they were playing with fire shorting a company with such excellent fundamentals.

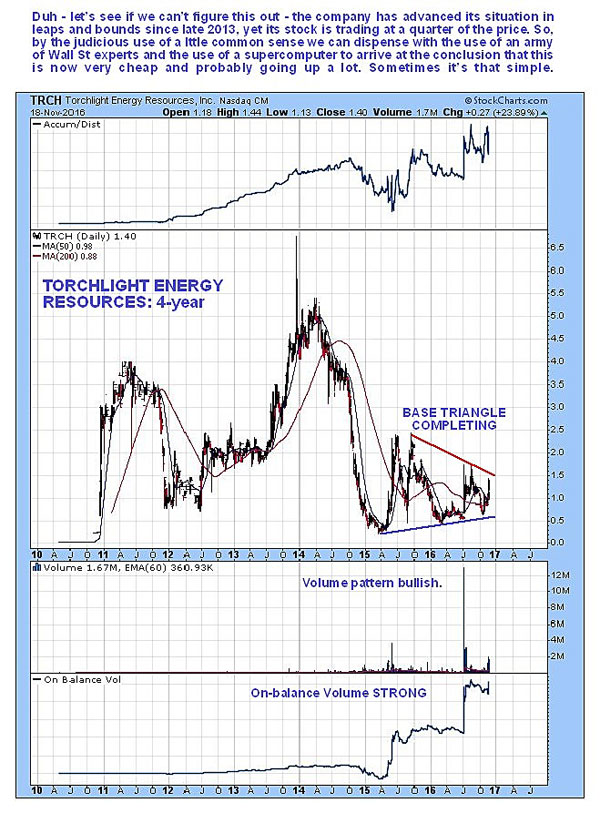

The 4-year chart is interesting as it emphasizes just how cheap Torchlight is now compared to the past, especially given its rapidly improving fundamental situation.

A big reason for this brief update, in addition to making clear that this successful breakout was a very positive development that opens the door to continued advance, is to point out that a day after the article was posted on the site on Nov. 14, Bob Moriarty of 321gold came out with an update of his own, replete with some exceptionally positive fundamental info about the company's situation (Torchlight Delivers Again and Again). While Moriarty is biased, and admits as much, I have no reason to doubt the veracity of what he says.

And anyway, in this business, there is nothing wrong with telling the truth, because most investors are too dumb to believe that this will go much higher, and will only believe it when they see it, which is good because it means that we can buy it much cheaper ahead of them.

So we stay long, and fresh purchases are in order on any weakness.

Torchlight Energy website.

Torchlight Energy Resources Inc. (TRCH:NASDAQ) closed at $1.13 on Nov. 17, 2016.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Read what other experts are saying about:

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) Torchlight Energy Resources Inc. is a billboard sponsor of Streetwise Reports. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.

Charts provided by Clive Maund